The console market has stalled, disrupted by the rise of digital game platforms and free games. The console cycle has lasted too long, and now we’ve entered a period of decline.

The console market has stalled, disrupted by the rise of digital game platforms and free games. The console cycle has lasted too long, and now we’ve entered a period of decline.

So now it has become a financial imperative for traditional game companies to make the leap to digital — before the all-digital companies gain too much of an upper hand in the emerging markets of social, mobile, and online games. Crossing over from an existing market to an emerging one is what our GameBeat 2012 conference is all about.

Looking back and forward

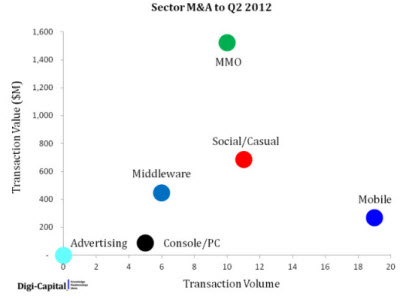

A year ago, we wrote about The Road Ahead in Mobile Games and a follow-up piece after our conference. The conference was all about the wide-open battle for control of the emerging mobile gaming market. A year later, this trend is still strong. Mobile gaming companies are still raising the most money, according to game investment bank Digi-Capital. But the battle has really spilled beyond all borders within the game market. This is, as our theme indicates, the Crossover Era. Companies are crossing over into other markets in a kind of giant street brawl. At our conference, we have more than 80 of the industry’s top minds focused on the evolution of games.

Zynga’s presence is from social to mobile. Electronic Arts is expanding to numerous digital platforms, including social and mobile. Activision Publishing is moving into mobile. Microsoft has expanded into free-to-play online games. Sony enters cloud gaming with the purchase of Gaikai. China’s Tencent is moving into the West with investments in Riot Games (makers of popular multiplayer online battle arena game League of Legends) and Epic Games (crafters of top-rated third-person shooter Gears of War and groundbreaking iPhone series Infinity Blade). Headlines from recent months explain why game acquisitions are up: Game industry acquisitions grew dramatically in the second quarter, putting 2012 on track to break records for game M&A deals, according to investment bank Digi-Capital.

In many ways, this is one of the best times for the game business. More than 72 percent of people in the U.S. play games now, according to Zynga. That means it’s not so crazy for Mark Pincus, the chief executive of Zynga and our opening fireside chat speaker at MobileBeat/GamesBeat, to dream of a billion people playing games. The opportunity for play is enormous. The worldwide game industry is expected to grow from $52 billion in 2011 to $70 billion in 2017, DFC Intelligence reports.

Transaction mania

Just six months into the year, games M&A is already at 88 percent of the transaction value for all of 2011, which was the previous record year. In the first six months of the year, Digi-Capital has tracked 51 transactions worth $3 billion in value. The average value of each transaction was $59 million. The firm tracked 113 transactions in 2011 worth $3.4 billion, with an average value of $30 million. That means we’re seeing fewer transactions, but the values are higher.

The state of the game market remains mixed and difficult to read. Longtime publisher THQ has seen its stock price wither as it closed studios and exited a number of game categories due to slow sales. Year-to-date physical retail game sales are down 25 percent, according to NPD. But digital content sales are up 10 percent.

Likewise, investment in game startups has cooled off from 2011’s pace. In the first six months of 2012, there were 73 investments in game companies that generated $481 million in transaction value at an average of $7 million, according to Digi-Capital.

In 2011, there were 152 game investment transactions worth $2 billion at an average investment of $13 million. The transaction volume is down by 4 percent, and the transaction value is down 51 percent. If this trend persists, then the game investment level for 2012 might return to the respectable level of 2010, the second-highest year on record.

Investment into mobile games is still strong, but money going into social games is tapering off. That suggests that many may believe that Zynga has locked up the casual games market on social network Facebook. And Facebook itself has seen slowing of its growth, enough so that its own IPO turned out to be mixed.

Social casino games

Despite the downturn in social game investments, there is a category of social that is on fire. Social casino games have rocketed this year in a couple of ways. In 2012, social casino game players now account for 13 percent of all of the players on Facebook, compared to just 8 percent in 2011 and 6 percent in 2010, according to analytics firm Kontagent. That’s a significant switch in consumer tastes, away from casual simulations such as FarmVille.

And social casino game startups have become a hot market for investors. In December, the Justice Department kicked off this frenzy when it announced that online gambling could become legal in the U.S., so long as each state passed laws allowing it. Nevada has done so, and Delaware will likely do it soon. More states will likely pass bills doing the same, since it means more tax revenues.

That in turn could bring down the barrier between social casino games and real-money online gambling. This might be a shifting of the bubble, from one market segment to another. But it certainly seems like a bubble, since the old guard casino gambling companies are moving into the market. IGT to acquire social casino game maker Double Down Interactive, a firm with just 70 employees, in January for $500 million. Many companies are in a race to create vertically integrated gambling companies, with social casino games, real-money online gambling, and land-based casinos.

