Asia’s online gamemakers are churning out the profits, but they aren’t well known on the global stage. Perfect World, based in Beijing, is one of those lesser-known companies. But it has made a fortune in free-to-play massively multiplayer online games.

Over the years, Perfect World has become an expert at monetizing free-to-play games, where users play for free and pay real money for virtual goods. The business model has become fashionable and is helping the company move to the forefront of games. In the past 12 months, Perfect World has had trailing revenues of $429 million. Outside of China, it is closing in on $100 million in annual revenue. In North America, nine of its 10 games are MMOs, and one is a first-person shooter. And the company has 350 employees in the U.S. now, and more than 4,500 worldwide.

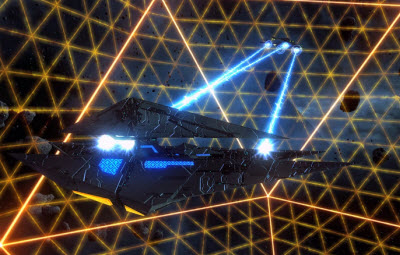

Perfect World Entertainment, started in 2008, is the U.S. subsidiary of the Chinese company. Chief executive Alan Chen heads the division, based in Redwood City, Calif. It is on the growth path, having acquired Cryptic Studios in Los Gatos, Calif. Cryptic has made MMOs such as Star Trek Online and City of Heroes. Perfect World Entertainment is readying the launch of its RaiderZ online game (which Korea’s Maiet Entertainment developed) and is preparing to launch the Western-style MMO Dungeons & Dragons Neverwinter, which Cryptic Studios is building.

We recently visited Chen at the company’s headquarters. Here is an edited transcript of our interview.

GamesBeat: How many years has Perfect World been set up here in the U.S. now?

Alan Chen: We set up the office in June of 2008. So it’s about four years now.

GamesBeat: Perfect World International was the first game that you brought over into the U.S. market?

GamesBeat: Perfect World International was the first game that you brought over into the U.S. market?

Chen: Yeah, Perfect World International. It’s a little confusing. The name of the game is also the name of the company. We try to use “PWI” as the official name of the game now.

GamesBeat: What’s the experience been like, as far as expanding in the U.S.?

Chen: We were pretty committed to the market because we believe that there’s great potential. We have a strategy with different phases. For phase one, we just wanted to leverage whatever product we had available in China. We wanted to polish it, localize it, and bring it to a good level of quality. Then we published it here to grow our business from scratch. I still remember having our meetings in a hotel lobby. We didn’t even have an office in the very beginning. Gradually, we published our first game. By the end of 2008, we made our business profitable. That’s quite amazing, in only half a year.

Right after that, we grew the business 100 percent every year, until recently. We’re still enjoying 30 to 40 percent growth. Of course, it’s more difficult when the numbers get bigger and bigger. Doubling the big numbers is more challenging than doubling the smaller numbers. Now we’re in the second phase of the business. We have a different strategy. In the second phase, since we’ve already grown significantly in the past two to four years. Ever since last year, we’ve started to license third-party games. We are not just bringing over projects from the parent company. We’re licensing and codeveloping new projects — western-style games. We want to make sure we provide high quality and the right style of games to gamers here in America and Europe. We licensed a few games from Korea. We also acquired a company, Cryptic Studios. Their Neverwinter MMO has some high anticipation in the market. That’s our second-phase strategy. We wanted to provide more tailor-made products to western gamers.

GamesBeat: The challenge always seems to be to have success crossing over from one market to the other. I wonder how you look at all the opportunities before you now in that way. You can cross over from different types of games to new types of games. You can cross over from China into the U.S., or cross from Asian content into worldwide content. You could also try different platforms, as well, from the downloadable PC games to browser-based to social and mobile content. How do you look at all these different opportunities right now?

GamesBeat: The challenge always seems to be to have success crossing over from one market to the other. I wonder how you look at all the opportunities before you now in that way. You can cross over from different types of games to new types of games. You can cross over from China into the U.S., or cross from Asian content into worldwide content. You could also try different platforms, as well, from the downloadable PC games to browser-based to social and mobile content. How do you look at all these different opportunities right now?

