Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Fast-growing online movie and TV hub Hulu plans to go public in an initial public offering that values the company at more than $2 billion, according to the New York Times.

Citing people familiar with the matter, the New York Times said that Hulu executives have talked to investment banks about doing an IPO as soon as this fall.

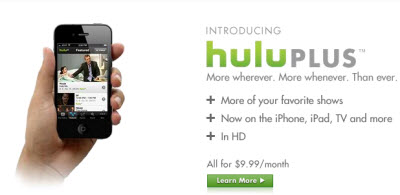

Hulu is one of the hottest companies in new media, since it can stream popular TV shows such as Glee. Users can watch the shows for free as long as they watch ads. Hulu is also adding a $9.99 a month subscription service, which could make it more competitive against rival services such as Netflix, YouTube and Apple TV, which is expected to get a makeover from Apple.

Hulu is just three years old. It was founded as a joint venture of News Corp, Disney, NBC Universal and private equity firm Providence Equity Partners. The goal was to provide a free service that could counter YouTube and user piracy of movies and TV shows. Overall, the IPO market has come back, with everyone from General Motors to Demand Media filing to go public during a market window that may or may not close this year. The New York Times could not reach Hulu for comment on Sunday.

Hulu is just three years old. It was founded as a joint venture of News Corp, Disney, NBC Universal and private equity firm Providence Equity Partners. The goal was to provide a free service that could counter YouTube and user piracy of movies and TV shows. Overall, the IPO market has come back, with everyone from General Motors to Demand Media filing to go public during a market window that may or may not close this year. The New York Times could not reach Hulu for comment on Sunday.

Hulu’s chief is Jason Kilar, a former Amazon.com executive. comScore estimates that Hulu’s monthly viewership in June was 24 million. Because Hulu has high-end movie and TV content, it commands good ad rates. [Update: The comScore number for July shows Hulu as the No. 1 ad-based video site at 27.9 million users.]