They all want to create a big funnel, according to Brock Pierce (the managing director of the Clearstone Global Gaming Fund and moderator of our panel on social casino games at GamesBeat 2012), with social games feeding players into online gambling and the casinos. But they might very well run into fierce competition from Zynga. I can imagine one day seeing a real Zynga casino on the Las Vegas Strip. If social casino game companies can get access to real gamblers, they could see their average revenue per paying user go from $2 a month to hundreds of dollars a month, according to an entrepreneur who will unveil a new startup at GamesBeat 2012.

These companies are all positioning against big companies like Zynga, but they clearly believe that innovation and entrepreneurship will pay off.

Mobile game race

Money is also flowing into mobile games. The mobile game market seemed “frothy” last year to Tim Chang, who is now a partner at the venture-capital fund Mayfield Fund. But it continued to gather steam in part because of the growth of mobile devices, with more than 550 million iOS and Android users now. That amounts to just 8 percent of the world population, so there is plenty of room to grow. And in the U.S., games account for 88 percent of the top grossing app rankings on the Apple App Store.

There are also big international mobile app markets, new devices such as Apple’s latest iPad, and the entry of new players such as Japan’s DeNA (which bought Ngmoco) and Gree (which bought both OpenFeint and Funzio).

Gree grew rapidly in Japan as its mobile social network took off. Naoki Aoyagi (pictured above), the chief executive of Gree International and a speaker at GamesBeat 2012, told us recently that he thinks that the mobile gaming market will play out in the next 18 months. Just as you saw Zynga move to dominance in social games, somebody will move to dominance in mobile games.

As with casino games, it’s another race. It’s not just mobile-focused companies that are running this race. It’s big companies like Activision Publishing, whose mobile leader Greg Canessa will speak at GamesBeat, and Electronic Arts, whose digital chief Kristian Segerstrale is talking at GamesBeat.

The tough thing about the mobile market is that it makes sense to invest a lot in it now, but mostly on the basis of future revenues, not current revenues. If you poured $10 million into a mobile game company now, it might be tough to get a $50 million return.

At some point, it could be doable. But that’s a risky proposition now. Has the market hit its stride yet? There are still tough issues such as fragmentation, discovery, and distribution.

Tablets über alles

The ultimate game market may prove to be tablets, which are at the center of the convergence of multiple trends. At the Electronic Entertainment Expo (E3) this year, the tablet meme was out in force. Sony pitched its dedicated touchscreen PlayStation Vita handhelds as living room companions for the console. Nintendo integrated its own tablet controller into the Wii U, and Microsoft launched its SmartGlass tablet companion technology for the Xbox 360. And Microsoft is also launching its very own Surface tablet (pictured above).

The aim is to fend off the threat of the iPad, which has sold more than 60 million units, or likely more than all of the Xbox 360 game consoles that have been sold to date. GameStop is getting into the act by preparing to sell Google’s Nexus 7 tablet in its retail stores, in recognition of the “hybrid gamer” trend where players spend as much time and money with digital games as they do with traditional games.

By 2016, the tablet market is expected to surpass the notebook market in size, according to NPD. It’s no surprise then that seasoned game developers such as Jason Citron, the founder of OpenFeint and a speaker at MobileBeat 2012, now want to go back to game development and target tablet games as their primary platforms.

The mammals still thrive

The mammals still thrive

Yet as much as some market leaders would love to lock up the market, there are always a lot of startups that live in the shadow of giants and find ways to coexist, cut a new path, and even disrupt the big guys.

Indie game developers accounted for 68 percent of the game sessions on iOS and Android in the first quarter, according to Flurry. A year earlier, indies accounted for only 56 percent of game sessions, versus established companies.

King.com and Wooga moved ahead of EA into the top positions in Facebook games, below only market leader Zynga. They were late entrants, but they still managed to tap interest in tournament and short, arcade-like games.

And Kixeye, a maker of hardcore games on social networks, is thriving even though it has only 4.8 million monthly active users on Facebook. Will Harbin (pictured left), the chief executive of Kixeye and a speaker in a fireside chat at GamesBeat 2012, insists that the competition “is totally not a race.”

Rather, it is all about the creation of high-quality games. Kixeye’s users spend 20 times as much as the typical social gamer, meaning it can be highly profitable on a lot fewer users than its rivals. Harbin believes that cool games with great 3D graphics are totally doable on the web browser, with no download necessary, and we’ll see proof of that in a matter of weeks or months. When that happens, the browser-based, free-to-play online game business will hit the consoles like a ton of bricks. Disruption is just getting started in that sense, Harbin said.

