Electronic Arts is a complex, multi-faceted company with $4 billion in annual revenues. But the company has simplified its strategy to focus on “brands, platforms, and talent,” according to chief executive John Riccitiello (pictured above, on left).

In a conference call yesterday with analysts after EA reported its fourth-fiscal-quarter earnings on Monday, Riccitiello said that EA has shifted from being on the defensive in the game industry to going on the offensive. As it does so, it is also moving from its base of core console and PC games to digital content, such as online games, social games on Facebook, and smartphone and tablet games.

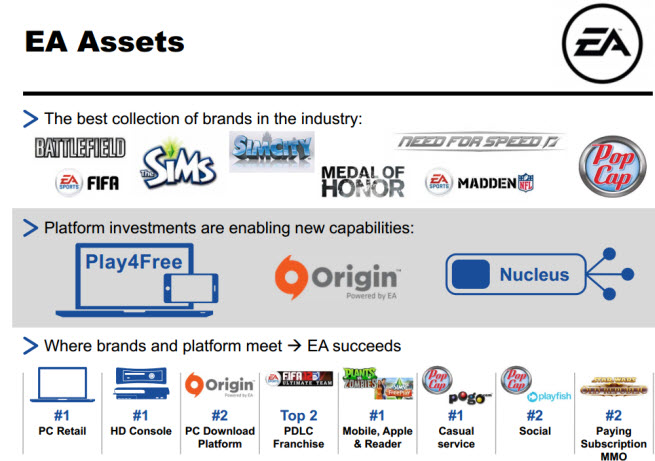

Riccitiello said the company’s strategic pillars are to develop the strongest collection of brands in the industry, create the infrastructure platforms to take brands into the digital market and direct to consumers, and hire and retain the talent that can lead create both great games and lead in the quantitative analysis of games.

“We’ve introduced a significant change in our strategy: a shift to offense,” Riccitiello said. “One that would complete our transformation into a digital, pure-play company.”

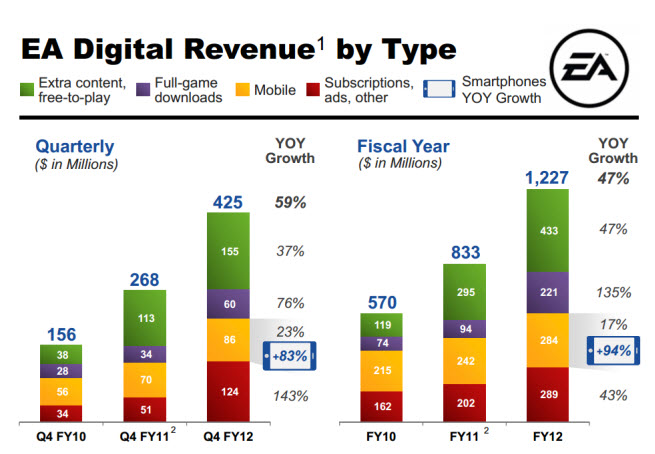

To underscore the shift, Riccitiello pointed out that in fiscal year 2009, EA shipped 67 games to retailers. In the fiscal year ending March 31, 2012, EA shipped 25 major, branded, online game services. Registered users increased from 27 million four years ago to 220 million for EA’s online services. And EA ended the year with $1.2 billion in digital revenues, making it one of the top-five largest digital-game companies. EA’s online game-distribution service, Origin, generated $150 million in the past 10 months.

That’s good progress but not necessarily something that will impress investors or analysts. Colin Sebastian, an analyst at Baird Equity Research, said in a note last night that the good results of the fourth fiscal quarter were “dampened by greater-than-expected subscriber losses for Star Wars.” He added, “While EA continues to make progress on its new digital initiatives, we expect the transformation to be remain a marathon event for the foreseeable future.”

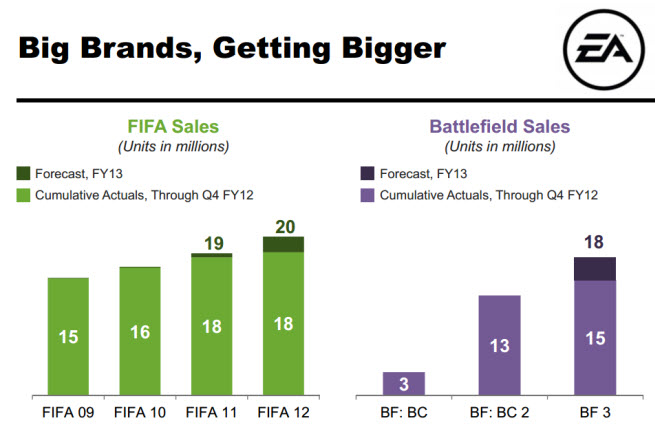

Riccitiello said EA will take its brands across all digital business models and channels. Blockbusters like Battlefield, Need for Speed, and FIFA Soccer will lead the way.

