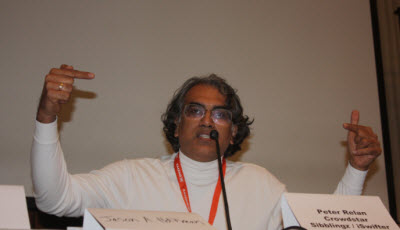

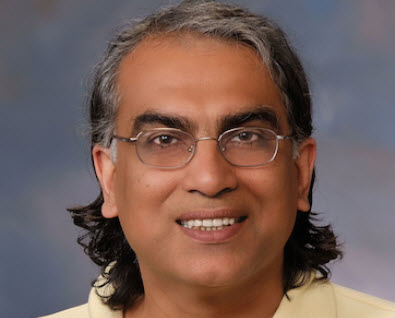

Peter Relan wants to build a mobile gaming empire, one app at a time. The chief executive of CrowdStar and chairman of game incubator YouWeb has pivoted from Facebook games to mobile games in a big way. His company formed a mobile game studio and has focused so far on making games for girls and young female teens.

Peter Relan wants to build a mobile gaming empire, one app at a time. The chief executive of CrowdStar and chairman of game incubator YouWeb has pivoted from Facebook games to mobile games in a big way. His company formed a mobile game studio and has focused so far on making games for girls and young female teens.

CrowdStar’s Top Girl and Social Girl titles have both cracked the top 25 in the past. And the company plans on doing that a lot more in the future. We had the opportunity to talk to Relan recently about his success with iPhone games. Here’s a transcript of our talk:

Gamesbeat: How tough is it to get two games in the top ranks of the Apple App Store? If you have one in the top 30 and you launch a new one, how much help does that new title get from the fact that there’s another title up there cross-promoting it in some way?

Peter Relan: I think you get some, but I can tell you, it has to stand alone. If you’re lucky, you’ll get 10 to 20 percent of the user base cross-promoting. Let’s say the two titles are roughly the same size. 80 to 90 percent of the second title still has to get its users and stand on its own and monetize that, completely independently. So I do think that it’s a help. But it has to stand alone.

GB: It looks like some other companies think you need to have five or 10 games out there just to get that cycle of cross-promotion going. Sort of like Zynga on Facebook.

Relan: It’s true, they do. You’ve got to have five to 10, yeah. And so I think everybody’s trying to build a portfolio of several games to get the cycle going. That sort of network effect, it cannot happen with just two. We feel like Top Girl and Social Girl, they are good in their own right. Until you have five or 10 there’s no way that you can say Top Girl is helping Social Girl that much.

GB: So then the rest of your strategy is to come out with more games, right?

GB: So then the rest of your strategy is to come out with more games, right?

Relan: Oh, yeah. We will absolutely come out with more games on mobile. We will hope to see the benefits. I just thought it was interesting that without those benefits, the sort of network effect of your titles, that we’re already ahead, because we’ve got two. Most people, even with the network effect, just have one in the top-grossing 10.

GB: Do you worry about the ability of stand-alone games to get to the top? I think some people worry about, say, the cost of acquisition, the money you have to spend to advertise and get a title to go way up. It seems like an independently produced game might not have as good a chance to get up to the top anymore.

Relan: I think that top-grossing is hard to crack. You see a lot of titles making it near the top, so that the hit effect of a top three … I feel like the iPhone gives you a good opportunity. If you look at Facebook, for example, it’s hard to get into the biggest games on Facebook. I think the mobile environment still gives you a good shot at that. The hit effect, if you will. Look at Temple Run. I mean who knew? Top-grossing is hard to crack. You have to get a big user base and have the best monetization engines. Getting both right is a rare thing.

GB: How high did both of your games get? What was the peak ranking?

Relan: On grossing, Top Girl reached number 10, and Social Girl on top-grossing. Social Girl I don’t ever think became number one, but I do believe it hit the top couple or so.

GB: What are some common threads between those two games, that made them more likely to get up to the top?

GB: What are some common threads between those two games, that made them more likely to get up to the top?

