Game fundings broke a record this year as 91 companies raised more than $1.05 billion in 2010. That number is up 58 percent from a year ago, based on VentureBeat’s own research.

We found that 115 game companies raised a total of $663.1 million in 2009. And in 2008, 112 game companies raised $936.8 million. That means that venture capital funding for games has never been bigger.

That’s a big change from years ago, when venture capitalists were afraid to invest in games because they were a lot like Hollywood movies, where it was too hard to pick the hits. But the big trend that continues to drive the investments is the theme of disruption. The traditional game business is being disrupted by the popularity of social games on social networks like Facebook.

Major VC firms such as Sequoia Capital, Kleiner Perkins Caufield & Byers, Andreessen Horowitz, and others all put their money behind game companies this year. Private equity firms such as Providence Private Equity Partners and Temasek Holdings also dove into the biggest deals. John Doerr (pictured right) of Kleiner Perkins, the “Michael Jordan of venture capital,” even said that his company’s investment in Zynga was its best ever.

Major VC firms such as Sequoia Capital, Kleiner Perkins Caufield & Byers, Andreessen Horowitz, and others all put their money behind game companies this year. Private equity firms such as Providence Private Equity Partners and Temasek Holdings also dove into the biggest deals. John Doerr (pictured right) of Kleiner Perkins, the “Michael Jordan of venture capital,” even said that his company’s investment in Zynga was its best ever.

Mobile gaming is coming into its own as a major platform for games. With Rovio’s Angry Birds, the iPhone has now had its first major mega-hit. It’s still not anywhere near as big as Call of Duty Black Ops, the blockbuster combat game that generated $1 billion in six weeks. But the numbers of downloads — more than 50 million to date — is becoming impressive.

And digital distribution is disrupting traditional game retailers as new players come in with Netflix-style businesses. New business models such as virtual goods are also giving users the option of playing for free until they find something in a game that they want to purchase.

And digital distribution is disrupting traditional game retailers as new players come in with Netflix-style businesses. New business models such as virtual goods are also giving users the option of playing for free until they find something in a game that they want to purchase.

In each of these categories, there are now entrenched leaders. Zynga’s $150 million raise from SoftBank builds on its $180 million in venture capital raised last year. It will be hard to fund social game startups that can compete effectively with Zynga. But companies are still trying.

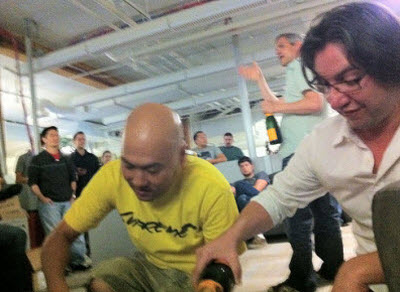

Investors and startups alike are no doubt inspired by the big transactions that have taken place, such as Disney’s $763.2 million purchase of Playdom and DeNA’s $403 million purchase of Ngmoco (the Ngmoco celebration is pictured above). Those prices are fueling a Gold Rush mentality.

We’ve chronicled the Gold Rush religiously ourselves but have also pulled data for these fundings from the internet at large, the EngageDigital site, and the National Venture Capital Association.

These fundings mean lots of innovation ahead and continued employment for game industry veterans. As we noted before, not all of these companies will last. But the successful ones will create revenues, profits and jobs in the years ahead.

We’ve ranked them here in order of the amount of money raised, and I’ve linked to our coverage. Fundings where the amounts weren’t made public are listed at the end. If you’ve heard of others, please note in the comments and we’ll add them to the list. The list includes companies that raised funds in prior years but disclosed for the first time in 2010. It’s likely that some companies from last year’s list or this year’s have gone out of business. If so, let us know in the comments.

Once again, we acknowledge our method is imperfect. As was the case last year, we have lots of deals where we don’t know the exact amount raised (we have listed them alphabetically at the end). We know that Mentez raised a substantial round, but the exact amount wasn’t disclosed, and so it is not included in our figure for 2010. And one of the big mysteries was the rumor that Google had invested $100 – $200 million in Zynga; but the two companies never announced the deal, leading some to believe that it wasn’t finalized. We expect that we’ll be revising the list upward in the coming weeks as we add more deals that we didn’t know about.

1. ZeniMax Media — $150M for acquiring high-quality game studios. A scene from Rage, a new game coming from id Software, a subsidiary of ZeniMax, is pictured at top. Investors: Providence Private Equity Partners.

1. ZeniMax Media — $150M for acquiring high-quality game studios. A scene from Rage, a new game coming from id Software, a subsidiary of ZeniMax, is pictured at top. Investors: Providence Private Equity Partners.

