Imagine this: You’re a founder of a Silicon Valley enterprise software company. It’s only 15 years old, but it’s already worth $3.5 billion. You’ve never lost money, and you’ve left your initial competition in the dust.

Imagine this: You’re a founder of a Silicon Valley enterprise software company. It’s only 15 years old, but it’s already worth $3.5 billion. You’ve never lost money, and you’ve left your initial competition in the dust.

The companies you’re now competing against are behemoths like IBM, Oracle, and SAP — all 35 or older.

What’s more, you’ve used your relative nimbleness — your company only has 3,400 employees — to run circles around those bigger incumbents on the technology front. You’ve invested in more modern, efficient products. Seamless integration with public cloud? You offer that. ‘Big data’ analytics? You saw that coming years ago (yeah, you even wrote about book about it). In-memory, all software processing, at millisecond speed? Check! And to top it off, you’re planning more fireworks soon.

What’s not to like?

Above: Forrester chart, April 2012

Well, last week, I went down to the offices of Palo Alto, Calif.-based Tibco to interview its founder and chief executive, Vivek Ranadive, who finds himself in that enviable position.

However, it wasn’t a day of celebration. To the contrary, it came on the day before Tibco was to release its weak first quarter earnings: Tibco’s results showed a mere 5 percent growth in the first quarter, year on year, deeply disappointing analysts who expected much more. Moreover, on a conference call, Tibco lowered its forecast for the next quarter. Over two days, Tibco’s stock tanked about 20 percent — to just under $20, from close to $24.

What happened?

Sales leadership problems in North America and the U.K. contributed greatly to the weakness of Tibco’s results in those regions, Ranadive explained in the conference call to analysts. Growth in Tibco’s North America sales, which began slowing in the fourth quarter last year, continued to show weakness — even though Ranadive had made executive changes last quarter.

“Well, it’s at all levels,” explained Ranadive during the analyst call, when asked how he was able to identify the “bad leadership” problem. Demand for Tibco product remained robust, Ranadive said, referring to a strong pipeline of deals in most regions. In Asia Pacific, sales were up 27 percent. So it was easy to identify the problem areas. Closure of only a couple more of the larger deals in our pipeline would have helped Tibco make its numbers. So when a few big deals didn’t get done in the U.S and the UK, Tibco went back to look at what happened. “There are all kinds of things I can point to,” he said. “So it’s… talking to a customer who was very happy and then going in and finding out that the customer doesn’t have a clue that we do these 4 other things,” Ranadive said. “Or not having the requisite expertise in a certain office in certain product categories or not doing — or not getting — in some cases, I mean, I’m embarrassed to say people not even being in the office.”

A wider enterprise story: It’s sales, stupid!

Tibco’s miss may embody a larger story that is playing out across Silicon Valley and beyond: As cloud and big data technology mature, mid-sized companies like Tibco and smaller ones must suddenly get more sophisticated about the way they sell, not just about what they sell, to the thousands of companies implementing this new technology. Turns out, it takes more than technology prowess and vision to succeed. Hell, even the big guys are having problems (Oracle referred to sales execution issues of its own, when it badly missed its earnings numbers last week).

Above: Tibco Spotfire on iPad

There’s no doubt: Tibco’s technology is sleek, exemplified by fast-selling products like Spotfire, an in-memory tracker of key corporate data and transactions (analysts say Spotfire revenues are growing at 30 percent or more). “I’m bullish on Tibco,” says Mike Gualtieri of Forrester, who tracks the enterprise software sector, referring to Tibco technology.

However, enterprise giants like Oracle, IBM, and SAP, which once sold only expensive “on premise” software (software not delivered over the web but downloaded onsite), are catching up. They’re starting to offer less expensive and more nimble cloud products as well as data analytic products — even if they’re often not as agile and cost-effective as Tibco’s. Armed with massive sales and marketing budgets, these larger players tell their existing customers that their offerings are “good enough.” A switch to Tibco’s solutions would be unnecessary and costly, they argue.

So while Tibco tries hard to penetrate the market with those customers willing to experiment, the slightest misstep on the execution side with larger accounts can make the difference between hitting or missing earnings expectations in any given quarter.

Exuding confidence

Not that Ranadive is obsessed with the company’s stock price. “I’m not concerned with market cap right now,” he tells me.

