Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

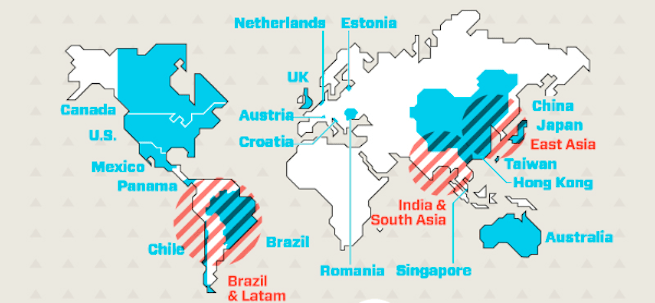

Tech investment firm/startup accelerator 500 Startups is raising a new $50 million fund, according to a SEC regulator filing.

500 Startups is an early-stage seed fund and incubator program that’s become a brand name over the last few years. The group invests between $25,000 to $250,000 in primarily consumer & small-to-medium-size internet startups, as well as startups related web infrastructure services.

The group’s first fund was $15 million and included 257 companies, a handful of which were later acquired by major tech companies, including BackType, Versly, CardMunch, Rapportive, and others.

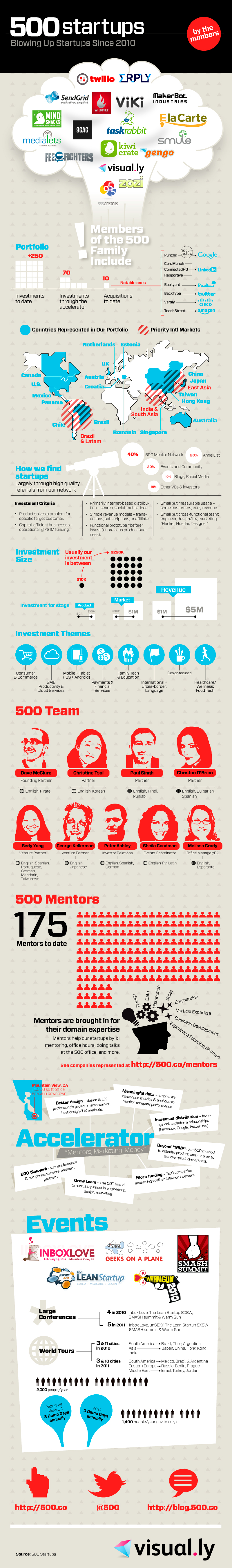

In an interview with VentureBeat, 500 startups founding partner Dave McClure said the new fund will seek out more startups in international markets, and could account for a fourth of all investments.

“I think the mentality of some Silicon Valley venture firms is to expect everything to come to them. We actually don’t. We get off our asses and go across the country and around the world,” McClure said, noting that he expects about half of all the groups investments to still come from the San Francisco area due to its obvious benefits.

The group also recently promoted Paul Singh and Christen O’Brien to partners and added two new venture partners: Bedy Yang, who will oversee investments in Brazil & Latin America and George Kellerman, who will oversee investments in Japan. Overall the new additions should help with the groups push to find more worthy startups in international markets.

500 Startups commissioned a new infographic covering its last 18 months of activity, which we’ve embedded below. (Click image to enlarge)