Mobillcash, Paymo and Zong have spent the last year or so competing to offer mobile payment services, most prominently for social gaming applications and casual gaming sites. Now, as social gaming continues to grow in users and revenue, the competition is getting fiercer — and that means consolidation. Mobillcash and Paymo have been rolled up into a new, fourth company: Boku.

Founded at the beginning of this year by serial entrepreneur Mark Britto, Boku is trying to combine Paymo’s reach in developing countries with Mobillcash’s technology — and a team of veteran payment and mobile employees. While Boku’s news is all being announced today, it’s been building up for awhile. It raised $3 million from Index Ventures and Khosla Ventures earlier this year, then acquired Mobillcash and started absorbing some of its employees and technology (including its payments interface).

San Francisco-based Boku more recently raised a second round of $10 million led by Benchmark Capital, with the other venture investors participating, and acquired Paymo. It has also been busy hiring people like Martine Niejadlik, a former eBay fraud expert, and Erich Ringewald, a former technologist at Amazon and Apple.

For those who aren’t familiar with mobile payments, they basically let you easily charge small items to a phone. While there are many variations, the overall concept is pretty straightforward. Say you’re playing a mafia game on Facebook, and you want to buy a virtual bulletproof vest so you can virtually out-survive the friend you’re playing. You need virtual currency to do so. In the game, you can buy the currency using your credit card or other form of real money, through a service like PayPal. You can earn the currency by participating in advertising offers available in the game interface through companies like Offerpal, Super Rewards and Gambit. Or, you can pay by billing your phone.

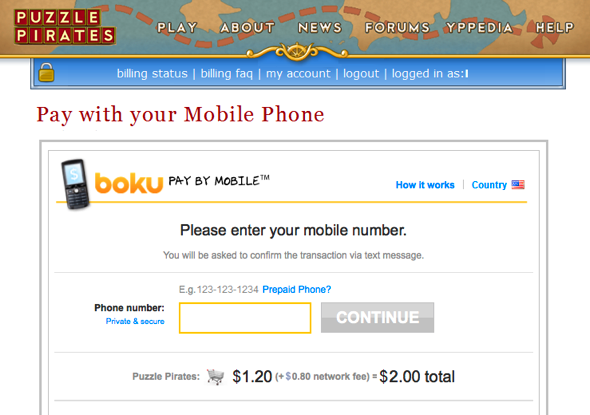

This is where Boku (and Zong) come in. In a typical mobile payment interface, you’re asked how much virtual currency you want to buy, then the payment company sends you a text asking you to verify the payment request. Then, you verify it. Mobillcash has, at least until now, asked you to text back “y” (short for “yes,” in case you are unfamiliar with text-messaging lingo), while Zong texts you a PIN number that you use to confirm your purchase within the game interface. However you verify the payment, it goes to your phone bill.

The payment companies make the billing process possible by going around the world and cutting deals with mobile carriers. This is part of their value, and an act of business development that “I wouldn’t wish on my worst enemy,” says Boku product manager Ron Hirson. Mobillcash and Paymo have solved the carrier connection problem by cutting deals with companies that aggregate local carriers in various regions. Boku can accept payments for 193 carriers to date, versus Zong’s 100 carriers. This gives it a bigger worldwide reach, sort of.

Zong counters by telling me that it has direct deals with around 80 of its 100 carriers that allow it to offer more nuanced pricing services and other features to users. Zong, unlike its agglomerated rival, has been around for nine years in Europe, forging content-related deals with big European media companies. It launched its mobile payment service for social applications last September.

What’s unknown, of course, is the future market opportunity. Developers on Facebook’s platform alone could see $500 million in total transaction volume this year, mostly from virtual goods. Boku, Zong and others, are aiming to be the mobile payment method of choice for game developers — and eventually for other sites, like social networks themselves.

Boku estimates that the virtual goods market today is worth $8 billion worldwide (granted most of that is in Asia). While nobody knows how popular virtual goods — and mobile transactions for them — will be, the trend is clearly up. Which means all sorts of other companies are getting more interested in enabling mobile payments.

It’s not clear if companies like Apple, that already enable some forms of micropayments (iTunes), might want to become direct mobile payment services. Social networks like Facebook and MySpace, meanwhile, are working on their own virtual currencies of sorts. Maybe they would compete against Boku and Zong? Both startups, when I asked, said they thought social networks wouldn’t want to bother building their own services. So look for business deals in the future — if not more acquisitions.