Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Following a string of recent acquisitions, IBM has announced that it will purchase marketing automation software maker Unica for about $480 million — at a price of $21 a share.

Following a string of recent acquisitions, IBM has announced that it will purchase marketing automation software maker Unica for about $480 million — at a price of $21 a share.

In the past few months, IBM has gobbled up the real-time data compression firm Storwize, network compliance specialist BigFix, business software maker Sterling Commerce, and web analytics firm Coremetrics. The company has said it will spend $20 billion on acquisitions through 2015.

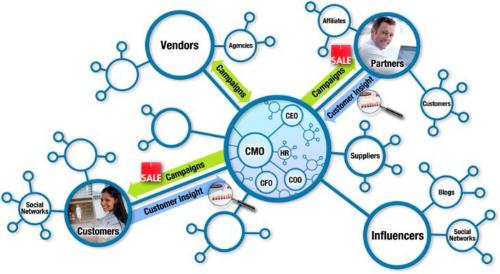

The Unica buy will strengthen IBM”s existing portfolio of software meant to “help companies automate, manage, and accelerate core business processes across marketing, demand generation, sales, order processing and fulfillment” — which includes the aforementioned Sterling Commerce and Coremetrics purchases. It will allow IBM to better help businesses predict and analyze customer tastes and focus their marketing efforts.

The Waltham, Mass.-based Unica has more than 1,500 customers worldwide — including Best Buy, eBay, ING, and Monster. Its 500 employees will move to IBM’s Software Solutions Group, and its software will bolster IBM’s Business Analytics and Optimization Consulting organization — which IBM describes as “a team of 5,000 consultants and a network of analytics solution centers” that’s backed by $11 billion in acquisition investments made over the past five years.