2. Zynga — $150M for social game business in Japan. Investors: SoftBank.

3. Gazillion — $60M for massively multiplayer online games such as Marvel Universe. Investors: Temasek Holdings.

4. OnLive — $60M in two rounds for games-on-demand online gaming service. Investors: British Telecommunications and Belgacom Group.

5. GameHI — $59M online games for Korean market. Investor: Nexon.

5. GameHI — $59M online games for Korean market. Investor: Nexon.

6. Playdom — $33M for social game publisher. (Later bought by Disney for $763.2M; Playdom CEO John Pleasants pictured right). Investors: Bessemer Venture Partners, Disney’s Steamboat Ventures, and New World Ventures.

7. Vostu — $30M for social game publisher focused on the Brazilian market. Investors: Accel Partners and Tiger Global Management.

8. Ngmoco — $25M for iPhones games. Investors: Institutional Venture Partners, Kleiner Perkins, Norwest Venture Partners, and Maples Investments.

9. Booyah — $20M for location-based social gaming company. Investors: Accel Partners, Kleiner Perkins Caufield & Byers, and DAG Ventures.

10. Foursquare — $20M for location-based entertainment. Investors: Andreessen Horowitz, Union Square Ventures, and O’Reilly AlphaTech Ventures. (Foursquare CEO Dennis Crowley, pictured right).

10. Foursquare — $20M for location-based entertainment. Investors: Andreessen Horowitz, Union Square Ventures, and O’Reilly AlphaTech Ventures. (Foursquare CEO Dennis Crowley, pictured right).

11. Mindjolt — $20M for social gaming company. In this deal, MySpace co-founder Chris DeWolfe raised funding to purchase MindJolt. Investors: Austin Ventures.

12. Red 5 Studios — $20M for online game developer. Investor: The9.

13. Vindicia — $20M for online payments system for merchants who sell virtual goods in games. Investors: Bertelsmann Digital Media Investments, DCM, FTV Capital and Onset Ventures.

14. PlaySpan — $18M for virtual goods and monetization platform. Investors: Vodafone Ventures and SoftBank Bodhi Fund.

15. 6waves — $17.5M for Facebook games. Investors: Insight Venture Partners.

16. Flurry — $15M for mobile analytics and social recommendation engine company. Investors: Menlo Ventures, Draper Fisher Jurvetson, InterWest, First Round Capital and Union Square Ventures.

17. Zong — $15M for mobile payments. Investors: Matrix Partners.

18. hi5 — $14M for game-focused social network and social game platform. Investors: Crosslink Capita and Mohr Davidow Ventures.

19. Glu Mobile — $13M in private placement for smartphone games. Investors: Greenway Capital, Cannell Capital, Cypress Capital, Granite Global Ventures, New Enterprise Associates, Scale Venture Partners and Stephens Investment Management.

20. Tonchidot — $12M for mobile augmented reality platform. Investors: KDDI Corp., Recruit Co. and SPiRE.

21. DreamBox Learning — $10M for education game startup. Investors: Reed Hastings and the Charter Fund.

22. Gaikai — $10M for cloud-based game streaming. Investors: Rustic Canyon Partners, Benchmark Capital, Triplepoint Capital.

23. in3Depth Systems — $10M for gesture-control systems. Parent company for both Softkinetic and Optrima. Investors: Belgacom, Hunza Ventures, and SRIW Techno.

24. InnoGames — $10M or more for browser-based games such as Tribal Wars. Investors: Fidelity Growth Partners Europe.

24. InnoGames — $10M or more for browser-based games such as Tribal Wars. Investors: Fidelity Growth Partners Europe.

25. Major League Gaming — $10M for online tournament gaming. Investors: Legion Enterprises and Oak Investment Partners.

26. OMGPOP — up to $10M for social games. Investors: unspecified (round in progress).

27. RockYou — $10M for social games and ad network. Investors: SoftBank.

28. World Golf Tour — $10M for social games focused on golfing. Investors: JAFCO Ventures

29. Machinima — $9M for web site that hosts videos made from game animation technology. Investors: Redpoint Ventures and MK Capital.

30. Sifteo — $9M for table-top gaming with plastic tiles. Investors: Foundry Group and True Ventures.

31. Aurora Feint/OpenFeint — $8M for social game platform Investors: Intel and The9.

32. mig33 — $8.9M for social mobile games platform. Investors: Gree and Indonesian telecom entrepreneur Pak Sugiono Wiyono Sugialam, Accel partners, Redpoint Ventures and DCM.

33. Runic Games — $8.4M for developer of Diablo-style dungeon crawler games. Investor: Perfect World Entertainment.

34. Image Metrics — $8M for facial animation tools for games. Investors: Reverse merger with International Cellular Accessories.

