While recent headlines such as “Game sales crash!” and “Games retail collapses!” don’t paint a rosy picture, I believe the report of the death of console games is an exaggeration. Yet an uncertain future faces those console games companies that choose not to evolve rapidly.

While recent headlines such as “Game sales crash!” and “Games retail collapses!” don’t paint a rosy picture, I believe the report of the death of console games is an exaggeration. Yet an uncertain future faces those console games companies that choose not to evolve rapidly.

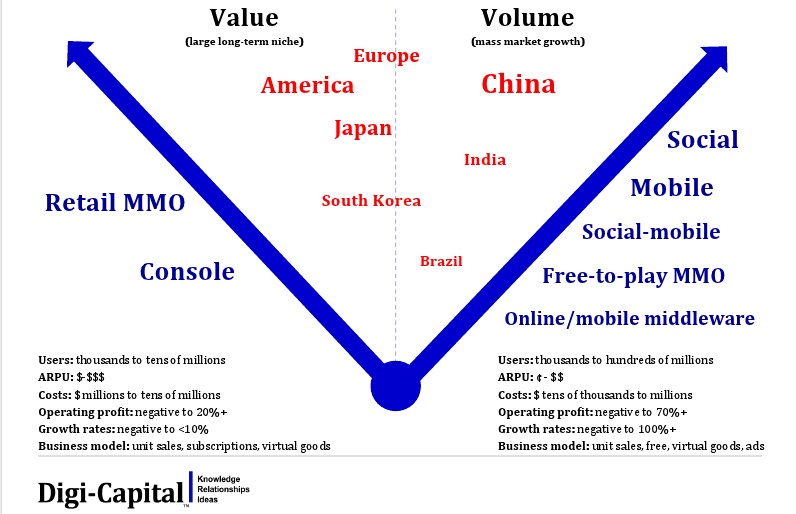

When I blogged back in early 2010 that console games publishers were at risk of going the way of traditional media companies back in early 2010, readers reacted strongly. So I wasn’t surprised by the even stronger reaction last year when I wrote that the games market had fundamentally split into “Value” and “Volume” markets, both by sector and geography. The two-speed market this is creating may have more rapid and profound effects on the games market than it did on the media market, with meteoric rises for some and slow going for others.”

In the last 12 months the Volume markets have seen significant growth in terms of revenue, profit, investment, and M&A. But we’ve also seen many Value market companies trying to pivot towards Volume through both acquisition (e.g. EA/Popcap) and organic growth. If the number of requests we’re receiving from console games companies to conduct strategic reviews (usually as a precursor to investment or M&A) is an indication, then some of the best in the business are trying to evolve as quickly as possible.

So it seems like a good time to look at both the opportunities and challenges facing great console games companies in the brave new world.

New order, new opportunities

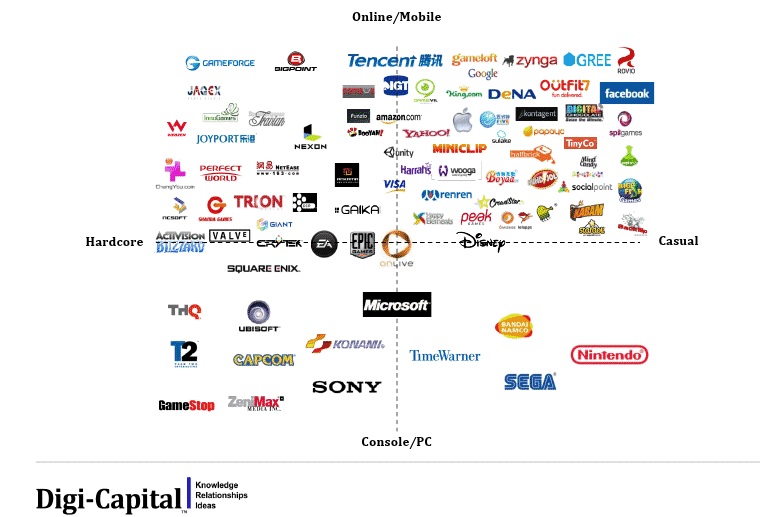

The balance of power in the games market today has fundamentally changed, with games companies nobody had heard of five years ago coming to dominate profits, investment, M&A, and headlines. In our Global Games Investment Review 2012, online and mobile games are forecast to take 50% of games software revenue share at $41B by 2015F (14% CAGR 11F-15F).

Yet as discussed in our Console Games Review, console generated 48% of global games industry software revenues and 62% of total games industry revenues including hardware in 2011.

Nonetheless, the console games industry faces clear challenges (declining revenues, user cannibalization by online/mobile games, “blockbuster” investment risks, long hardware cycle, etc), which the coming eighth-generation console cycle might not fix. One hurdle is that where casual games were a significant driver for the seventh-eneration console market (>95M Wii, >10M Kinect, >150M DS sold), today many great online/mobile games are either free or cheap on increasingly capable mass-market platforms (iOS, Android, Facebook, QQ, GREE, etc). This creates a potentially significant hurdle at the casual end of the market on the basis of price/convenience. Cloud gaming (OnLive, Gaikai) is still relatively early-stage but also holds promise as a platform in its own right. So while console games might remain a large long-term niche market, the next hardware cycle might not herald a return to mass-market growth.

