Earlier this week I wrote about a PricewaterhouseCooper report on cleantech investment last year, which pointed to a rising trend in the startup world. A new report released today by the same company gives a good look over the opposite side of the cleantech fence — the board rooms of electricity utilities worldwide.

The report, based on questionnaires sent out to industry executives, shows that utilities are well aware of oncoming changes. While renewable energy ranked only sixth in their concerns in 2004, it hit the top spot in 2007, and still holds it today. Emissions and efficiency are also top concerns. Energy efficiency is expected to have the greatest overall impact over the next decade, while nuclear energy tops the list of technologies expected to reduce greenhouse gas emissions.

Notably, execs in the United States show a stronger belief in technological innovation to solve their problems.

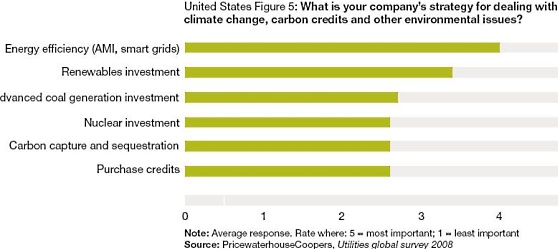

That’s important for renewables like solar and geothermal, because constructing new electricity generation plants is also considered the most important issue by a majority of executives. And the two top strategies for the future involve, again, adding to efficiency through smart grids and similar initiatives, and additional investment in renewables.

The increased investment in generation has both a negative and positive side for startups. Negatively, there’s less chance of a profitable acquisition. With utilities pouring their money into internal initiatives, there will be less to go toward scooping up other companies.

However, the increased investment in efficiency and renewables requires partnering with a wide array of startups, and putting money into their products. That’s most visible with projects like PG&E’s 900MW solar thermal deal with Brightsource. Less noticeably, utilities are actively testing out multiple smart grid and metering schemes, from companies like eMeter, GridPoint and Silver Spring Networks. We mentioned two years ago that the smart grid could be a $45 billion market. With the attention being paid to it, that number could become even higher.

While utilities seem optimistic about the future for cleantech, they’re also not willing to move on their own. A large majority of execs think that the biggest actions need to come from government regulation. That could create a serious risk, if politicians get weak-kneed about enacting serious change.