Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Save the rumors and speculation for another day, folks. Today, Facebook formally kicked off the the all-important roadshow leg of its initial public offering preparations with an investor meeting held in New York.

Last Thursday, May 3, the social network set its opening range at $28 to $35 share for an offering that could value the company as high as $96 billion. (The IPO is expected to happen later this month, with May 18 the likely date.) The preliminary pricing was followed up with a roadshow video that was light on information but heavy on emotional impact. Now, Facebook has taken its dog-and-pony show on the road — literally — hoping to prove to investors that, despite declining revenue, it’s bigger than the hype.

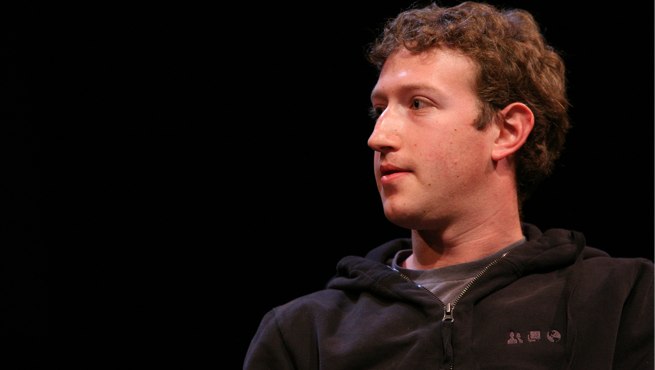

Facebook chief operating officer Sheryl Sandberg and chief financial officer David Ebersman, outfitted in Wall Street-worthy suits, hosted an hour-long presentation in front of a packed room of investors Monday. Hoodie-wearing CEO Mark Zuckerberg, surrounded by security, also made an appearance and spoke for roughly 10 minutes, according to reports. Some investors, however, left feeling “unsated,” according to tweets by CNBC journalist Kate Kelly.

And if you care about the little details, the meeting, held over lunch at a Sheraton New York Hotel on 7th Avenue in Manhattan, started late, was kicked off by the roadshow film, and was said to include a Cobb salad and cookies.

On to more serious matters. Facebook and Zuckerberg fielded questions about its advertising-heavy business, and will likely continue to face a barrage of questions about the social network’s recent revenue hiccups and its pricey acquisition of Instagram as the road show continues.

“Investors will want to understand business fundamentals, not hype,” Gartner research director Brian Blau told VentureBeat. “Being hip, hyping your company, and hoping for a good future is a risky way to build a business.”

In the first quarter of 2012, Facebook made $205 million in net income on $1.06 billion in revenue. The revenue figure represents a six percent dip from the previous quarter, and the income number means that Facebook made $28 million less than it did in the same quarter last year. The company also rushed to close a surprise, reactionary $1 billion acquisition of Instagram, driven entirely by Zuckerberg.

“Given that Facebook missed earnings last quarter they need to show that the future of ads and credits revenues can be sustained, rather than saying ‘just trust us,'” Blau said. “I believe investors will have some level of trust given the potential and opportunity that Facebook has already shown, but company performance is a key aspect of the public market and without clear signals as to their future, investors could have reason to be skeptical and may take a more cautionary approach.”

Photo credit: Crunchies 2009/Flickr