Zynga is about to begin trading as a public company on Thursday, but the value of the company is up for debate, based on reports from some well-known Wall Street analysts and other financial experts.

Zynga is about to begin trading as a public company on Thursday, but the value of the company is up for debate, based on reports from some well-known Wall Street analysts and other financial experts.

The San Francisco-based social gaming company is planning to raise about $850 million to $1.15 billion at a price of $8.50 to $10 a share, giving the company an expected valuation of $7.6 billion to $8.9 billion. Zynga, whose history we chronicled in a 25,000-word story on Monday, has argued that the social gaming revolution has just begun and that the $9 billion virtual goods market could triple in five years. If Zynga raises those funds, it will be the largest tech IPO since Google in 2004 and significantly more than Groupon’s recent $700 million raise.

But Arvind Bhatia, an analyst at Sterne Agee, published a report on Tuesday initiating coverage of Zynga with an “underperform” rating that put Zynga’s price at about $7 a share.

While that’s lower than the expected IPO price, that price is equivalent to about 11 times 2012 estimated EBITDA (earnings before income tax, depreciation and amortization). That gives Zynga a 30 percent price premium relative to its peer group, meaning it is viewed as one of the leaders of its pack.

Bhatia wrote, “While we believe in the potential for social games, we think that Zynga’s growth is slowing even faster than what is obvious at first, its margins are under pressure, and free cash flow has been declining recently; thus we believe the implied valuation in the IPO is not justified.”

A similar social gaming company, Nexon, went public on the Tokyo Stock Exchange with a pre-trading market capitalization of $7 billion, although it closed the day down about 3 percent off its IPO price. The Asian online gaming giant raised $1.2 billion and it made net income of $260.1 million, up 14 percent, on revenue of $853.5 million, up 26.5 percent, for the nine months ended Sept. 30. By contrast, Zynga made a paltry $30.7 million on revenue of $828.9 million for the nine months ended Sept. 30.

The Sterne Agee research note says that FarmVille, Zynga’s former flagship title, has peaked and other titles are coming online at a slower pace. CityVille, Bhatia says, is tracking 50 percent below where FarmVille was at the same point in its history.

Zynga would no doubt dispute that analysis. It said in its roadshow video that FarmVille is posting record quarterly earnings more than nine quarters after its launch. CityVille grew faster than FarmVille and CastleVille is growing faster than CityVille. It’s still pretty early to say how CastleVille will turn out.

But Bhatia has other negative details. Mafia Wars 2, released in early October, hit 28 million players two weeks after its launch. But its daily active users have fallen to less than 1 million (it’s 680,000, according to AppData).

But Bhatia has other negative details. Mafia Wars 2, released in early October, hit 28 million players two weeks after its launch. But its daily active users have fallen to less than 1 million (it’s 680,000, according to AppData).

Still, Zynga’s picture isn’t dismal. The company has 222 million monthly active users and 51 million daily active users in all. In some ways, Mafia Wars 2 is probably losing users to CastleVille.

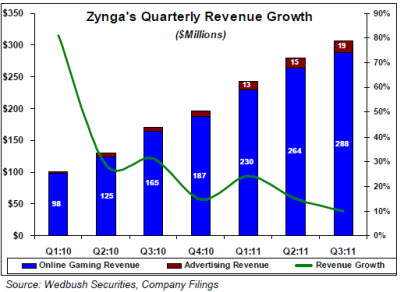

In 2012, Bhatia expects Zynga to launch its previously-released titles Hidden Chronicles and Zynga Bingo as well as grow its mobile business and expand internationally. But Bhatia said that bookings growth, a measure of cash-based revenue, will slow to 20 percent in 2012 and 17 percent in 2013. That compares to growth of 156 percent in 2010 and 37 percent in 2011.

Andrew Cleland, a partner at Comcast Ventures, by contrast, has looked at the same fundamentals and come up with a different analysis. He noted that investors should not expect growth in the near future as Zynga invests heavily in the next stage of social gaming. Those who buy Zynga’s stock, he says, should understand that they are betting on Zynga’s long-term platform vision, not its 2012 cashflow.

Bhatia said that other bearish arguments include Zynga’s dependence on Facebook for 94 percent of its revenue. And barriers to entry aren’t that high, as proved by the launch of Electronic Arts’ The Sims Social this summer, which took the No. 2 spot for a time on the top charts despite the fact that EA had almost zero presence on Facebook before. Lastly, Bhatia said that a small percentage of Zynga’s users — 2.5 percent, or 7.7 million users — generate most of the company’s revenue.

[Update: BTIG also wrote a report on Zynga on Wednesday morning that said investors should participate in the Zynga IPO within the $8.50 to 410 a share price range.

The research firm’s analysts Richard Greenfield and Brandon Ross wrote that they believe Zynga’s social games are cure for boredom, much like TV, and can be played anywhere. They said that Zynga is a “media company” focused on taking a greater share of your time and money spent on entertainment. They said Zynga’s growth will be driven by launches across more game platforms, with a powerful network effect. They see continued growth of social networking beyond 1 billion users, with both Zynga and Facebook benefiting. They see an acceleration of smartphones, tablets, and connected TVs, providing Zynga with more ways to grow. And they believe that brands will advertise with Zynga the more that its games engage users. ]

Atul Bagga, an analyst at Lazard Capital Markets, noted in a report dated Dec. 2 that the “toughening landscape” for social games bodes well for category leaders such as Zynga and EA. Those companies enjoy network effects, while smaller game companies are seeing rising costs for acquiring customers and declining virality for games. He also said that monetization on Facebook seems to be improving, but he did not put out an opinion on Zynga.

Michael Pachter, an analyst at Wedbush Securities, said in a report on Dec. 8 that he expects pricing at the midpoint of Zynga’s $8.50 to $10 a share range. He noted that Zynga has a revenue run rate (its implied annual income based on the current quarter’s revenue) of $307 million. Its valuation at the midpoint of the expected initial share prices implies a multiple of seven times revenue.

“For 2012, we think the company is well-positioned to grow revenue once again, considering the launches,” Pachter said. Pachter believes Zynga’s growth will correlate closely with Facebook’s own growth. Over the next four years, Pachter said Facebook could grow 25 percent, hitting the billion user level by 2015. He also said that Zynga has the first-mover advantage in social games and that the engagement of its games has been getting progressively better.

Pachter also said that FarmVille’s ability to earn revenues nine quarters despite user declines is worth noting. He also noted that new games are not cannibalizing current bookings, a good sign that Zynga simply isn’t stealing users from itself every time it launches a new game.

Investor’s Mosaic, a research firm for investors, said in its analysis that favorable trends for Zynga include its powerful business model, market leadership in social games, and strong social gaming growth. The negative is the dependence on Facebook, and Investor’s Mosaic is neutral on the valuation. The company believes that a fair valuation is about $9.25 a share, but it foresees risks for Zynga in the next 12 to 18 months as it tries to reduce its dependence on Facebook.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More