Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

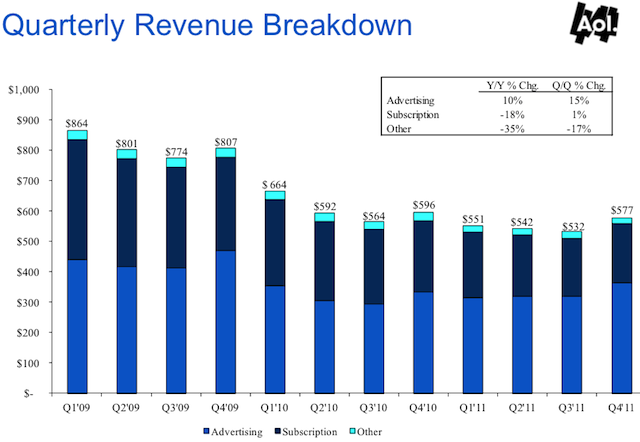

AOL reported a 10 percent increase advertising revenue in the fourth quarter to $363.8 million, compared to $331.6 million during the same period last year. However, the company’s overall revenue slipped by three percent, or $576.8 million, compared to $596 million last year.

Still the fourth quarter revenue numbers mark the first increase for AOL in four consecutive quarters.

“AOL took a large step forward in Q4 and I am very pleased with the way we ended the year,” said AOL Chief Executive Tim Armstrong in the release. “Our Q4 results highlight AOL’s ability to methodically improve our consumer offering and financial performance”

Over the past few years, AOL has attempted to shift away from its roots as a dial-up Internet service provider in favor of growing its media and advertising business. However, some of the company’s biggest investors have previously expressed concern over AOL’s media business, due in part to poor profit returns on acquisitions, like the $25 million purchase of TechCrunch and the $315 million purchase of The Huffington Post. The company has also suffered from a number of top-level talent losses this year.

AOL attributes its ad revenue gains to increased display revenue from Patch, the company’s local news blog initiative, which investors accused of being a waste of time and money. On the call, Armstrong stated that the number of local “patches” that earned over $2,000 in monthly revenue went from 33 in Q1 to 401 in Q4. That’s still not a huge percentage of overall revenue, but at the very least the company is reporting growth.

“Patch is a highly scrutinized investment by our management team and our board, but Patch is not a pet project,” Armstrong said. “Patch is a business that meets deep consumer and advertiser needs.”

Fourth quarter 2011 highlights:

- AOL grew global advertising revenue by 10 percent — its third consecutive quarter of year-over-year growth.

- Total revenue decline was its lowest rate of revenue decline in 5 years.

- 15 percent growth in global display revenue — AOL’s fourth consecutive quarter of year-over-year growth.

- AOL reported the lowest rate of search and contextual revenue decline in approximately 3 years, due in large part to growth in search revenue on AOL.com.

- Dial up subscription revenue declined 18 percent (lowest rate of decline in five years), with a monthly average churn of 2.2 percent year-over-year.

- AOL’s Adjusted OIBDA expensess, excluding Traffic Acquisition Costs (TAC) and an $8.5 million legal settlement were $360.4 million, down from $391.3 million and $368.0 million in Q2 and Q3 2011, respectively.

- AOL’s operating income and Adjusted OIBDA grew $46.2 million and $37.4 million sequentially. Both declined year-over-year due to lower total revenue, strategic investments and an $8.5 million legal settlement. Net income declines year-over-year also reflect the gain on sale of AOL’s investment in Brightcove in Q4 2010.