Platform wars

Platform owners can still make life easy or difficult for everyone. Apple has created a wonderful platform with the iPhone and paid out more than $5 billion to developers. But it can also be a tough platform owner that sets the rules for developers. If they stray from what Apple says, they can face a pretty fierce banhammer. And developers must always pay 30 percent of their proceeds to somebody, it seems.

Trip Hawkins (pictured above), speaking at last year’s GamesBeat, wanted nothing more to do with platform owners. He complained that the industry was caught in the “dark age” where it is enslaved by platform owners. But out on the open web, he promised that the “browser will make you free.” Hawkins is out of a job this year, as he recently resigned from Digital Chocolate.

But the appeal of making royalty-free games hasn’t been lost on everyone. Zynga has created its own Zynga.com website to host games for social networking fans who are really interested in games. It has also created its own platform, with networking infrastructure and analytics, so that it can be its own platform and publish games for other developers. Faced with its own challenges, Zynga is crossing over barriers and doing what many have done before it: creating its own platform. And if Facebook and Apple get too aggressive with their platform policies, there’s always someone like Google offering an alternative platform as relief.

The existing platform owners are aware of this, and they’re changing with the times. Sony demonstrated this when it acquired Gaikai, a cloud-gaming startup, for $380 million. Sony’s Jack Buser, the head of digital platforms for Sony PlayStation, will talk about Sony’s own crossover strategy at our event.

New business models

The free-to-play game business is sweeping through the game industry. Sony Online Entertainment is converting its massively multiplayer online games into free-to-play titles.

But there are more business models awaiting. What if, rather than having gamers pay for games, you could turn that upside down and pay gamers to play games?

Brian Wong, the chief executive of Kiip, and Dennis Fong (pictured above), the CEO of Raptr, talk about this in a fireside chat at GamesBeat 2012 with Wired Game Life editor Chris Kohler. Both companies have reward programs where brands enthusiastically reward gamers for hitting achievements in certain kinds of games. In those cases, the rewards pile up high enough so that you could really interpret them as being paid to play.

That sounds crazy. But what if the customers come back and become loyal high rollers, spending a lot of money on a company’s brands? Rewards companies could be laughing all the way to the bank.

Red ocean or blue ocean?

Zynga recently showed off a bunch of new games at its Unleashed event, only to see its stock price fall. Evidently, investors weren’t that impressed with its lineup, which seemed targeted at the “red ocean” to me.

From what I saw at the event, Zynga is charging head-on at its rivals, fighting for market share with the sharks as they go after the meat (in this case, Facebook players) in the bloody red ocean. The concept here was chronicled in 2005 in the book “Blue Ocean Strategy” by W. Chan Kim and Renée Mauborgne. In a red ocean battle, the market share is fixed, and competitors fight each other for it in a zero-sum game. But in the blue ocean, where there are no competitors, a company can be successful by expanding the size of the market. Zynga’s battle with EA is a case in point. EA creates The Sims Social; Zynga counters with The Ville. Zynga launches CityVille, and EA counters that with SimCity Social.

Mark Pincus (pictured above), the chief executive of Zynga, believes very much in the blue ocean strategy. We’ll see if his company can continue to expand the games market. We’ll ask him about it at our opening fireside chat on Tuesday morning.

The golden age of gaming

Bing Gordon (pictured left), a partner at the venture capital firm Kleiner Perkins Caufield & Byers, made headlines in early 2011 when he declared — in a poem — that we were in a “golden age of gaming.” Gordon was an early pioneer in games and spent more than 25 years at Electronic Arts. Now, in his second career, he has scored big with investments in Ngmoco and Zynga. His own personal reinvention is something that everyone is going through. And so our theme isn’t just about the Crossover Era as it relates to companies. It’s about the personal journeys that people in the game business are making every day as they move from one part of their careers to another.

Gordon is back for a fireside chat. Gaming’s success is “more than we imagined, as much as we hoped,” he said. Gordon remains an inveterate optimist about the industry that he has been in for more than 30 years. We hope you join us to figure out where it’s going next.

[Photo credits: Dean Takahashi, Matthew Lynley]

![]() GamesBeat 2012 is VentureBeat’s fourth annual conference on disruption in the video game market. This year we’re calling on speakers from the hottest mobile, social, PC, and console companies to debate new ways to stay on pace with changing consumer tastes and platforms. Join 500+ execs, investors, analysts, entrepreneurs, and press as we explore the gaming industry’s latest trends and newest monetization opportunities. The event takes place July 10-11 in San Francisco, and you can get your tickets here.

GamesBeat 2012 is VentureBeat’s fourth annual conference on disruption in the video game market. This year we’re calling on speakers from the hottest mobile, social, PC, and console companies to debate new ways to stay on pace with changing consumer tastes and platforms. Join 500+ execs, investors, analysts, entrepreneurs, and press as we explore the gaming industry’s latest trends and newest monetization opportunities. The event takes place July 10-11 in San Francisco, and you can get your tickets here.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More