Investment app Robinhood has added a feature that it says will provide short-term credit to you while your bank transfer is being completed. Robinhood Instant, as it’s called, aims to remove the time delay that occurs between investments due to settlement periods and bank transfers.

Instant is made up of two key components: instant deposits and instant access to funds. With the former, Robinhood makes bank transfers of up to $1,000 available for investing immediately. This removes the hassle of having to wait for funds to be available in your account. The latter lets you quickly reinvest proceeds from a stock sale — previously you had to wait three days before the funds would settle in your account.

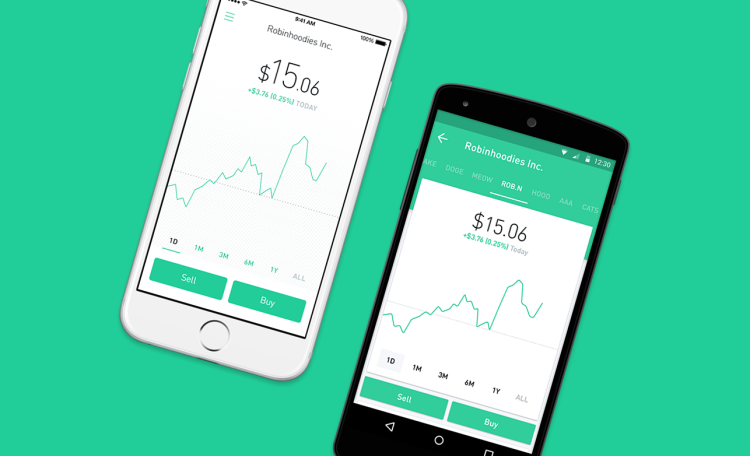

Robinhood is a social investing platform that facilitates stock trading. It offers fee-free training with no minimum investment, letting you buy and sell stocks, options, and corporate bonds. In March it opened up its iOS app to everyone before releasing an Android version.

In order to remain competitive, Robinhood needs to further distinguish itself from many new entrants in the marketplace. Similar services include Rubicoin, TradeKing, and Zecco. By reducing how long it takes to transfer funds, Robinhood seeks to provide a service that’s near real time, something that its target market — millennials — seems to expect.

Robinhood Instant is available by invite only; the company is opening up access based on how many people you can get to join the service. The more people who create an account through your unique referral link inside Robinhood’s app, the sooner you’ll receive access.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More