Read more about Facebook

Facebook files its S-1 (Read full filing)

Facebook says “mobile” is big risk — starting with Android and iOS

How “The Hacker Way” helped propel Facebook to market dominance

Facebook’s monster mobile numbers: Over 425M users

How Zuckerberg wrested control of Facebook from his shareholders

Facebook has 845M monthly users, 2.7B likes & comments each day

Zynga accounted for $445M, or 12 percent of Facebook’s revenue, in 2011

Facebook made $1B on $3.7B in revenue last year

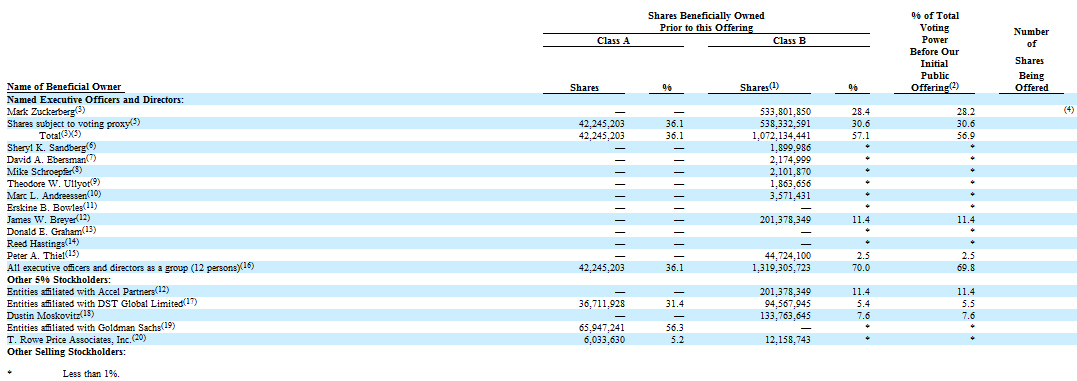

Facebook CEO Mark Zuckerberg owns 28.2 percent of the company, according to Facebook’s just-released IPO S-1 filing with the Securities and Exchange Commission.

Facebook’s initial public offering is one of the most hyped technology events of the year, and the company is expected to debut on the stock market in May. Its stock ticker symbol will be “FB.” The company has not yet named a starting price has yet been named, but Facebook said in the filing that it expects to raise at least $5 billion in the IPO.

Since the Facebook story began, we’d wondered how much ownership and control 27-year-old Zuckerberg had of the company he started while attending Harvard. Now we know he has 28.2 percent of the company’s shares, according to the S-1 — and controls a majority of Facebook shareholder votes.

Also interesting is who else has a serious stake in the company. The filing states that Accel Partners has 11.4 percent of company shares, and superstar investor Peter Thiel owns 2.5 percent of company shares. Facebook co-founder Dustin Moskovitz owns 7.6 percent of shares, while current Facebook COO Sheryl Sandberg has less than .1 percent of company stock.

Also eye-popping is that Zuckerberg actually has control of a majority of Facebook’s voting stock. Check out this language from the filing that indicates just how much power and control Zuck has over Facebook:

Mr. Zuckerberg has the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation, or sale of all or substantially all of our assets. In addition, Mr. Zuckerberg has the ability to control the management and affairs of our company as a result of his position as our CEO and his ability to control the election of our directors. Additionally, in the event that Mr. Zuckerberg controls our company at the time of his death, control may be transferred to a person or entity that he designates as his successor. As a board member and officer, Mr. Zuckerberg owes a fiduciary duty to our stockholders and must act in good faith in a manner he reasonably believes to be in the best interests of our stockholders. As a stockholder, even a controlling stockholder, Mr. Zuckerberg is entitled to vote his shares, and shares over which he has voting control as a result of voting agreements, in his own interests, which may not always be in the interests of our stockholders generally.

Altimeter Group analyst Rebecca Lieb told VentureBeat that she anticipated that Zuckerberg would retain an immense level of control, but no one knew he would have complete say over nearly all decisions.

“Facebook is his baby and he has been judicious with his decision making,” Lieb said. “By all accounts, this was an expected move.”

Although Facebook is planning to raise at least $5 billion with the IPO, the company could raise a lot more. With a rumored valuation of $100 billion, Zuckerberg’s shares would make him worth more than $28 billion. By extension, Breyer’s shares are worth more than $11 billion, Moskovitz’s are worth more than $7 billion, and Thiel’s are worth more than $2 billion.

You can see the full ownership chart below (click for a larger image):

Image credit: Jolie O’Dell/VentureBeat

[Update: This story was corrected from an earlier version, which said that Jim Breyer owned 11.4 percent of Facebook. In fact, Jim Breyer is a partner of Accel Partners, and while Breyer does own some shares in Facebook, the overwhelming majority of the shares are owned by Accel Partners]