Skype burst onto the scene with considerable buzz in 2003. It was one of the first companies to allow calls over the Internet — and thus forever change the way people make calls. Consumers gobbled it up. However, large businesses were tougher customers to crack.

Skype burst onto the scene with considerable buzz in 2003. It was one of the first companies to allow calls over the Internet — and thus forever change the way people make calls. Consumers gobbled it up. However, large businesses were tougher customers to crack.

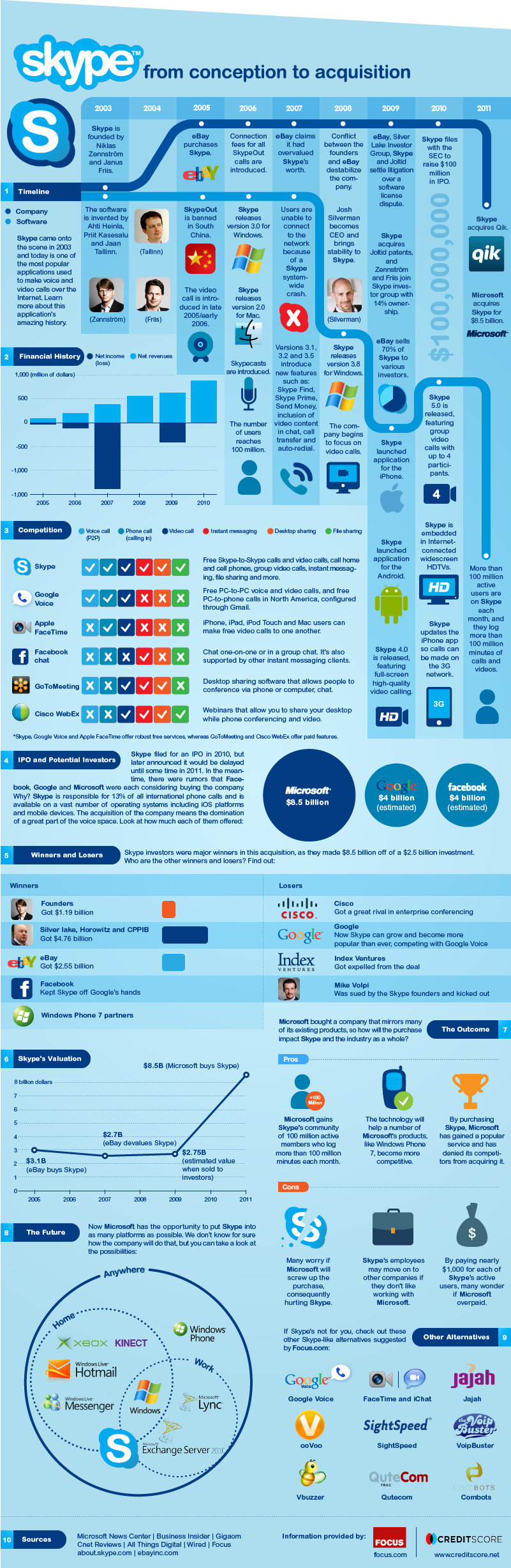

And thus Skype was very difficult to monetize at first. Consumers liked the free version. And Skype became an embarrassment to eBay, which acquired the company for $2.6 billion in 2005 with no clear articulation of how it fit into eBay’s business. Neglected and unwanted, Skype was eventually sold off by eBay to a group of investors in November 2009, after eBay admitted its mistake.

In the histories I’ve seen so far (see one nice info graphic below), a lot of credit is given to investor Silver Lake for the sale last week to Microsoft for $8.5 billion. And rightly so, because Silver Lake was the leader of a syndicate that fronted most of the cash for a buyout in 2009. Unmentioned in some accounts is the investment by Marc Andreessen, of Andreessen Horowitz, who invested $50 million in Skype in 2009.

When Andreessen invested, it was a big bet for his firm, because Andreessen had planned to make most of his investments (up to 80 of them) in very early stage companies with sub-$1 million commitments. He said he’d only make two or three bigger bets of the $50 million size, and Skype was one of them. And at the time, he articulated a very clear vision for Skype, telling me in an interview that the smartphone revolution would propel Skype’s success. And it did. I’ve now got Skype on my phone, for example.

The other big reason Andreessen said he believed in Skype was that it had a huge opportunity to sell to the enterprise. Large companies use Skype on an ad-hoc basis, in part because they haven’t found a way to integrate it nicely into their offerings. Microsoft could be the perfect partner to help do that with its reach into the enterprise with productivity software. Will Microsoft benefit as much as that vision would suggest? Well, the jury is out. Microsoft has been pumping billions of dollars into its internet strategy, and it’s getting pretty ugly. There are a huge number of critics of its Skype bet.

There’s been a lot of heartache suffered by the owners of Skype throughout history. One investor, Index Ventures, was jettisoned from the deal after some aggressive board room tactics, and won’t fair as well.

But like Silver Lake, Andreessen is an exception. His firm is getting about $153 million from the outcome, a three-fold return in just a year and a half. We already called him the new king of Silicon Valley last year, and this latest deal shores up that status. Now we’ll watch the next chapter unfold, and see if Andreessen’s promise that Skype would be huge in the enterprise comes true.

[Update: I’ve corrected an earlier version of this story which suggested that Andreessen Horowitz had originally focused solely on very early-stage investments, and thus that the Skype investment was outside of its mandate. Not true.]

Image from www.focus.com

Research and Design by CreditScore.net