The web may already have a wide array of personal investment sites, but startup Betterment believes it has something new to offer.

The company launched today at TechCrunch Disrupt. “When you go to a broker you have to pick among a menu of funds and stocks that are available,” said CEO and founder Jonathan Stein. “It’s an overwhelming experience for many people, even Columbia MBAs.”

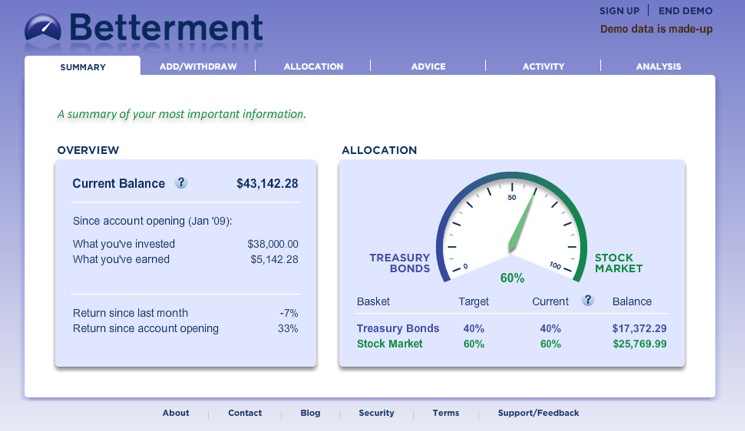

The result is that many people simply leave their money in savings accounts, said Stein. Betterment gives users one decision to make, an allocation between Treasuries and stocks. The company, which is an SEC and FINRA licensed investment advisor, chooses which stocks to buy and puts the individual securities into each user’s account.

Betterment does not charge its customers a per transaction fee like most online brokerage accounts. Instead, it charges a management fee of 0.9 percent of the average annual balance. Betterment accounts are as liquid as a savings account, with the money transferring directly to and from users’ checking accounts.

The company has already provided returns for its beta users. While the S&P 500 is up 23 percent on the year, Betterment’s stock portfolio is up 29 percent across the same period, which is a significantly higher return than a savings account.

“Banks are in the business of paying as little as possible for deposits,” said Stein. “This would cannibalize their most profitable business.”

According to Stein, Betterment is looking to target the 20 million Americans who have online savings accounts and, more specifically, the nearly 10 million who are between 20 and 40 years old.

“We want to take this really big. We want to make investing accessible for people as soon as possible.”

Betterment’s founders have already invested $640,000 to pay staff, create technical infrastructure, and build capital reserves required by the SEC. The company is looking to raise a $1 million round of institutional funding in the near future.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More