Despite these challenges, the best console games companies have great core strengths that could enable a successful pivot to online/mobile:

- Strong brands

- Large installed user bases

- Strong cashflow

- AAA games design quality

- Genre dominance

But perhaps the greatest advantage they possess are players trained for decades to pay for fun. This is a specific advantage that many free-to-play games companies can only dream about.

Whales are not an endangered species

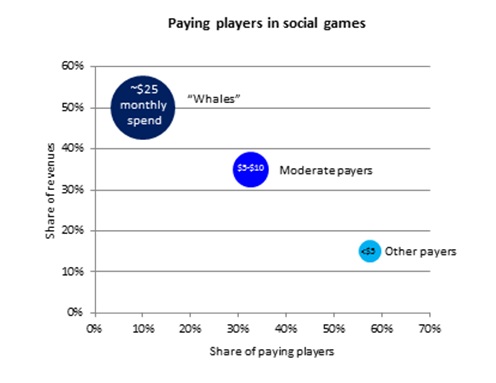

In free-to-play games (social, mobile, mobile-social, free-to-play MMO), a core part of game design is the focus on user acquisition, upsell, and retention. While the numbers vary from game to game, it helps to think about ≥80% of revenue coming from ≤10% of users:

- ≤1% of users are “Whales,” who will buy every virtual item no matter how expensive to show off to their in-game friends.

- 5-9% of users will buy one or more virtual item(s) to speed up their achievement of specific game objectives.

- 90-95% of users will never buy anything, but add value for other users and advertisers.

As shown below in the revenue breakdown from Digi-Capital’s Social Games Review (and again these figures vary from game to game), Whales are the most important player group commercially.

Looking at the opportunity through this lens, console games companies swim in a sea of Whales, where players will pay $60 for a game they haven’t even played yet. Epic Games is a great example of a console games company that took advantage of the opportunity with Infinity Blade for iOS (over $30M revenue, and Mike Capps tells us it’s “still selling strongly and on top of the sales charts”). They also showed that there is still money on the table for high-quality paid games despite the success of free-to-play.

So does how does Moby Dick catch Angry Birds?

The tools that great console games companies have for turning their businesses towards online/mobile games fall into three broad areas:

- Cross-promotion: for user acquisition, upsell, retention, and organic user growth. A strong core audience of organically acquired users might play longer, pay more and serve as evangelists to increase virality, lower user-acquisition costs, and become the bedrock of a strong online/mobile player community;

- Game design: To cater to Whales and players for whom game quality is a determining factor in their willingness to pay for their fun; and

- Barriers to entry: Strong brands and high quality are hard to replicate, enabling category dominance in ways that might not otherwise be possible.

Looking at console games companies this way, there is much that can be leveraged to pivot from Value to Volume markets.

A journey of a thousand miles begins with a single step (and a few questions)

While potentially attractive, the online/mobile pivot is not easy to plan or deliver. Before starting down that path, you might think about a few things:

- Brands: Are your brands strong enough to migrate players to online/mobile platforms?

- Games: How could your games adapt to become great online/mobile core, mid-core or casual games?

- Uniqueness: How might your games stand out in a market of hundreds of thousands of apps?

- Accessibility: Could your core games be made accessible enough for a mass market audience?

- Genres: Could you leverage your basic game mechanics to other game genres popular on online/mobile platforms?

- Platforms: Which online/mobile platforms could work for you, and does your team have successful experience on them?

- Users: Could your games attract millions or hundreds of millions of users?

- Business model: Could your games be adapted for virtual currency, virtual goods or advertising?

- ARPU: Could your business model work with ARPU in cents rather than dollars?

- Costs: Do you have the right cost/revenue model for online/mobile markets?

- Development: Could you reduce development cycles and costs by an order of magnitude?

- Marketing integration: How could you integrate user acquisition, upsell, and retention into game design and development?

- Live team and community management: How might you manage a user community of millions of players in real time?

- Geography: Could your games operate across geographies and cultures?

- Value to Volume transition: How do you bring your team with you? Who stays focused on console? How do you balance different internal cultures under the one roof?

- Scalability: How do you become a business platform with scale advantages, rather than a string of hits?

- Buy vs. build vs. partner: What do you need to succeed in online/mobile, and how do you get it (organic growth, investment, M&A, partnerships)?

- Investment: How much financial runway do you have left, and how do you finance everything you need to do?

- M&A: Could you deliver your pivot by merging with a leading online/mobile games company?

I suggest you don’t let the grass grow under your feet before answering these questions.. The clock is ticking.

Tim Merel is Managing Director of Digi-Capital, the digital investment bank focused on games across America, Europe, and Asia (China, Japan, South Korea). In addition to its fundraising, M&A, and strategic review work, Digi-Capital publishes its Global Games Investment Review 2012.

Tim Merel is Managing Director of Digi-Capital, the digital investment bank focused on games across America, Europe, and Asia (China, Japan, South Korea). In addition to its fundraising, M&A, and strategic review work, Digi-Capital publishes its Global Games Investment Review 2012.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More