Relan: Both of the monetization engines are strong engines. Top Girl’s monetization engine is very focused on shopping and dressing up. We know that for the target audience, it’s pretty good. That’s a very strong mechanic. For Social Girl it’s a different monetization engine; it’s more about managing your friends and relationships, your boyfriend, your cliques and friends. A little less emphasis on shopping, a lot more emphasis on your virtual friends and your virtual boyfriend. Again, different mechanics, but the monetization engines behind both perform strongly for each mechanic. And then I think the production quality is one thing that is common across the two. We do believe in the CrowdStar art style, the production quality, the avatar, and the way it moves. These are very important elements. A lot of the competitive, top-grossing games still out there are about worlds. They don’t all focus on a high-quality avatar. That’s a commonality across both games, a very high-quality avatar engine that is just beautiful. You don’t see that in a lot of games. You see worlds and farms and pets, whatever, but if you look at the tower games or the town games, they’re all non-avatar-focused.

GB: The genre where you guys appeared, can you talk about the originality of the games there? Did it bump into two or three other similar fashion-shopping games? And was anybody trying to knock off you guys?

Relan: You see knockoffs. The clones are very poor quality. I think the production quality of our games is so much higher that the cloning effect doesn’t matter. I’ll give you an example. Dress Up Valentine by SGN. The production quality, if you look at it, is so poor compared to what we have. One of the clones was even pulled off the App Store. But I’m looking through the top 50 right now, and there’s only one clone, Dress Up Valentine. There’s nothing else here, really. It’s pretty difficult to make these games at the quality level. The game design, the game engine behind it, is using all of our experience from the last three or four years. These clone guys come in, they look at our game, maybe they try it, they get up in the top three with some marketing, and then it goes away. In the top 100 there are only two that are even close.

GB: I hear about these bots that can download a lot of brand-new games and get them up on some of the lists. It sounds like that doesn’t really work, that you can hire 5,000 Chinese folks to vote for your game or download it, but then it just doesn’t go anywhere after that.

Relan: Yeah. If a game fundamentally doesn’t perform, you can push it up all you want and it still won’t make money. What’s the point? The point is not to get into the top three. The point is to make money. That’s one. Two, if the game fundamentally isn’t high-quality and engaging, it won’t stay up there. The top-three list is always being competed for, so that stuff, in my opinion, is highly, highly overrated. You either have to build a network of five or 10 games, or on a stand-alone basis the game itself has to be fundamentally appealing. Those are the only two strategies. This gold-farming stuff isn’t going to work. If a game isn’t good, it’s not going to get up there; and if it’s good, it’s going to get up there anyway.

GB: How do you look at the cost of user acquisition? Fiksu put out their index information for the month of December and said that the cost of acquisition was higher in December than it’s ever been.

GB: How do you look at the cost of user acquisition? Fiksu put out their index information for the month of December and said that the cost of acquisition was higher in December than it’s ever been.

Relan: Yeah. But the good news is, again, unlike Facebook games, in mobile you do see a big holiday rush in December. It’s a store, it’s the App Store, so it does have that retailing effect. The cost since December hasn’t stayed up. I would say, year on year, comparing January of last year to January of this year, the cost of user acquisition has doubled. But it’s still half of what it was in December. December has a very unusual effect. That doesn’t mean costs aren’t going up. We have acquired over 10 million users in mobile just with these two games, and we have over two and a half million, almost three million monthly active users right now, just on these two games. Those, I would say, are based on costs that were much lower than they are right now. But December’s an anomaly. December you’re talking about two or three-dollar CPI. That’s an anomaly.

GB: That’s not sustainable, I guess?

Relan: The trend is clear. It’s getting more expensive. But it’s not the December numbers. We feel pretty good about continuing to invest in more user acquisition right now.

GB: I wonder, though, does the industry itself have some kind of big problem, where if the cost of user acquisition is going up, the amount of money you can raise these days may not be as high as it was last year?

Relan: Yeah.

GB: There’s also the question of how long you can hang on to a customer. What’s the lifetime value of a customer now? If that shrinks, this whole formula doesn’t sound good, right?

GB: There’s also the question of how long you can hang on to a customer. What’s the lifetime value of a customer now? If that shrinks, this whole formula doesn’t sound good, right?

