Update 5/28: See below for another recent IPO that did even worse, although at a much smaller market cap.

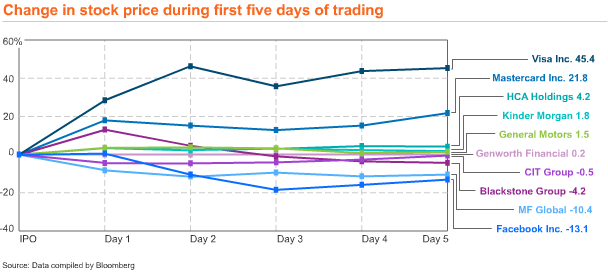

Facebook’s first five days as a public company saw its value drop 13.1 percent, the worst first-week performance of any initial public offering in a decade.

That’s the sorry picture compiled by Bloomberg at the close of trading yesterday. In contrast, Visa’s 2008 IPO resulted in a first-week bump of 45.4 percent, putting big smiles on the faces of anyone lucky enough to buy stock on that company’s first day of trading.

Of course, small investors’ loss is Facebook’s gain. As we explained yesterday, Facebook and its underwriters, led by Morgan Stanley, pegged its opening price at the top of its range, $38, even though it was privately telling select investors that its revenue forecasts for the coming year were on the “low end” of its previous guidance. That message didn’t get out to the wider market — including smaller investors — until after the IPO. In other words, Facebook maximized its IPO raise, even though its actions would torpedo the stock as soon as the full revenue predictions became public.

While a first-day or first-week “pop” may look nice, and get big headlines, it actually leaves money on the table: It’s a sign that the company didn’t set its IPO price at the correct market price. By contrast, Facebook may have set its IPO price a little too high, but that’s the smart thing to do, from the accountant’s point of view.

Facebook now faces an embarrassing series of investigations and the difficulty of keeping employees’ and investors’ spirits up in the face of a sinking share price. On the other hand, it has $18.4 billion in IPO proceeds to console it for suddenly being the most unpopular tech stock on the block. (That’s because the company got $16 billion for the initial IPO allotment, plus another $2.4 billion for the “greenshoe” option that its underwriters exercised last week.)

It will be interesting, and more relevant, to see how Facebook’s stock looks after 30 days of trading. As the chart below shows, Digital Domain had the worst 30-day performance of any IPO in the last year, sinking 39.2 percent in its first month. Skullcandy dropped 23.5 percent in its first 30 days. By contrast, Yelp and Guidewire Software were up about 80 percent after their first 30 days, and Brightcove was up 92 percent.

UPDATE: A reader pointed us to the sorry IPO performance of Digital Domain (DDMG), which debuted on the market at $8.50 on November 18, 2011 and had slid to $6.50 by the end of its fifth full day of trading, a drop of 23 percent — much worse than Facebook’s first-week debut. DDMG is currently trading at $7.36, giving it a market capitalization of $307 million. We regret the oversight.

Top chart: Bloomberg. Bottom chart: NASDAQ