Venture capital firm Khosla Ventures is apparently raising another $1 billion fund, a huge amount of money for a firm that raised a similar sized fund just two years ago.

Venture capital firm Khosla Ventures is apparently raising another $1 billion fund, a huge amount of money for a firm that raised a similar sized fund just two years ago.

But then again, there are signs of a bubble, and venture firms need more cash if they’re going to hold their own in highly-valued rounds. The bubble comes in part because of the perception of real opportunity, however. Real money is being made from the mobile, social and cloud revolutions. So while valuations may be high, the cost of not investing is even higher.

The latest fund, called Khosla Ventures IV, was revealed in an SEC filing today.

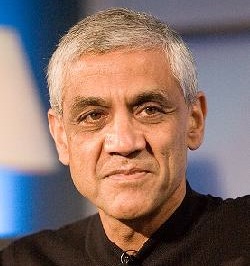

It’s also a sign that newer, aggressive venture firms like Khosla Ventures and Andreessen Horowitz continue to be able to raise large amounts of money at a time when some older second-tier firms are slowly fading from the scene. Khosla Ventures’ founder, Vinod Khosla (left), is known for his significant risky bets: After leaving Kleiner Perkins seven years ago to found his own firm, he immediately began making some of the biggest, boldest bets in clean technology of any firm, especially considering his early funds originated from his own money. The three most recent funds have tapped outside investors.

Khosla made his name investing in Internet backbone companies during the Web 1.0 build-out more than a decade ago, and he has credibility with entrepreneurs because he also co-founded Sun Microsystems. His firm has since made significant investments in the newer generation of Web and IT companies (including Square, Xobni and GroupMe) in addition to green-oriented companies. And unlike others, Khosla hasn’t been afraid of halting support for companies he’s made large investments in but which don’t seem to be doing that well.

The fund-raising may also explain the timing of the departure of partner Gideon Yu, the former YouTube and Facebook CFO. He left a few weeks ago to work for the San Francisco 49ers. Often, when new funds are raised, a firm decides which partners will stay to invest the funds and which ones won’t.