The race to build a cleaner, more efficient electrical grid has sparked a diverse, rapidly-growing industry, including traditional utilities, titans of the internet boom like Cisco Systems and Intel, and a crop of startups hoping to hit it big. Now a new report from research firm Zpryme says that if this market stays on track, it will double in just four years.

The finding is significant for two reasons. First, it suggests that demand for smart grid equipment, installation and related services will continue to grow, making the technology and the efficiency of the grid a prime concern for even average citizens — good news for the environment as well as business. Second, if the U.S. demonstrates that the smart grid can make people money, countries that have been slow to adapt their grids may follow suit, making it a truly global market.

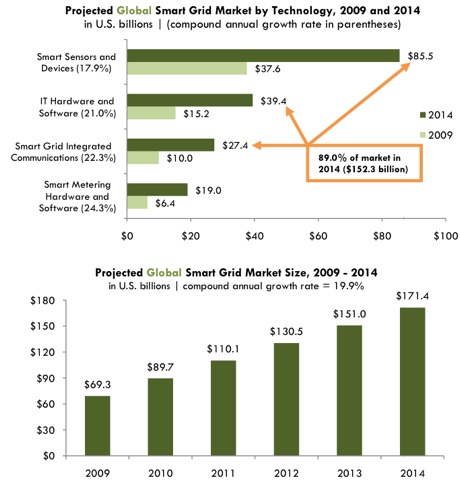

In 2009, the smart grid industry was valued at about $21.4 billion — in 2014, it will hit at least $42.8 billion, Zpryme’s report says. Given the smart grid’s success in the U.S., the world market is expected to grow at an even more explosive rate, jumping from $69.3 billion this year to $171.4 billion by 2014. And the segments set to benefit the most will be smart metering hardware sellers and makers of software used to transmit and organize the tidal waves of data collected by meters.

This is exactly what meter makers like Itron and Landis+Gyr want to hear. Both have landed major contracts with utilities to supply millions of homes with smart meters. And it looks like this trend won’t slow down any time soon. Zpryme’s findings also reinforce predictions that venture-backed smart grid networking provider Silver Spring Networks will grow tremendously, and maybe see a lucrative public exit (an outcome no doubt helped by the $100 million in equity it received yesterday).

Because the market is expanding at such a quick rate, there will be room for more smart grid players for longer. Industry analysts have noted that certain segments of the business are already becoming saturated, namely the home energy monitoring and management space, where companies like Tendril, Control4, EnergyHub, OpenPeak, and more are battling it out for dominance. For a while it looked like there would be a wave of consolidations and closures, but if demand keeps growing, this might not happens for a while.

Lastly, the Zpryme report is basically a prediction of success for the government stimulus programs focused on building a smarter grid. In order for the market to double over such a short time span, venture and equity investments will need to rebound and stay healthy for a while. Zpryme’s conclusions suggest that the U.S. Department of Energy has done enough to jumpstart this activity and set grant and loan recipients on a winning path.