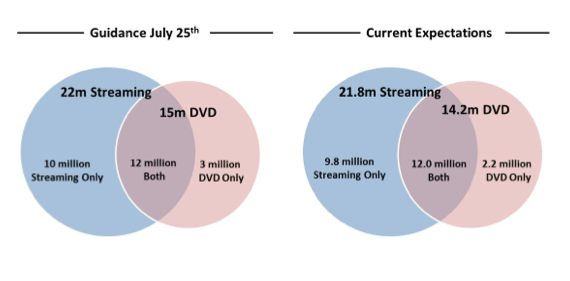

In a guidance update Thursday, streaming video service Netflix cut its estimated third-quarter U.S. subscriber projections from 25 million to 24 million — a decrease of four percent.

In a guidance update Thursday, streaming video service Netflix cut its estimated third-quarter U.S. subscriber projections from 25 million to 24 million — a decrease of four percent.

The lower expectations are attributed to a 60 percent price hike in July to Netflix’s DVD rental/streaming service combo subscription rate, according to the company. Still, Netflix said the price hike was the right move.

“We know our decision to split our services has upset many of our subscribers, which we don’t take lightly, but we believe this split will help us make our services better for subscribers and shareholders for years to come,” Netflix CEO Reed Hastings and CFO David Wells said in a joint statement.

Most of the domestic losses were DVD subscribers, which are far less profitable for the company than its streaming-only customers. This is especially true when looking into future projections, since the cost of shipping DVDs is expected to rise while streaming prices will either drop or remain the same.

of the domestic losses were DVD subscribers, which are far less profitable for the company than its streaming-only customers. This is especially true when looking into future projections, since the cost of shipping DVDs is expected to rise while streaming prices will either drop or remain the same.

The company stated four main defenses of its long-term business strategy in the guidance update:

- To create a dedicated DVD rental division that takes pride in great execution and maximizes the opportunity for disc rental over the coming decade;

- To enable us to improve our global streaming service even more rapidly, because it is not meshed with a domestic DVD business;

- To enable us, with the growth in revenue, to license more streaming content and thereby improve our streaming service even more;

- To remain very price aggressive, with $7.99 per month for unlimited streaming of a huge library of TV shows and movies, and $7.99 per month for unlimited DVD rentals, 1 out at-a-time.

Despite additional revenue from international launches in Latin America and soon Europe, Netflix’s stock price has been taking a beating. The company’s stock was hitting $300 a share earlier this summer but is now hovering just below $200.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More