Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

The NASDAQ has reached levels not seen since 2000 at the tail end of dot-com bubble. And tech has a lot to do with it.

The NASDAQ has reached levels not seen since 2000 at the tail end of dot-com bubble. And tech has a lot to do with it.

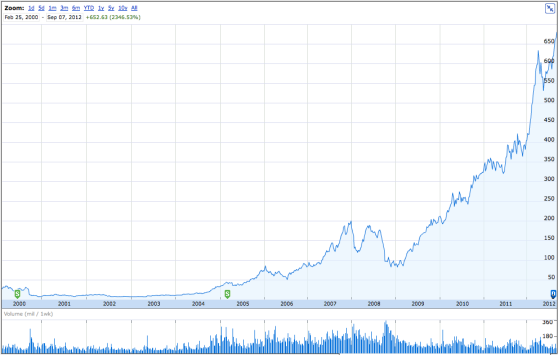

Above: Apple shares from 2000 to today

CNet credits Apple for NASDAQ’s rise, among other companies, which makes a lot of sense. Apple has gone from a market capitalization of under $25 billion to a massive and world-leading $638 billion value.

But it’s not only Apple that is killing it, especially this year.

This week Fortune released its list of top 100 fastest-growing companies, and a plenty of tech exposure is in the list. Apple is there — which is frankly amazing, because it’s easier to move the dial on huge growth with a small company than with a multi-billion-dollar giant — but so is Baidu, the massive Chinese search engine.

NetApp, VMware, Rackspace, and Netgear are other well-known tech companies on the list. 3D printing company 3D systems is also there, with many other smaller tech companies. In fact, counting those small companies, at least 25 of the top 100 fastest growing companies in America are technology companies.

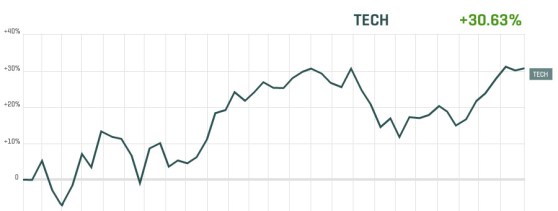

And technology, as a business sector, is growing the second-fastest of any industry, with almost 31 percent growth in the past 12 months.

Above: Growth of the technology industry this past year

By contrast, the energy sector is only up 6.56 percent, education is down 3.65 percent, and mining is tanking at -30 percent.

Google is trending up, too, as CNet mentioned, with a stock price that just recently topped the $700 mark for the first time since 2007. Search revenue is strong — growing 21 percent this past quarter — and Android continues to tear up the mobile charts, with all the implications that has for future monetization possibilities.

The only downer, perhaps, is Facebook, with stock that has been hammered hard and is now at about $19, close to 50 percent down from its IPO. But that story is still in the first chapter.

A rising tide floats all boats, perhaps, and Apple — with other tech company’s assistance – is helping the index soar.

photo credit: Marc Ben Fatma – visit Benymarc.com and like my FB via photo pin cc