35. LucidLogix — $8M for game-focused graphics chips. Investors: Rho Ventures, Giza Venture Capital, and Genesis Partners.

36. Qualtré — $8M for gyroscope chips for motion sensors in game consoles and gadgets. Investors: Matrix Partners and Pilot House Ventures.

36. Qualtré — $8M for gyroscope chips for motion sensors in game consoles and gadgets. Investors: Matrix Partners and Pilot House Ventures.

37. UltiZen — $8M for game development outsourcing. Investors: JAFCO Asia, Hotung Investment Holdings, and Tokio Marine Investment Services.

38. Vivox — $6.8M for voice chat for games (pictured right). Investors: IDG Ventures, Benchmark Capital, Canaan Partners, and GrandBanks Capital.

39. Moonshoot — $6.6M for games that teach kids English. Investors: Alsop Louie Partners and TL Ventures.

40. Glyde — $6M for used game online sales. (raised in previous years). Investor: Charles River Ventures.

41. PlayFirst — $5.2M for casual games such as Diner Dash on multiple platforms. Investors: Mayfield Fund, Trinity Partners, DCM, Rustic Canyon Ventures, and $4 million in debt financing by Comerica Bank.

42. BigDoor Media — $5M for white-label virtual goods systems, or gamification, for publishers. Investors: Foundry Group.

43. Gaikai — $5M for cloud-based game streaming service. Investors: Benchmark Capital.

44. MetroGames — $5M for social game company in Argentina. Investor: Playdom.

45. Pocket Gems — $5M for iPhone and mobile games. Investors: Sequoia Capital, Michael Dearing, Jeff Fluhr, and Omar Hamoui.

46. Turbulenz — $5M for browser-based online game platform. Investors: unspecified.

47. Tiny Speck — $5M for social games such as Glitch. Amount raised in 2009, revealed in 2010. Investors: Accel Partners, Andreessen Horowitz, and angel investors.

47. Tiny Speck — $5M for social games such as Glitch. Amount raised in 2009, revealed in 2010. Investors: Accel Partners, Andreessen Horowitz, and angel investors.

48. Zattikka — $5M for mobile and social games. Investors: Notion Capital, Harald Ludwig and others.

49. Avatar Reality — $4.2M for Blue Mars virtual world. Investors: Henk Rogers and Kolohala Ventures.

50. Open Sports Network — $4M for sports fantasy games. Investors: unspecified.

51. GameGround — $3.5M for gamers social network. Investors: Sequoia Capital, SoftBank Capital, Vodafone Ventures, and Novel TMT Ventures.

52. JNJ Mobile/MocoSpace — $3.5M for mobile social game platform. Investors: SoftBank Capital and General Catalyst.

53. Rocket Ninja — $3.5M for 3D browser-based social games. Investors: unspecified angels.

54. Monumental Games — $3.2M for technology for virtual worlds and online games. Investors: Maven Capital Partners.

55. NeoEdge — $3M for game ad platform. Investors: MMV Financial.

56. Ngmoco — $3M to $5M for mobile game publisher. Investors: Google.

57. Heyzap — $3M for social game platform for indie developers. Investors: Union Square Ventures, entrepreneur Naval Ravikant and Chris Dixon from Founder Collective.

58. Woozworld — $3M for virtual world for tweens. Investors: Inovia Capital and ID Capital.

59. Sparkplay Media — $2.8M for massively multiplayer online games. Investors: Redpoint Ventures and Prism VentureWorks. (Company shut down).

60. Badgeville — $2.5M for white-label platform for publishers to integrate social rewards into their web sites. A gamification company. Investors: Felix Investments, and senior executives from eBay, PayPal, Chegg, Shopping.com, Drugstore.com, Palantir, and Warner Music.

61. Quick Hit — $2.5M for online sports games. Investors: Valhalla Partners, Triplepoint Capital, and New Enterprise Associates.

61. Quick Hit — $2.5M for online sports games. Investors: Valhalla Partners, Triplepoint Capital, and New Enterprise Associates.

62. Secret Builders — $2.3M for educational virtual world and casual games (pictured right). Investors: The Entrepreneurs Fund, Michael Tanne, David Jeseke, Sheila Marcelo, Carl Page, John Welch, Sohaib Abbasi, Scott Hassan, Carlos Cashman, and Ken Morse.

63. DNA Games — $2M for Flash games such as Casino City. Investors: Battery Ventures and Bain Capital Ventures.

64. Hangout Industries — $2M for Facebook social games such as Fashion City. Investors: unspecified.

65. Social Gaming Network — $2M for iPhone games. Investors: Tomorrow Ventures and Lars Hinrichs.

66. SupersonicAds — $2M for virtual goods platform and monetization service. Investors: Michael van Swaaij.

67. Vivox — $2M for game voice chat. Investors: Peacock Equity, Benchmark Capital, Canaan Partners, GrandBanks Capital and IDG Ventures.