Relan: Right. The economics are dependent on customer acquisition costs, which are higher right now, trending in a way that is offset by two things. One is lots of discovery, because the market is growing so fast. Let me give you some numbers. For iOS, we think the estimate is 120 million or 130 million iPhones sold this year. Of which 60 percent will be upgrades, let’s say, and 40 percent will be absolutely new devices. Maybe 50 million new users are coming online. I remember when Facebook was growing by 50 – 100 million users a year, right? But these are highly qualified users that have expensive devices. So they’re very monetizable. And by the way, they’re going to ship 60 or 70 million iPads this year, most of which are not upgrades. So I would say we’ll see 100 million new iOS users coming online this year, between iPhone and tablets. And their average revenue per user (ARPUs) are much better than the ARPU was when Facebook was adding users, because Facebook was mostly international. If Apple continues to drive growth of monetizable users, then the economics continue to work. Which, I think, is what we will discover this year. For those who have products, who have a strategy, we think it works. For new entrants I would say it’s getting tough. The learning curve you’ll go through, by the time you crack it, a lot of the user base on mobile will have been exploited. You remember the old Facebook days, right? There were the big four or five companies in gaming. CrowdStar, Zynga, Pocket Gems, Backflip. You can name the companies that are clearly in a position to grow their user bases at an economic level that works. New entrants coming in today, just starting out, doing a one-off game and trying to build a business, I think it’s very tough.

GB: Do you see some value in teaming up with others in some kind of network? The way that Applifier got companies together on Facebook.

Relan: Informally, that’s going on, even in the mobile space. People are doing what are called traffic exchanges. ChartBoost and MoPub are both enabling that, so there are players like that already making it happen. At scale, I would say it remains to be seen. There are initiatives that I can’t speak about in that area. My guess is that you will see some experimentation, or not just experimenting, some serious investment in that area this year to bring down customer acquisition costs. We’ll see what happens there. But yeah, experimentally, on a sort of low scale, it’s already happening.

GB: Tapjoy or Gree or Ngmoco. They’re offering solutions?

Relan: I think that today it’s more ChartBoost and MoPub, those type of things. I think that Ngmoco and Gree are going to take it to the next level. When I say it’s going on at a lower scale, I meant ChartBoost, MoPub, Tapjoy. The higher-scale stuff, I think it will be the Ngmoco network, the Gree global platform launch that they’re talking about. Zynga, if it does something. Those will be the big ones that will officially create networks of users that are much larger than these smaller networks of users. I would put Tapjoy, MoPub, ChartBoost into a “what’s going on today” category of network exchanges. Much lower scale. But the big guys I think are going to step in this year.

GB: What about the value of some of these independent app stores? Are they also good for the industry in some way? GetJar, Amazon?

Relan: On Android, yeah. On Android, absolutely. I think that on Android, curated app stores are very valuable. Google Marketplace is not highly curated. You look at Amazon’s app store for example, we’re very pleased with it. We were one of the first people on it. Performance is good, Kindles are shipping well, there are some other devices too, absolutely important for the Android marketplace. Maybe there’s a little bit in other app-store-like applications that promote games, but on Android I don’t really see a choice. I think you’ve got to have curated app stores, because of the nature of the environment. It’s a very horizontalized device, operating system, app store. You need that vertical sort of integration, full stack, to make it work well. But if somebody’s purely in the app store business on Android, I would say even that’s useful. This curation is an important thing.

GB: The size of the company you must have in order to come up with a game every two or three months, what would you say that is now?

Relan: Our goal is a game every quarter. We have some of our resources still on Facebook, but honestly, even on Facebook we really want to see the mobile web come along, the Facebook Spartan or whatever it was called. It’s still not really exploding, it’s just slow, because of the technology that has to be built. We still have some investment in Facebook, and we’re hoping that mobile will accelerate. Much of our investment today is in mobile, and we’re 150 people. To produce a game a quarter of high quality and with a strong monetization engine, yeah, I would say 100-plus, minimum. It’s hard to do that many games and run them. Again, I’m talking about free-to-play, virtual goods games with a service. You can always make something, stick it up there, and move on to the next thing. Arcade games. But it would take 100 people or more to really do them systematically and then run them, if you want a game a quarter or five or six games a year. Let’s say five or six games a year, that’s what our plan is. You’re looking at that kind of investment.

GB: Mark Pincus (CEO of Zynga) mentioned that CityVille has more than 100 people working on it, just to do all of the updates for the service now.