Ranadive, 57, is a slight man who likes to speak in confident, declarative statements. They leave little room for interpretation and can impress with their conviction — though they’re often clearly meant to provoke — a hallmark of a cocky entrepreneur.

“We’re the fastest growing enterprise software company,” he boasted early in our talk, noting that for the last decade the company has grown 20 percent each year. And unlike Salesforce, which makes barely any profit, Tibco has spent $1 billion in profits buying up its own shares over the past six years, he said.

Ranadive also likes to talk about the need to deliver value and invest to do that in the future. He’s proud that Tibco’s technology runs crucial businesses such as banks, exchanges, phone networks, and airlines — all of which would grind to a halt if Tibco were to go down, he said. By contrast, social networks, no matter how big, aren’t nearly so essential.

“If Facebook goes down, what stops?” he asked me. “What would you not do? Maybe you wouldn’t know what some random friend ate for dinner.”

And because Tibco has positioned itself for the future, the company’s growth is going to accelerate over the next few years, he said.

The ‘visionary’

Granted, Ranadive has reason for his confidence. He trailblazed the enterprise software market from an early age, and he’s credited with digitizing Wall Street in the 1980s. That came in 1986, when he made a breakthrough innovation based on the computer “bus,” the system that governs data communication between the CPU, memory, and other I/O devices. Ranadive devised a software-based version of the bus that enabled messaging to happen on a computer network in real time. His first customers were big banks like Fidelity and Goldman Sachs, which used his technology to push market data such as stock quotes and news to their traders. By 1997, Ranadive had founded Tibco, naming it after his software bus innovation (The Information Bus, or “TIB”).

But Ranadive kept innovating with the rise of the web in the 1990s. He built his messaging technology around the HTTP web server send-receive protocol. Tibco thus became the earliest software company offering customers real-time data communication in the cloud. From there, Tibco has continued to surge ahead, releasing a range of other software products nicely oriented for the future of real-time data analytics. The background stands in contrast with the IBMs and Oracles, which have older core architectures, and which were forced to acquire newer technology and tack it on — often in ways that are clunkier and more expensive.

“They have all of the pieces,” said Forrester’s Gualtieri, of Tibco. “The thing I really like about them is that they’re so nimble. From a technology standpoint, and the way they serve customers, they can run circle around the IBMs and the Oracles.”

Gualtieri says it helps to have a guy like Ranadive at the helm, who has written books about The Two-Second Advantage, or the need to for companies to make split-second decisions. “He’s a visionary,” says Gualtieri.

‘I know everything about you’

Take, for example, how the Golden State Warriors of the National Basketball Association is using Tibco’s software. Tibco created something called Fan Zone, which Ranadive calls a sort of “psychological router.” It detects what Warriors fans are doing in real time and then helps Golden State make offers to fans based on their behaviors, interests, or even moods. “I know everything about you,” Ranadive, who is a part owner of the Warriors, explained. “You’re eating pizza, I know it. You tweet, I see it. You’re going to be unhappy? I know it before you know it.” Tibco won’t comment about what specific cases are being used, because the Warriors want to keep that private. But the technology will let Golden State specify certain events it wants to respond to in real-time. If you tweet “my hot dog is cold,” “my seats are too far away,” or “parking costs too much here,” the Oakland Coliseum Arena would like to know that and respond accordingly. But it really gets more interesting with the application of geolocation data. If the Arena detects you’ve been standing in line at a hot dog stand for 15 minutes, the vendor can greet you with an offer, saying “Sorry, this one is on us!”

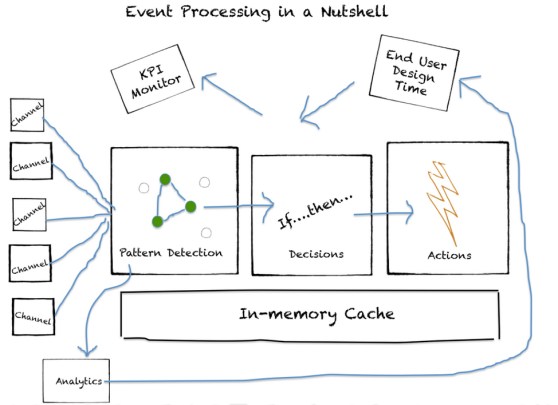

Tibco is pushing the same sort of real-time analytics and messaging technology aggressively elsewhere, such as banking, hospitals, and retail. Macy’s is using Tibco to make real-time offers to customers based on their interests, Ranadive said. (The chart at right illustrates Tibco’s event processing approach.)

