[For a view on gaming investing myths, read this guest post from YetiZen CEO Sana Choudary. -Ed.]

In 2012, investors were excited about the game market’s march toward billions of new users with the rise of smartphones and tablets. But that excitement fizzled as Zynga’s fortunes wavered, and it reported weak earnings starting in August. Consequently, game investments rose dramatically for a while, and then they tapered off.

The data for this story comes from GamesBeat’s own original research into fundings during the year, with contributions from Sana Choudary of YetiZen, Tim Merel of Digi-Capital, Internet Deal Book, Signia Venture Partners, and Electronic Arts.

The upshot is that game investors have been spooked and they aren’t making as many deals as they once were. That means that higher-quality startups will receive funding, but copycat ideas aren’t necessarily going to. And as weak as the year was in investments, nobody is changing any forecasts about the march of gaming into the stratosphere in revenues and player numbers over time. So the industry is facing a confidence contradiction. Game companies are growing, but the money they’re raising isn’t.

The number of game investments rose to 188 deals, compared to 145 a year ago. But the value of the announced deals was $901.3 million, compared with $1.540 billion in 2011. That represents a 29 percent increase in the number of deals, but a 42 percent decline in dollars invested.

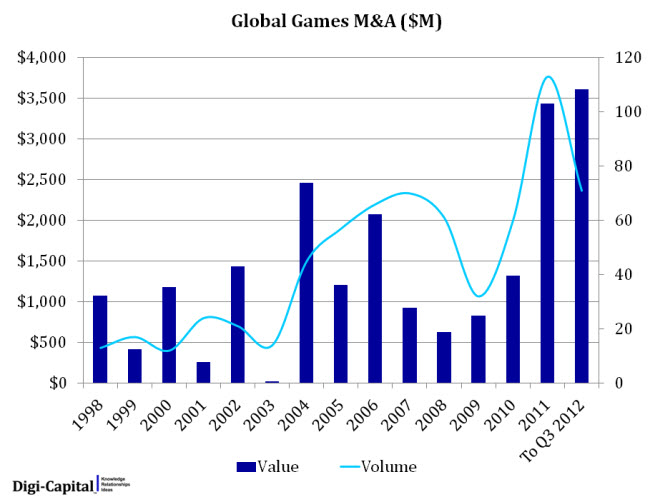

By comparison, the value of game acquisitions rose 23 percent in 2012 to $3.47 billion, compared to $2.87 billion a year earlier. The number of game acquisitions fell from 77 in 2011 to 58 in 2012. According to Avista Partners, the value of publicly traded video game companies is about $153 billion, but 78 percent of the value is in the top 10 companies, with China’s Tencent leading the list.

A big gap exists in investor thinking, according to analyst Peter Warman of Newzoo in a recent interview with GamesBeat. Fear kept investors from pouring money into a sector that was actually producing much better results in terms of cashing out through acquisitions. Since 1997, Avista Partners says that games have produced $44 billion in value for venture capitalists and private equity investors since 1997.

Tim Merel, the managing director at Digi-Capital, said that the collapse of social gaming investments in the wake of Zynga’s troubles accounts for almost all of the decline in the game investment deals. Investment capital continued to shift from traditional console games to social, mobile, and online games.

But the clear bright spot for the year was mobile gaming. Merel reported that mobile deals account for as many as 40 percent of the overall game deals. But a mobile game studio with 10 employees can produce a game and get it into the market. It doesn’t need the same kind of capital that earlier game startups required, so it makes sense that the average size of a game deal is getting smaller.

In 2012, the average size was $4.8 million, compared with $10.6 million a year earlier. Zynga’s crash in the stock market (it’s trading at 25 percent of its peak value) also deflated game investment valuations.

Another savior for many game companies was Kickstarter, the crowdfunding platform that raised $83.1 million for video games and board games from 520,000 backers (we’ve included Kickstarter deals in our list). Of that amount, $55 million went to 296 video game companies (we haven’t included most of those on our list). The average amount raised via crowdfunding was $186,000, as most projects raised money for games instead of trying to finance whole companies.

More than anything, Kickstarter changed the dependence of developers on major publishers for funding. Midsized game companies such as Double Fine Productions, which started a Kickstarter mania back in March, could turn directly to their fans for the first time to raise money to make games. The crowdfunding platform became an important place to test disruptive ideas such as the Oculus VR virtual reality goggles and the Ouya Android video game console for televisions.

Certain sectors saw a boom, as hardcore game companies such as Kabam and Kixeye saw huge demand for free-to-play hardcore games. And social casino games debuted by the dozens on Facebook and mobile game platforms. More disruptions are happening as game companies adopt new business models such as free-to-play games, where you play for free and pay small amounts for virtual goods. Gaming also has its own version of the war for talent as big companies acquire smaller ones. Green Throttle Games raised $6 million on the hope that its Android game controller and app could disrupt $60 console games on the television. Such trends serve as grist for the bigger investments.

Signia Ventures (which did eight deals in games in 2012) noted that about 80 percent of investments in 2012 were in North America, with a lot of excitement continuing in mobile gaming, analytics, distribution and the larger consumer mobile ecosystem.

Investors probably shied away from the sector because of the almost total absence of initial public offerings. China’s YY and Zattikka staged a couple of small IPOs, but no one grabbed the attention or the investment dollars like Zynga and Nexon did in 2011, when both companies raised $1 billion each. Zynga raised $515 million in a secondary offering not long before its stock collapsed. And Tencent completed a $598 million fixed income offering. If the IPOs return, you can bet that the investors will as well. But perhaps the only trend to count on is further consolidation with a continued acquisition boom.

Here’s a cautionary note about these numbers. If we knew the value of every deal, the numbers would be much higher this year. We’d love to know how much money Tencent invested in Epic Games, but we don’t. But we have the same problem every year as the majority of the dealmakers keep their values secret.

Here’s a look at the deals of the year below. We’ve organized them by dollar value of the transactions. For those deals where the value is unknown, we have listed them in reverse chronological order. We have linked to our own VentureBeat/GamesBeat stories where we covered them. For deals we didn’t cover, we have linked to other publications or press releases.

Major VC firms such as Accel Partners, Sequoia Capital, DCM, Kleiner Perkins Caufield & Byers, Andreessen Horowitz, and others all poured money into big game companies this year. Google Ventures continued its role as an active strategic investor. Check out the GamesBeat game investments list in the following pages.