Apple may be bold and ambitious. Apple may have $137 billion in the bank. Apple may have generated record revenues and record profits last quarter. And Apple may be banking $50 million in revenue from each of its 400 retail stores around the globe and adding 30 more this year.

But apparently, Wall Street doesn’t really care.

Apple CEO Tim Cook talked more directly to the financial world today at the Goldman Sachs Technology and Internet conference than, perhaps, he ever has before, telling the pinstriped and necktied money managers of the world that Apple’s focus is on the long term, is still the center of innovation in the technology world, is not likely to acquire any major companies any time soon, probably won’t increase the screen size of the iPhone to match Android tablets, and won’t rush to produce a cheaper iPhone just to ship more units.

“I’m very proud that we’re out front, that we’re changing people’s lives, that we’re doing what’s right and just in moving the ball forward,” Cook said today. “I don’t mean to gush, but it’s how I feel.”

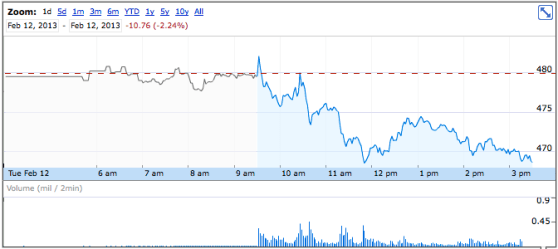

In response, Apple’s stock, which is down over $200 billion since its peak in 2012, drooped a little more, losing over $11 a share, or another 2.3 percent of its value:

In other words, Wall Street ain’t buying what Cook has to sell.

By the end of the day, the picture had not changed much: AAPL was down $12.03 — a 2.5 percent drop in value, equivalent to about $12 billion. That’s a little shocking for a company with dominant smartphone market share in the U.S. and a price-earnings ratio well under 10 when you take out its cash on hand. But analysts are worried that Android is going to eat Apple’s lunch in smartphones and tablets, and Apple’s desktop numbers in its last quarter were nothing to write home about either.

And given that Apple, which had established a reputation for exceeding analysts’ expectations for years, missed the Wall Street consensus numbers by about $500 million, analysts are adopting a wait-and-see attitude.

Perhaps anticipating this reaction, Cook did end his chat with a bit of a barb:

“We don’t care if people are lobbing grenades from the sidelines.”

photo credit: WanderingtheWorld (www.LostManProject.com) via photopin cc

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More