Tibco is pushing the same sort of real-time analytics and messaging technology aggressively elsewhere, such as banking, hospitals, and retail. Macy’s is using Tibco to make real-time offers to customers based on their interests, Ranadive said. (The chart at right illustrates Tibco’s event processing approach.)

Tibco is making other acquisitions to help build this out, especially for customers to track mobile customers. Just this week, Tibco acquired a French location analytics company Maporama, which Tibco will rolled into its Spotfire offering. Spotfire, along with Tibco’s messaging product, Tibbr, and some other cloud products are all growing quickly. In five years, half of Tibco’s revenue will come from products “I don’t have right now,” Ranadive said.

When loyalty is a personal weakness

For now, though, it’s the big sales to larger enterprise customers where Tibco needs to apply itself. These require more focus on the relatively mundane area of sales and marketing, where careful execution counts for more than the actual prowess of your technology. And its here where analysts grilled Ranadive for missteps during the quarter, where Tibco lost some deals to the bigger players, in part because of what Ranadive called “a void in leadership” in U.S. sales.

Ranadive shouldered the blame for this during my interview. He responded that he’d wanted to make a leadership change in North American sales for some time, but he hadn’t moved fast enough.

When I asked him what he thought his great personal weakness is, Ranadive said, “Sometimes I don’t go with my gut … that’s cost me from time to time.” He likes to give his executives relative autonomy, he said, and likens his leadership style to that of a jazz band conductor, with tolerance for a lot of improvisation — and he wants to let people come around to his point of view. However, he’s loyal, he said, and this can often let people stay in a job “when the company has grown bigger than them.”

That’s not to say that Ranadive is touchy-feely. He bristles when I raised Google’s practice of allowing employees to spend 20 percent of their time to dream up projects. He says there’s a myth about innovation, that somehow it stems from having a cushy job, spare time to dream up projects, and having freedoms like bringing a dog to work. He disagrees. He says he wants his employees on site (he’s in full agreement with Yahoo CEO Marissa Mayer’s policy of forcing employees into the office). He likes to drive his employees hard, he said. His version of innovation, he says, is to “shut the doors, lock them in a room, turn off the light, cut off the water, and if green shoots come out from under the door, you have innovation.”

Sales and marketing help badly needed

That’s the sort of focus that Ranadive needs to translate to his sales and marketing efforts. Ranadive has made changes (in October, he revamped both his sales and marketing teams), but analysts like Forrester’s Gualtieri worry it hasn’t been fast enough.

Today’s enterprise sales teams need to communicate clearly to IT executives who are overwhelmed by the plethora of technology options in front of them. Most customers have a mix of existing on-premise technology investments and a growing number of public cloud experiments. Integrating these, and calculating what makes sense to spend on improvement, can be as much art as science. So Tibco is forced to go the mat to make many of its big new sales.

Take the case of a “travel and hospitality” client during the first quarter. IBM initially stole the deal even after Tibco had cultivated the customer for weeks, Ranadive explained on last week’s analyst call. But Tibco fought back, arguing that Tibco’s product is superior and more agile.

Tibco won the deal.

The problem is, Tibco hasn’t been in fighting mode near enough. Ranadive says he’s determined than ever to fix that, he says. “If we come against them,” he says of meeting Oracle in a sales battle, “we will crush them.”

Just as urgent is the need to fix marketing, according to Forrester’s Gualtieri. Few people know, for example, that Tibco moved very early into big data analytics with its acquisition of a precursor technology to hot open source statistical computing language R. Instead, smaller companies have defined themselves and taken the lead as big data pioneers. “When you think of R, you think of Revolution Analytics,” Gualtieri said, referring to a private Silicon Valley company founded in 2007. Without more marketing clout, Tibco risks coming across too much like a me-too enterprise company, living in the shadow of IBM and Oracle. (This is one of the reasons an HP acquisition of Tibco would make sense. HP needs compelling cloud and big data technology, and would have brought marketing muscle to Tibco. A deal was rumored to be in the works last year, but fell through.).

“They have to do some more work,” said Gualtieri of Tibco. “They’ve succeeded in saying they’re ‘full-stack,’” he continued. “But now they have to make a perception transition, and they haven’t done it as fast as they need to.”

Top photo credit: Tibco