Chen: We started with PC massively multiplayer online role-playing games (MMORPGs), and I still believe there are tremendous opportunities in the MMORPG market. We’re continuing to invest in MMORPGs. However, I look at different platforms — like iOS, Android, or browser platforms — as new initiatives for us, particularly for the American and European markets. The browser market is not as hot as it is in Asia, I believe, because of the culture and the history of video games in the different markets. A very big chunk of business was taken by console games here, and console games are very well represented in the gaming market. Console games gave you a very high quality of experience here, and that made it very difficult for people to accept less quality from the browser space. If a 3D, good-quality game can be developed in the browser or web game space, I believe that’s going to be the future of the market. We’re paying a lot of attention to this. We’re actively looking around at opportunities, be it for investment or codevelopment or acquisition. We think that’s the way to go when the time is right.

GamesBeat: Technologies like Google’s Native Client or Flash 11.4 are making these browser-based 3D graphics technologies possible. We’re close to having some really good 3D browser games.

Chen: Exactly, right. We’re looking at a new generation of 3D browser games. People here aren’t so interested in 2D, although it’s super hot in China. Whenever I went back, people were always talking about browser games. I don’t see that happening in the U.S. The market perception is totally different.

GamesBeat: Does it make sense to do more U.S.-specific content and fewer imported Asian games for the U.S.? Is there a difference in tastes…?

GamesBeat: Does it make sense to do more U.S.-specific content and fewer imported Asian games for the U.S.? Is there a difference in tastes…?

Chen: There are two points I’d want to make. Number one is when we talk about online games, we consider an online game a service. It’s not a product, where you eventually finish the development of the product — the game. Most important is the continued support of that service. When a game launches, it’s just the beginning. It’s not the end of the development process. It’s the beginning of the business. So we need a developer to be able to continuously drive the business higher and higher. Our first choice would be working with our own teams. With our own team, it’s easier to be involved in the future development.

If we use a developer-publisher deal, like we see on the console side, it’s going to be challenging after the developer finishes up its work. The future support becomes questionable. Of course, like I said, we want to provide more tailor-made games to local players — no matter whether we import them from Asia or we develop them here. But we’d like to move away from the projects that are only suitable for China or Asia. We want to make Western games, regardless of who might be the developer. Because Western games in the Chinese and Asian game markets…. It’s not just the cultural or visual differences. Gameplay-wise, they’re also very different.

GamesBeat: Have you seen some teams in China actually make good games for a worldwide audience yet? I think PopCap, for example, has a team in Shanghai that’s just launched a U.S. game. I think Spicy Horse Games, which American McGee runs, is also making U.S. games out of China. I wonder about that possibility.

Chen: Yeah. That’s the strategy of leveraging the cost factor in the Chinese market. It’s still a question of how you introduce your Western game concepts and how you manage the project to leverage those lower costs there. It’s doable. But it’s different from importing a Chinese game from China. If it’s designed for the Chinese market, it can still be popular in other countries. Like PWI, the game we launched — our first project. It was the most successful international game that was originally developed for the Chinese market in China. That game was licensed to more than 40 countries around the world. I consider it the most successful global game from China. It was developed for China, but it also worked in other countries.

GamesBeat: What about the ability of studios in the West…like, say Cryptic…to develop games that are also popular in China?

GamesBeat: What about the ability of studios in the West…like, say Cryptic…to develop games that are also popular in China?

Chen: I think, in general, the markets in China and the West are different in terms of demands on gameplay. For example, in the Western market, people are more focused on gameplay. People enjoy the experience of directly playing the game. In China, it’s different. It’s more social; it’s about showing off. “How can I get to the maximum level as fast as possible and then player-kill everyone else in one shot?” That’s what a lot of people enjoy. Different gameplay, different market demands. But if you want to make one game that’s universally popular, then that’s very challenging. Especially if it’s an MMO. It’s easier with eSports-type games. That kind of appeal is more universal. But if you want to do an MMO, that’s more challenging.

With Cryptic, we’re working on a very attractive title, Neverwinter. It’s very attractive to the Chinese market, as well. When we took it to ChinaJoy [game show], we drew a lot of attention from the media and from players. However, in order to make a game very successful, it’s going to be challenging if we don’t have some local adjustment to the content. We need to tailor it for local demand. Not only graphics-wise, but also as far as gameplay. In that regard, we will deploy local development teams in different countries and markets we consider significant. We’ll transfer technology to those places to make sure they can produce content tailored for their local markets.

GamesBeat: It seems like League of Legends and World of Warcraft are some of the only ones from the West that have made it in China.

