Financial organization company BankSimple is shedding the “bank” and emerging as Simple, now available to consumers in the US.

Financial organization company BankSimple is shedding the “bank” and emerging as Simple, now available to consumers in the US.

Taking care of finances is an arduous task. It confronts you with bills, loans, savings goals, and other stressful topics. In fact, these cause so much stress, some people opt to ignore their money all together. Keeping track of your finances is necessary, however, so why not make it easier by connecting today’s technology and our more widespread willingness to organize our finances online?

That’s what the newly renamed Simple (how did they get that URL?) is doing with its front-end financial organizing system.

“Simple is a better representation of what we aspire to. It releases us from the constraints of an industry in desperate need of innovation,” said Joshua Reich, Simple chief executive officer, in an official blog post.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

While the financial industry is under fire from Occupy Protests, Simple is attempting to create something new. When you work with Simple, you aren’t quitting the banking system, but you are quitting the bank you usually work with. To replace it, Simple takes your money and invests it in a number of FDIC-insured institutions on your behalf. According to Adam Erlebacher, the vice president of marketing for Simple, the company doesn’t work with the “too big to fail” banks, in exchange for small and mid-sized ones. These institutions are partners with Simple, which has agreements in place concerning fees and other regulations.

“When we’re going out and selecting bank partners we are looking for banks that share our values,” said Erlebacher in an interview with VentureBeat. “As long as bank partners are in line with our philosophy of no surpise fees and clear and transparent terms and conditions, then we’re happy to work with them.”

The BanCorp Bank in Delaware is Simple’s launch partner.

Simple’s front-end acts as your organizing dashboard, allowing you to see transactions under the “safe-to-spend” header. This view does not show you all of the money you have, but rather the amount of money you can spend per day to stay within your goals. These goals include savings goals, bills commitments, loan paybacks, etc. You set the goals, and Simple calculates what you can spend each day to stay within those parameters.

Setting up a savings goal in Simple is fairly easy to do as well. On the savings page, you enter the amount of money you’d like to save and scroll a bar over to the date by which you’d like to have the money. You can lock a savings account down, to deny yourself access, or pause it if you don’t want to add any more money to that pot.

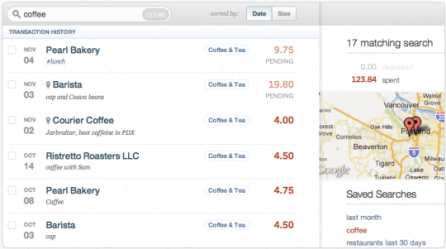

In creating this dashboard, one of Simple’s main goals was to make the search function as close to natural language as possible. You can type something like, “Restaurant from November in Portland” and Simple will find the restaurant for you. You can also search based on amounts spent, and each transaction comes with a detailed description as well as a map to the location of the transaction. If these details are often correct, given the direct connection to the bank, it’ll be a significant improvement from the Mint finance app, which regularly gets transaction locations wrong.

In creating this dashboard, one of Simple’s main goals was to make the search function as close to natural language as possible. You can type something like, “Restaurant from November in Portland” and Simple will find the restaurant for you. You can also search based on amounts spent, and each transaction comes with a detailed description as well as a map to the location of the transaction. If these details are often correct, given the direct connection to the bank, it’ll be a significant improvement from the Mint finance app, which regularly gets transaction locations wrong.

Like Mint, Simple also pre-categorizes your transactions and allows you to create your own categories. It also lets you tag transactions with names of friends, or other reminders to help you recall purchases at the end of the month.

“There are lots of people who feel really comfortable with these intense budgeting platforms,” said Erlebacher, “But for most people, the idea is getting fast answers from your finances.”

Regular customers will be able to sign up for Simple by requesting a beta invite. Those with an alpha set up do not have to re-sign-up for the beta. In its blog post, Simple reminds, “[we] replace your bank, but we are not a bank,” which may set off alarms with people. However, while having a third party distribute your money amongst different institutions is jolting, that’s a price you’ll pay in any industry for convenience.

See below of a video on how Simple works:

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More