Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

![]() We’re hearing M:Metrics, a company that sells data about mobile phone traffic, is about to be acquired.

We’re hearing M:Metrics, a company that sells data about mobile phone traffic, is about to be acquired.

The deal is pretty much done and will be announced any day now, according to our source. The company was last asking for a price of between $50 and $80 million. The acquirer is a large company with international operations.

This is all about mobile advertising, which is a big deal right now. The mobile data industry has become very hot because of increasing traffic on the mobile Web, spurred by innovations like the iPhone, which lets people browse the Web much more efficiently. But advertisers are going to need much better data before they’ll be willing to spend money on mobile.

M:Metrics’ acquirer isn’t the only large player moving into mobile. Last August, Nielsen acquired Telephia, a San Francisco mobile data company, to boost its mobile traffic measurement service.

To date mobile analytics has been poor. Experts compare the mobile data analytics industry with the early Internet analytics industry — the data is unreliable because vendors have only recently started taking the industry seriously. Operators haven’t really cared about such data. Off-deck traffic (traffic from people surfing mobile Web sites outside a phone carrier’s platform) is growing quickly, making such information much more valuable.

Mobile industry consultant Matthäus Krzykowski of Hmm Aha, who has been researching mobile for VentureBeat, said he’s seeing margins of errors of up to 50 percent on traffic data analytics offerings. He’ll find an Internet company getting a million page impressions using one software, and then only getting 500,000 page impressions using another.

Measurements such as “mobile unique users” are not reliable due to the limitations of tracking users on WAP (IP addresses and cookies don’t work as they do on the web), according to Josh Levine, VP of Marketing at mobile software company Icebreaker.mobi. A preferable metric, says Levine, is “validated and unique mobile phone numbers.”

In some cases, operators use only a single IP address to channel traffic from a whole country. This frustrates both advertisers and publishers.

For just one example of how divergent vendors can be, take a look at how they measure mobile social networks. More than 1.6 million mobile users in the UK were accessing social networks by October, with Facebook as the most popular with nearly 680,000 monthly users, according to M:Metrics data. MySpace was second with just over 417,000, and Bebo third with over 310,000.

However, more recently, despite strong growth of mobile use of Facebook and MySpace, Nielsen Mobile found that Facebook had an average of a mere 557,000 unique monthly mobile users in the first quarter 2008, while MySpace followed with 211,000 unique mobile users. Such drastic declines aren’t possible, says Krzykowski, who puts the huge gap down to measuring differences.

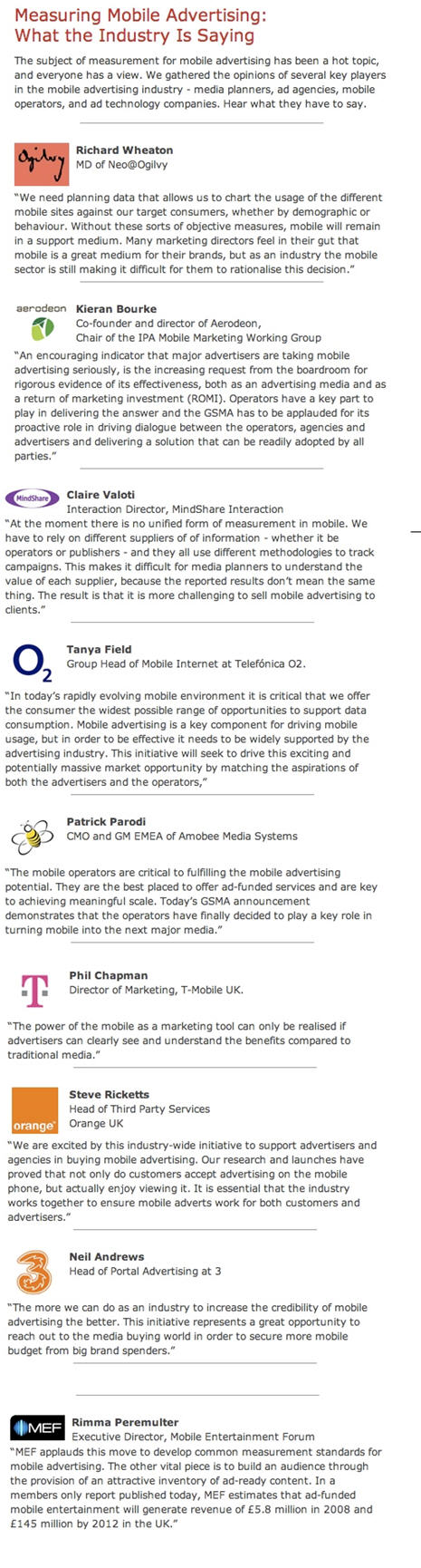

The mobile industry organization GSMA launched an initiative in February to deal with the problems. Here are some quotes from industry participants.