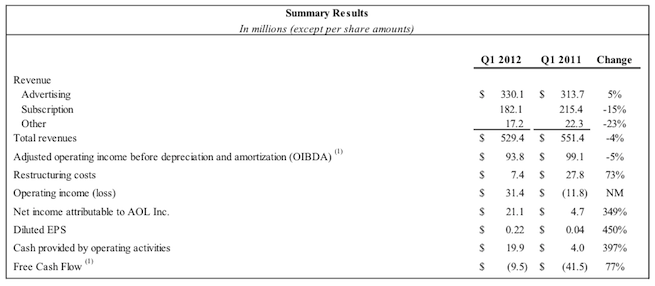

Continuing its trend of stemming the bleeding, AOL reported an increase in overall revenue in the first quarter 2012 to $529 million at 22 cents a share, which bests analysts estimates of $527 million at 7 cents per share.

Profits grew a healthy 349 percent to $21.1 million, up from $4.7 million a year ago.

AOL’s advertising was also up five percent to $330.1 compared to the same quarter last year, with its global display ad business seeing its fifth consecutive quarter of growth. Mostly this would indicate that AOL chief executive Tim Armstrong’s strategy of transforming the company into a media/advertising powerhouse is working — just don’t look at domestic ads.

AOL’s domestic display ad business declined by one percent to $118.9 million for the quarter, down from $120 million during the same quarter in 2011. The company attributes this to “a decline in reserved impressions sold, partially offset by growth in reserved inventory pricing and Patch revenue,” it states in the release. Considering that most of AOL’s largest properties are targeted at a domestic audience (as well as the amount of money it’s spent on publications to attract attention), this is an area AOL should be nailing.

In terms of traffic/audience, AOL reported a four percent drop across all its properties. Such information will certainly fuel the fire lit by activist shareholders like Starboard Value LP, who has said AOL’s media business is in trouble. This is partially due to a number of high-profile acquisitions the company has made since 2009, including the $25 million purchase of TechCrunch and the $315 million purchase of The Huffington Post. The lower traffic/audience numbers in Q1 could also add credibility to the rumor that AOL may be trying to sell some of its tech-related news sites, such as TechCrunch, Engadget, TUAW, and Joystiq.

Despite those crucial traffic and domestic ad growth being down, Armstrong said in the report that “AOL is a much stronger company today than a year ago and began 2012 by growing advertising revenue, lowering expenses and improving Adjusted OIBDA trend. In 2012 and beyond we are simultaneously focused on the continued successful execution of our strategy and on creating and unlocking value for our shareholders.”

Here are some of the highlights from the Q1 earnings report:

- Improved Revenue & Expense Trends Lead AOL to Increase 2012 Adjusted OIBDA Guidance to $350 Million*

- Global Advertising Revenue Grows Year-Over-Year for the Fourth Consecutive Quarter

- Combined AOL Properties Display & Third Party Network Revenue Grows 10% Year-Over-Year

- Subscription Churn Rate the Lowest in Seven Years

- Significant Improvements Made to Search and Contextual Revenue Trends

- Operating Expenses Decline Quarter-over-Quarter for the Fourth Consecutive Quarter

- Reported EPS of $0.22 Compares to $0.04 in Q1 2011

- AOL Repurchased 1.8M Shares Since its Last Earnings Release at an Average Price of $17.65

- AOL has Repurchased 14.8M Shares To-Date at an Average Price of $14.11

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More