Facebook’s IPO was scheduled for May 2012, or so every analyst across the country was saying a couple months ago. However, that just ain’t gonna happen, and we’re here to tell you why.

No, it’s not because CEO Mark Zuckerberg is getting wishy-washy or touchy-feely about so-called distractions or his billion-dollar impulse buy of Instagram. It’s because right now is an absolutely awful time to bring any company onto the public market for an IPO.

Let’s follow the money, shall we? Here’s a graph we made showing the performance of six recently public technology stocks just over the last month:

As you can see, LinkedIn is the only one that isn’t outright losing, and it’s not even up one percent over where it was a month ago. The others have lost between 15 percent and 30 percent in value.

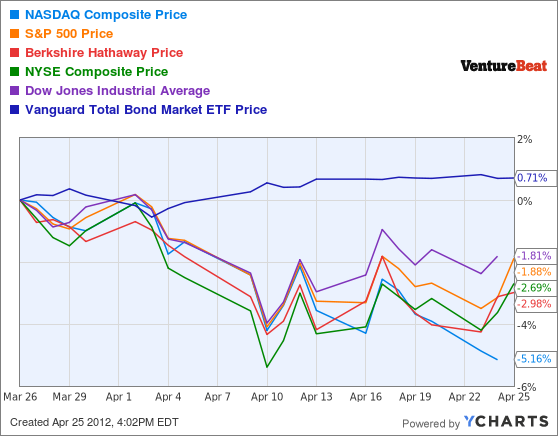

Looks pretty shaky, doesn’t it? But it’s not just the technology sector. Take a look at these common indices for overall market health, again showing performance over a one-month time period:

Again, you can see that things aren’t looking great. The most stable indicator has gained less than one percent, and all other economic indicators have dropped over the past 30 days.

Now, if you take a look at the past year or the past three months, you see a very different picture. Here’s another chart we made to show the same economic indicators for the past half-year:

As you can see quite clearly, the overall economy was rising very sharply between January and February. Overall economic indicators slowed somewhat in growth between February and March, but they really hit a rough patch in late March and early April.

If you lay Facebook’s financial decisions over that graph, the company’s timing and choices become obvious. On February 1, Facebook filed its S-1 with the SEC. At that time, the market was particularly robust, as you can see above. Now that growth has slowed and even declined, we’re hearing there might be a delay, and it makes total sense.

Unless the market overall and recently IPO’d stocks in the tech sector perk up drastically very soon, there’s almost no way we’re going to see a Facebook IPO as soon as May.

Analysts back up this assertion. Dun & Bradstreet tech IPO specialist Lee Simmons told us in a recent interview we should watch the market for cues as to when Facebook stock will land on the public market. If the market looked choppy, he said, we should expect a delay.

“You saw a couple companies last year pull in the reins and delay the IPO,” Simmons said. “Facebook can do the same thing.”

In fact, during last August’s huge market shake-up, a record number of IPOs were delayed — the most IPO delays we’ve seen in a single week in more than a decade. And the delays happened for a good reason.

“Thinking back to last May when LinkedIn priced, it seemed like the public markets were going to be really robust for the rest of the year,” Simmons recalled. “Then everything tanked.”

As a result of the market’s mini-collapse last August, LinkedIn stock experienced some severe turbulence and still hasn’t fully recovered to its July 2011 high point:

So, if you’re just itching to buy some Facebook stock and are looking for signs of an impending IPO, keep your finger on the S&P 500 rather than the rumor mill. When making financial predictions, you’re always better off following the money than some random hunch you found on the Internet.

Top photo and image manipulation by Jolie O’Dell; charts created by O’Dell with help from YCharts.