68. Camelot Media Investments/StudioEX – $1.9M for Facebook games. Investors: unspecified.

69. Lionside — $1.6M for social sports games. Investors: unspecified.

70. BringIt — $1.5M for tournament social game platform. Investors: Blumberg Capital, Seraph Group and ErGo Media Capital.

70. BringIt — $1.5M for tournament social game platform. Investors: Blumberg Capital, Seraph Group and ErGo Media Capital.

71. Social Game Universe — $1.5M for game-like cross-promotion bar for Facebook games (pictured right). Investors: Michael Cohl, Ron Demo, Howard Gorman, Bruce Hooey, Gary Slaight, Clive Smith, and Moses Znaimer.

72. Kontagent — $1.5M for Facebook analytics tools. Investors: fbFund, Jameson Hsu, James Hong, Benjamin Sun, Auren Hoffman, Greg Thomson, and Mike Sego.

73. Rixty — $1.24M for alternative payment cards for games. Investors: Javelin Venture Partners, Accelerator Ventures, First Round Capital, Freestyle Capital, Nueva Ventures, and Soft Tech VC.

74. Appitalism — $1M for social discovery community for getting apps noticed. Investors: Mobile Streams.

75. Gendai Games (GameSalad) — $1M for game creation tool for iPhone, GameSalad. Investors: DFJ Mercury, Steamboat Ventures, DFJ Frontier, and ff Asset management. Angel investors include Paul Bricault, Paige Craig, Tom McInerney, Josh Resnick and Mark Suster.

76. Moblyng — $1M for cross-platform game technology. Investors: unspecified.

77. Titan Gaming — $1M for white-label tournament platform. Investors: William Quigley, Jill Armstrong, Brock Pierce, Michael Robertson, Kamran Pourzanjani, Carlos Bhola, Eric Pulier, Jeffrey Tinsley, Adam Walker, Andrew Frame, John Lee, Andy Mazzarella, Scott Walker, and SAM Venture Partners.

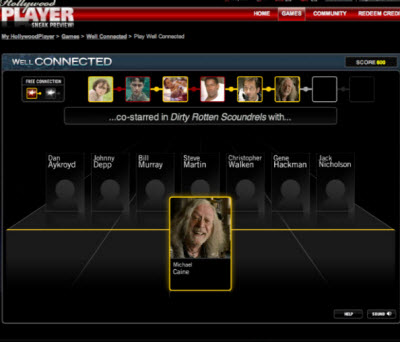

78. Exponential Entertainment — $700,000 (plus $1M in debt) for Hollywood-focused social games. (The company won our first GamesBeat Who’s Got Game? contest — pictured at right.) Investors: Band of Angels and other angels.

78. Exponential Entertainment — $700,000 (plus $1M in debt) for Hollywood-focused social games. (The company won our first GamesBeat Who’s Got Game? contest — pictured at right.) Investors: Band of Angels and other angels.

79. MiniMonos — $550,000 for New Zealand company creating kids virtual world. Investors: Venture Accelerator Nelson and New Zealand government’s Seed Co-Investment Fund.

80. Beyond Gaming — $232,000 for socializing console gaming with online tournaments. Investors: Rocket Ventures and others.

81. Gamify — $193,000 for gamification. Investors: Dan Dodge, Ron Williams and Dean Gebert.

82. Ayeah Games — unspecified seed funding for social reality games. Investors: John Landry, Janpieter Scheerder and others.

83. BoomBang Games — unspecified funding for Spanish Flash game developer. Investors: Nexon.

84. Double Fusion — unspecified funding for in-game advertising company. Investors: Jerusalem Venture Partners.

85. Drimmi — millions for social games. Investors: Mangrove Capital Partners and ABRT Venture Fund.

86. Flutter — unspecified funding in 2009 for social game studio for games with alternative themes. Investors: Natural History New Zealand.

87. Gaikai — unspecified funding for cloud-based game streaming service. Investors: Intel Capital and Limelight Networks.

87. Gaikai — unspecified funding for cloud-based game streaming service. Investors: Intel Capital and Limelight Networks.

88. iActionable — unspecified seed funding for gamification startup. Investors: unspecified.

89. Mentez — unspecified large round of funding for social games in Latin American and Brazilian markets. Investors: Insight Venture Partners.

90. Summerlight — unspecified funding for social games played on web site. Investors: unspecified.

91. Virgin Games — unspecified funding for tournament games. Richard Branson, the billionaire CEO of Virgin Group, announced the company at E3 (pictured above). Investors: Virgin Group.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More