“We strongly believe our brand collection is unmatched by any competitor in our industry,” Riccitiello said.

Riccitiello said that platforms like EA’s Nucleus system will enhance the gaming experience for consumers, who can play the games in the most direct way possible. Another big platform is the web-based, free-to-play platform, EA Play4Free, which takes EA brands to players who don’t want to pay a lot of money at the outset.

Lastly, the EA boss said, “For many, talent is a consideration. For us, it is a core strategy.” Such talent would make EA more like Google, Facebook, “and yes, Zynga,” Riccitiello said.

EA recently hired its first ever chief technology officer, Rajat Taneja, formerly of Microsoft. His team is building an infrastructure for playing EA games on any device.

Riccitiello also pointed out former Playfish chief Kristian Segerstrale, who was recently appointed executive vice president of digital at EA. Segerstrale is assembling a team of quantitative analysts who can help optimize EA’s games for better traffic and revenue.

Peter Moore (pictured top, on right), the No. 2 executive at EA, echoed Riccitiello’s emphasis on brands, platforms, and talent.

“Each of these reinforces how EA’s digital business has grown and evolved,” Moore said in the conference call.

Overall, EA expects console games to return to strong growth, but those games will have a greater and greater digital component to them. This current quarter, EA expects to launch one packaged-good title for stores and 11 titles for digital formats.

Moore said that FIFA Soccer is poised to spread to a larger digital online audience on multiple platforms. The day is coming when EA will store the achievements, rewards, and community recognition for FIFA players in the cloud rather than on players’ physical consoles. In Asia, FIFA Online 2 has more than 28 million registered players for a free-to-play version of the soccer game. About 80 percent of Korean males ages 16 to 19 have played the game. And in Japan, Gree has published an EA FIFA Soccer mobile game that has generated $30 million in revenues in five months.

“FIFA is powering much of our thinking about the connected brand universe,” Moore said.

SimCity will debut in EA’s fourth fiscal quarter for the year ending March 31, 2013. That game will be “always on, always connected,” i.e., SimCity will require an active Internet connection every time the game starts. EA’s Maxis game studio is also preparing to launch a new unnamed social game this quarter.

Moore said EA’s Battlefield Play4Free is a solid free-to-play game that continues to generate revenue. Play4Free generated $1.8 million in revenue per week in the fourth fiscal quarter, up 80 percent from a year earlier. These games serve as a “funnel,” bringing in consumers who play casually and then eventually turn into more dedicated, lucrative players in hardcore games. These games help reduce the cost of user acquisition because EA can stay in constant contact with consumers — via social, online, free-to-play, and mobile titles — as they await the next version of a console game. Moore said EA is now much savvier at monetizing games in the digital world.

“When I arrived five years ago, EA was a configuration of siloed businesses,” Moore said. “There wasn’t much communication between brands, studios, and marketing. There was little contact with consumers beyond the initial sale. Today, we are a much more cohesive team.”

“Fiscal ’12 was a great year, but fiscal ’13 will be much better,” Riccitiello said. “This is the year we break away from the pack, with a very different profile from the game companies we grew up with. We will have capabilities that none of our new competitors can match. We have a bunch of powerful brands projected over a variety of devices, with a powerful direct-to-consumer network. All of it created and maintained by the industry’s most talented people.”

He said digital revenues would enable better margins to help EA invest in next-generation console games. As a result, EA may not suffer the same kind of problems it has historically had.

“We are changing the company from Tower Records to iTunes, from Blockbuster to Netflix, from Sears to Amazon. But, unlike many of our digital competitors, we draw our growth from more than one revenue source. We have a much more diversified revenue base. We are building this digital business more organically than most.”

![]() GamesBeat 2012 is VentureBeat’s fourth annual conference on disruption in the video game market. This year we’re calling on speakers from the hottest mobile, social, PC, and console companies to debate new ways to stay on pace with changing consumer tastes and platforms. Join 500+ execs, investors, analysts, entrepreneurs, and press as we explore the gaming industry’s latest trends and newest monetization opportunities. The event takes place July 10-11 in San Francisco, and you can get your early-bird tickets here.

GamesBeat 2012 is VentureBeat’s fourth annual conference on disruption in the video game market. This year we’re calling on speakers from the hottest mobile, social, PC, and console companies to debate new ways to stay on pace with changing consumer tastes and platforms. Join 500+ execs, investors, analysts, entrepreneurs, and press as we explore the gaming industry’s latest trends and newest monetization opportunities. The event takes place July 10-11 in San Francisco, and you can get your early-bird tickets here.

[Photo credit: Joystiq]

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More