Chen: Yeah. World of Warcraft is different because of their timing in the market. It’s like our game, PWI. If we published it today, it wouldn’t be as successful as it was when we published it four years ago. At that time, high-quality 3D MMOs were not so common in China. So it hit the market at the right time. We acquired players who would stick to the game. They made so many friends there in the game, and eventually they had so much virtual property in the game, that they didn’t want to abandon it. So that’s the trick, in one way: to enter the market in its early stages, when there’s less competition. That’s also one of the success factors for World of Warcraft in China. For League of Legends, it’s a different genre of game. It’s more geared towards eSports. That appeal is more international.

GamesBeat: It seems like the conclusion could be that companies that succeed in a crossover strategy — that succeed in more than one market or one type of game — are the ones that create the most value. If EA has any particular value right now, it’s that a quarter of their revenue is digital. And if Zynga is considered valuable by anybody still, then it’s because they have so much investment in mobile. Somebody who’s crossing over from their stable base in social games on Facebook, say, and moving into mobile…. If they succeed, then their stock price will go back up. Would you agree with that assessment: that any company that succeeds in a transition like that is going to be one of the more valuable companies?

Chen: Exactly. If you can make your games more appealing to an international market, then by all means you can create value. You might build a special genre like eSports, where you don’t need to localize it too much to make it appeal to all the markets. Or you might have to deploy local resources and make sure you have a local…. I’ve always believed localization will pay off with local demand. Even between the Chinese-speaking markets in China and Taiwan. They’re still different. Either you focus on one market, the original market, and you just make your money there, or you should do your best in every market, which means listening to the requirements of those different markets and making a change — creating different content locally. I believe that’s the way you can succeed, with an MMO or with online games in general.

GamesBeat: It’s interesting to look at which companies can afford to do this now, too. If you look at THQ, they’re a $500 million dollar company still, but they can’t afford to invest in mobile and social anymore. They’re going to invest just in console games.

GamesBeat: It’s interesting to look at which companies can afford to do this now, too. If you look at THQ, they’re a $500 million dollar company still, but they can’t afford to invest in mobile and social anymore. They’re going to invest just in console games.

Chen: Actually, the investment in social and mobile is not something that’s so challenging or difficult. It’s all about strategy. The cost isn’t much. If you look at most of the mobile developers, there’s a lot of them, actually, that are just one, two, three, or five people. For a big company like THQ, which has 100 or 200 employees, they could easily afford to start in this business. So the challenge isn’t the investment. The challenge is does it make sense? You’re jumping into a very crowded pool against a lot of those developers with just two or four people. You’re one of thousands of developers, and there are thousands of new games that queue up in the App Store waiting to be published every week. So that’s the challenge. It’s not coming up with the investment. The challenge is what’s the hook? Your odds of getting in the top 25 are very long.

That’s had us thinking very dynamically in recent days. Where will be the next move? What will be the next booming business in the gaming market? What’s making people think this way is mobile gaming makes the barrier to entry very low. Anyone can get into this kind of gaming now. Because of the popularity of the iPad or mobile phones, people can enjoy kinds of gameplay that weren’t possible on mobile devices. It’s diversified the way people use their time, especially small bits of time. Given that so many people can develop these kinds of games, it makes it difficult for a big company to decide to get into this space. You think of EA, THQ, or us…. How many development teams do you want to establish for mobile projects? Ten? Twenty? Even 50 might not be enough because you’re facing up against hundreds or thousands of other developers. For so many people, it’s so easy to make games now. University students or even high-school students can make a fun game and get a ton of market attention — a lot of market share. For the big guys, it’s challenging. It’s harder for us to move around. Where should we go? That’s why I believe that big companies have to carefully consider what platforms we choose and how we can provide better services. How do we provide something that one or two people can’t? We have to leverage the size of the company to provide a benefit.

GamesBeat: Has that led you to conclude that you should just focus on what you do best?

Chen: Yeah. We’re going to continue to invest in very high-end, high-quality online games. We don’t do everything. If you look at our portfolio recently…. Initially, it was a portfolio of Chinese games only. Then we added licensed Western games. Now we have Neverwinter, as you saw at E3 this year. We’re promoting Neverwinter as our main thing. But we’re thinking, next year, what will be our focus? It has to be something Western-style. We don’t want to go back to just Chinese games. We want to provide a high-quality game and services to local markets everywhere.

GamesBeat: How many people are you at now?

Chen: We have about 180 people here and about 50 people in Amsterdam. And then there are about 70 people providing us with dedicated support in China. Cryptic is about 120 or 140 people. That 180 people doesn’t include Cryptic. So in America alone, we have around 350 people.

