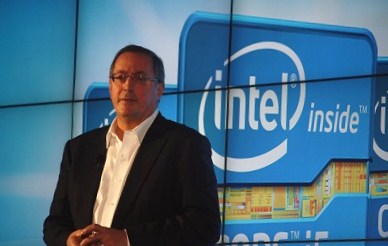

Intel chief executive Paul Otellini said on an earnings call today that he took issue with the weak forecasts for PC sales growth in 2011 by the major market researchers.

Intel chief executive Paul Otellini said on an earnings call today that he took issue with the weak forecasts for PC sales growth in 2011 by the major market researchers.

Intel had record double digit earnings and revenue in the first quarter, despite lots of worries about how growth could have stalled due to a bug in a key Intel chip, uncertain economies worldwide, growing tablet sales, high gas prices and the Japan quake. Many look to Intel as a bellwether for the tech economy, since it is the world’s largest chip maker and the world’s largest PC component maker.

But Otellini said he was confident that the PC industry could grow in the low double digits this year in terms of units sold. By contrast, Gartner predicts growth of 11 percent and IDC projects growth of just 6 percent. Gartner said that PC sales shrank 1 percent in Q1 and IDC said it shrank 3.2 percent, partly because they believe growth of smartphones and tablets is eating into laptop and netbook sales. Based on Intel’s numbers today, Otellini said he expects they will revise their figures upward.

“Our views differ from theirs,” Otellini said. “We are expecting more than 400 million PCs to ship this year.”

Otellini said Intel typically has more insight into emerging markets than the market researchers do and that may explain the difference.

Overall, the tech industry is in a strange recovery. Japan is in a tough state after the quake. Some European economies are ailing. S&P said it was pessimistic about the Democrats and the Republicans solving the debt crisis, a move that sent the markets lower on Monday. Gas prices are at $4 a gallon and unemployment is still relatively high.

But spending on personal computers in the aggregate is strong, especially as businesses emerge from the big recession of 2008-2009 and return to spending for new data center equipment.

Otellini said Intel’s operations and employees in Japan are largely safe and so is its supply chain, despite the quake.

Otellini said that one slow cooking market — chips for digital TV devices — is finally heating up. Digital home revenues were up 129 percent and Intel is now shipping 10,000 chips a day for set-top boxes and smart (computer-like) TVs.

“We are witnessing an explosion of computing devices that connect to the internet and Intel is a big part of this trend,” Otellini said in a conference call with analysts.

Intel’s Data Center revenues were up 32 percent from a year ago at $2.5 billion in the quarter and those could reach $10 billion this year. Intel has a strong server chip line-up and many corporations are only halfway into a four to five-year refresh cycle. About 75 percent of corporate PCs still use Microsoft’s old Windows XP operating system, Otellini said. Otellini said he saw no reason that 2012 should be any different from the strong PC sales year expected for 2011.

While the PC market looks strong, analysts have been skeptical about Intel’s ability to break into smartphones and tablets with its new Atom microprocessors. ARM-based chip makers dominate the field for low-power chips for mobile devices, but Intel keeps hammering away.

Later this year, Intel will launch its new Atom chips targeted at running on mobile devices with the Windows Phone, Android and Meego operating systems.

“We remain committed to success in the handset market,” Otellini said, though he admitted that Nokia knocked the “wind out of our sails” when it decided to end support for the Meego operating system, which is based on an Intel-created flavor of Linux. He said that Intel Atom chips would appear in tablet computers being introduced this year, including some that will be disclosed at the Computex trade show in Taiwan in June. Most Intel-based tablet models shipping this year will likely be Android models.

Intel has a shot in mobile because it has processors with more computer power, better graphics and media playback, and power consumption levels that are “smack in the sweet spot” for mobile devices, Otellini said.

Otellini also teased a new manufacturing process announcement in early May. He said Intel would unveil a revolutionary new manufacturing process at the 22 nanometer node and it would continue to use that when it launches 14-nanometer manufacturing a couple of years from now. Intel will likely use that advantage in manufacturing to launch faster, smaller and cheaper mobile processors.

Intel said it generated $4 billion in free cash flow in the first quarter.