Twitter is on track for nearly $140 million in revenue for 2011, up from a reported $45 million just last year.

Twitter is on track for nearly $140 million in revenue for 2011, up from a reported $45 million just last year.

These figures come from eMarketer, a digital intelligence firm that keeps a close eye on ad revenues for companies like Twitter and Facebook.

Last year was Twitter’s first full year of selling advertising products. In 2011, however, Promoted Tweets, Promoted Trends and Promoted Accounts (as the company calls its various ad products) really started ramping up. Earlier this month, the company started serving promotional content in a new way altogether, allowing advertisers to push tweets to users even if those users don’t follow the advertiser’s account.

Another new source of revenue for the end of 2011 and the duration of 2012 will be political advertising. The company opened a Washington, DC-based ad sales office to gear up for a slew of political advertising over the next 13 months or so.

While Twitter has played an important and growing role in politics since its use by the 2008 Obama presidential campaign, this marks the first time the platform will be used for traditional, disclosure-tagged political ads.

eMarketer estimates that by 2013, Twitter’s ad revenue shall have grown to around $400 million annually. Not bad for a startup that famously didn’t have a business model just two years ago.

This month, the company also announced that ad targeting options would be coming up soon. These would allow marketers and brands to target consumers by location and other criteria.

Already, Twitter’s unique approach to ads is creating stellar engagement rates for brands. The company doesn’t even call its promoted content advertising, in fact, because it insists that even brand-related messages are and should be indistinguishable from “normal” tweets and trends on Twitter.

“Marketers have seen solid engagement rates with Twitter advertising — in some cases better than those on Facebook — despite Twitter’s relatively smaller audience,” said eMarketer principal analyst Debra Aho Williamson.

Twitter CEO Dick Costolo confirmed this at a meeting three weeks ago, saying, “We continue to see great engagement rates … The health of the business is great.”

Costolo noted that one major advertiser, Virgin, had its fifth largest sales day ever due to a Twitter campaign. Most advertisers see an engagement rate of between 3 and 5 percent, and 80 percent of advertisers run more than one campaign.

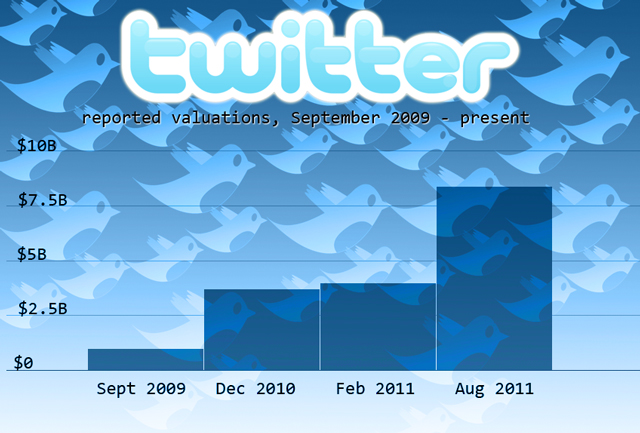

Twitter’s rising valuation

As the company’s business model has emerged and begun to show early signs of success, its valuation has grown.

In April 2008, the company was worth less than $150 million and actually closer to $80 million, according to sources familiar with the company’s then-latest round of funding.

But by the following year, the company’s valuation had already skyrocketed to $1 billion. Another round late in 2010 put Twitter’s worth at $3.7 billion, with another February 2011 investment pegging it at more than $4 billion.

While speculation was running rampant that some investors valued the company at around $10 billion toward the end of 2010, a confirmed funding round last month left Twitter valued at $8.4 billion.

While $8.4 billion seems like a significant jump from $4 billion a few months before, VC firms aren’t the only ones who’ve pegged Twitter’s valuation in that neighborhood. Recent private stock trading on sites such as SharesPost has seen prices ranging between $34.50 and $31, which values the company at $6.8 billion to $7.7 billion on the private market.