Taulia, which offers discounts in exchange for timely payments, announced an $8.5 million second round of funding yesterday. DAG Ventures joined existing investors Matrix Partners and Trinity Ventures to lead the round.

Taulia, which offers discounts in exchange for timely payments, announced an $8.5 million second round of funding yesterday. DAG Ventures joined existing investors Matrix Partners and Trinity Ventures to lead the round.

In a sluggish economy, San Francisco-based Taulia is offering suppliers an alternative to the traditional – and expensive – modes of external financing. This means suppliers of all sizes can avoid resorting to lenders and keep paying their employees.

And even though borrowing money is often the financing of choice, the fear of more blows to the economy – be it a double-dip recession or the fight over raising the debt ceiling – leads lenders to balk at small business loans. Taulia aims to save businesses from falling prey to external financing, and helps them when external financing isn’t an option.

“If you look between 100 years back and today, payment terms have stayed the same or even stretched out,” said chief executive Bertram Meyer, pictured right.

That is to say the life of an invoice may be up to 60 days long, with the buyer often not paying suppliers until day 60. Having a payment delayed for two months after a product has shipped can force a company to take out loans just to cover payroll expenses.

That is to say the life of an invoice may be up to 60 days long, with the buyer often not paying suppliers until day 60. Having a payment delayed for two months after a product has shipped can force a company to take out loans just to cover payroll expenses.

“A supplier has three ways to get financing. The first is bank loans, the second is credit-card borrowing (similar to the first) and the third is factoring. Taulia is replacing all three.”

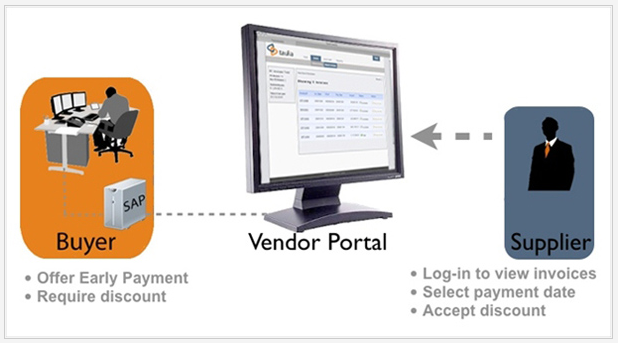

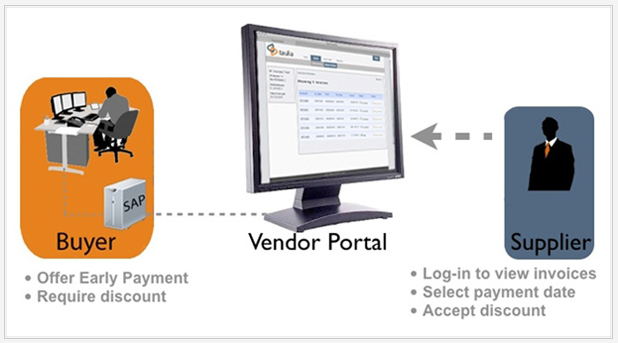

Taulia works as a facilitator, managing “win-win” discounts between a buyer and seller. Discounts are used to encourage buyers to pay invoices quickly, instead of waiting until the end of a payment term. As Taulia’s moto says, “Pay early, pay less.” Suppliers are willing to take the price cut because a regular payment cycle means cash in the bank to cover overhead.

The funding will be used to expand Taulia’s resources to accommodate for what Betram says are unexpected parallel projects. The company originally budgeted for one client project at a time, but is seeing five to six. Currently, Taulia signs one Fortune 500 company a month, with a few Fortune 50 companies interspersed. Big-wig clients include Phizer and Coca-Cola.

In addition to U.S. growth, Taulia wants to expand into the European Union and is hiring for its Germany office. Betram also expressed Taulia’s need for engineers. The company has 8 positions open, but is seeing a lot of competition for engineers.

Taulia was incorporated in 2009 and is approaching 40 employees. The company has a total of $11.7 million in financing from the same venture capitalist firms. Taulia received its first round of funding in December 2010.