GamesBeat: Do you think that’s enough for now? Or do you expect you’re going to have to increase that a lot?

GamesBeat: Do you think that’s enough for now? Or do you expect you’re going to have to increase that a lot?

Chen: We’re going to have to do it, like I mentioned. We are considering the next level of strategy. MMOs are one of our cash cows, and we’re going to continue to invest in those, to make sure people can still enjoy playing in virtual worlds. But in the meantime, we’re also looking at new projects, like iOS. That platform is very challenging, but it’s very interesting, and we have a lot of expertise. We’re looking at how to organize our teams and how to invest in this new area. We want to make it into a business, not just a tool to help our publishing. So we’re moving forward in new directions. Very likely, we’re going to expand our investment.

GamesBeat: At some point, once companies expand and they get a hit or two, then they turn it into a third-party platform. Zynga is doing that with Zynga.com, and some other companies are…. Trion is starting to do that, as well. Are you also heading in that direction at some point?

Chen: It’s different. The key factor is what’s your strength? We have to leverage our strength. We don’t just want to do generic stuff, whatever people are doing. I don’t believe in a following strategy. So our strength is free-to-play publishing and know-how and also free-to-play game design and development: virtual money, virtual currency management, and virtual account management.

GamesBeat: Do you believe that free-to-play still has a long way to grow out here?

GamesBeat: Do you believe that free-to-play still has a long way to grow out here?

Chen: Yeah, free-to-play is diversifying in different areas. Initially, when we started our business here, we were kind of the only one: the one company talking about MMO and free to play. But gradually, we’ve seen it expand. There’s Facebook games, browser games, and mobile games. They all offer free to play. So I think free to play is one of the strong growth engines for games in different areas: mobile, Facebook, and online.

GamesBeat: And maybe on the consoles, as well?

Chen: Yeah…. But consoles have a lot of changes there. The key thing for free to play is you need to update very frequently — almost every week. But the current processes with console games — the testing and approval processes — don’t support this. Microsoft, Sony, and all the platform owners need to establish new processes.

GamesBeat: There’s a lot of talk about that now.

Chen: A lot of people talk about it, but it’s very difficult to implement. That’s the reason. They don’t have the ecosystem.

GamesBeat: We’ll see if the next generation of consoles changes things.

Chen: Right, right. Personally, I believe that with the technology involvement…. Eventually, consoles, the PC, and the tablet are all going to consolidate. They’ll be merging together. For gamers and developers, they don’t want to see all these platforms. Gamers want to play the same game on different platforms, wherever they go — no matter when and no matter what device they have. They want easy access to all their games. Developers, meanwhile…their desire is to develop their games for one platform. I don’t know if that’s going to happen, but I think there’s a small number of choices. Nobody wants to develop for three or four platforms because of the difficulty involved. So in that regard, when the market becomes open, that’s when the technology becomes open.

Chen: Right, right. Personally, I believe that with the technology involvement…. Eventually, consoles, the PC, and the tablet are all going to consolidate. They’ll be merging together. For gamers and developers, they don’t want to see all these platforms. Gamers want to play the same game on different platforms, wherever they go — no matter when and no matter what device they have. They want easy access to all their games. Developers, meanwhile…their desire is to develop their games for one platform. I don’t know if that’s going to happen, but I think there’s a small number of choices. Nobody wants to develop for three or four platforms because of the difficulty involved. So in that regard, when the market becomes open, that’s when the technology becomes open.

GamesBeat: And then you don’t have to pay somebody 30 percent….

Chen: [Laughs] Exactly, exactly.

GamesBeat: You have some news coming later this year. You have more games coming?

Chen: Yeah, we have RaiderZ. It’s our next action-MMO. Gamers can enjoy something like a console action experience in an online space with social features and community — talking and competing with other players online. You can do all kinds of fighting moves, just like in a console action game. It’s very interesting. We have high expectations. The closed beta is going online today or tomorrow, and the commercial launch will be later in the year.

Our strategy is that we want to focus on our key games. We don’t want to have too many at once. By early next year, we’ll have our next big title, which is Neverwinter. After Neverwinter, there’s a couple of very highly anticipated Chinese games on their way, as well as some international projects from companies like C&C in Japan. The IP is from Japan, but we developed the MMO. That’s going to fill out our portfolio very well as far as a variety of styles.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More