Relan: Facebook is a different animal. I was talking about mobile. Facebook games, to produce at Zynga’s scale, probably take more than 100 people, and then to maintain and run them probably takes 100 people plus. It’s a very unique situation. I don’t think Zynga’s position on Facebook reflects the industry. That’s the one thing that is different, I think I said to you. They have 70 percent of the market on Facebook. To feed such a giant market, you have to have thousands of people. It’s a billion-and-a-half people industry, and they have over a billion of it. The mobile industry, though, they don’t have anything close to that. So I don’t see those kinds of investments required in mobile games yet. It’s starting to remind me of the early Facebook days. Earlier you could do a game with a couple of people, three or four people, and put it out there; now you’re starting to need tens of people to build and run mobile games, virtual goods-based. But it’s not into the hundreds. Zynga on Facebook is a very unusual, special, one-off situation.

GB: What are some big events that you might expect to happen in 2012?

Relan: One will be the introduction of social platforms at scale from the two Japanese companies and maybe one or two others. That’s a big event. There will be a very big holiday Q4. Christmas last year was big. You see that a lot of people got their games ready, cost per installs went up. I think today it’s 50-50, arcade versus virtual goods-based games, in the top-grossing, top 30 or 15 of each.

I expect that to swing towards free-to-play virtual goods games this year, by Christmas. They’re fundamentally much more immersive. You see people returning. We’re seeing the trends on that, returning daily active users and all that. I would expect acquisitions, like in the Facebook days. It’s not an easy market to crack. The learning, the understanding of distribution and monetization, how it all works, it’s very different on mobile. Extremely different from Facebook. So those are the big three.

Dream Zoo didn’t do so well. CityVille didn’t do so well on mobile. The mechanics that Zynga used on Facebook that did so well don’t do the job on mobile. They have to design it completely differently. We’ve done that with Top Girl and Social Girl. They’re completely different game mechanics built for mobile. You’ve seen how Zynga tried twice with big properties. CityVille Hometown Edition or whatever they called it. It’s just not there. They introduced it around the same time we did Top Girl, last summer. Top Girl continues to stay up there.

We did not take It Girl and move it over. We designed that game from scratch for mobile. Eight months later, still performing well. CityVille comes in, it’s nowhere. Entered at the same time, nowhere on the charts today. But Zynga learns, they’ll learn. They learn fast. They clone [chuckles], Be careful, I’m not discounting them, I’m just saying, they didn’t crack it on their own. It’s a different skill set, the whole way you run and manage and build these games on mobile.

GB: And right now there’s 130,000 publishers going after that, right?

Relan: Yeah. As I’m saying, though, it’s like Facebook. There were a million app developers. And now today there’s the big four or five on Facebook. We are no longer one of the biggest on Facebook, but we are one of the biggest on mobile, for reasons related to what I said earlier. Until the Facebook mobile web comes out, I’d rather compete in an industry where there isn’t one guy with a 70 percent or 80 percent share. That just leaves you with a very small share to compete for. Here,100 percent of the market is available. I can get a lot of people going for it. There’s a lot of people going to Facebook as well, hundreds of thousands of apps. So we had value once on Facebook, we’re very confident we’re doing it on mobile. We are there as one of the top developers. I just don’t think that Apple and Google are intending to create a structure for Zynga like Facebook created. I think Facebook was a very special, unique environment, where engagement on Facebook was dependent on Zynga games. Whereas games were engaging on smartphones well before Zynga showed up. Right? I think that, generally speaking, there’s a lot of competition. But we moved early, we got two top grossers out there, and we’re ahead of the curve. It doesn’t bother me that there’s a lot more people competing. We did that on Facebook, we came out as one of the top developers, we’ll do it again.

![]() GamesBeat 2012 is VentureBeat’s fourth annual conference on disruption in the video game market. This year we’re calling on speakers from the hottest mobile, social, PC, and console companies to debate new ways to stay on pace with changing consumer tastes and platforms. Join 500+ execs, investors, analysts, entrepreneurs, and press as we explore the gaming industry’s latest trends and newest monetization opportunities. The event takes place July 10-11 in San Francisco, and you can get your early-bird tickets here.

GamesBeat 2012 is VentureBeat’s fourth annual conference on disruption in the video game market. This year we’re calling on speakers from the hottest mobile, social, PC, and console companies to debate new ways to stay on pace with changing consumer tastes and platforms. Join 500+ execs, investors, analysts, entrepreneurs, and press as we explore the gaming industry’s latest trends and newest monetization opportunities. The event takes place July 10-11 in San Francisco, and you can get your early-bird tickets here.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More