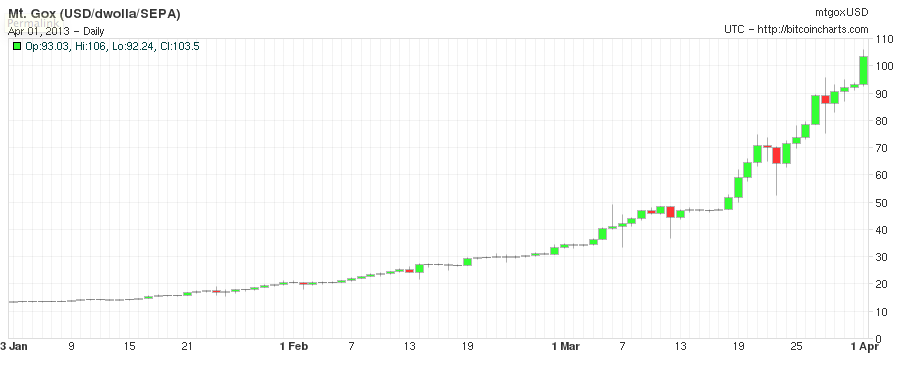

The value of a single Bitcoin surpassed $100 today, a huge milestone for the virtual currency. But with its crazy rise in the past few months, it’s time to start seriously wondering if Bitcoin is in a bubble.

Bitcoin is a virtual, decentralized currency that no government or central bank controls. As of this report, a single Bitcoin is trading at $104.50 on Mt. Gox, the largest Bitcoin exchange. In January, the currency was trading at $15 a pop.

The currency’s rise has been bolstered by several major announcements in the past six months by large companies. One of the biggest announcements was that Mt. Gox struck a deal to let Seattle startup CoinLab handle its U.S. operations to give Bitcoin a larger foothold with institutional and wealthy investors. On top of that, news-sharing site Reddit started accepting Bitcoin as payment, and the Internet Archive began accepting Bitcoin donations.

Check out the rise of Bitcoin prices over the past three months in the chart below:

But history suggests Bitcoin’s rise in the past few months could simply be a bubble waiting to pop. Bitcoin’s value has been destroyed before. Back in June 2011, the value of Bitcoin quickly jumped to above $30 per Bitcoin and then the value plummeted after major hacking incidents shook confidence in its security.

ConvergEx Group Chief Market Strategist Nick Colas, one of the only Wall Street analysts willing to talk about Bitcoin, told Business Insider today that his clients believe Bitcoin is in a bubble. He said:

The reaction from clients has been pretty uniform: it must be a bubble. Too far, too fast, too new … you get the idea. Moreover, it’s very hard to short Bitcoins, so there’s no real way to express that pessimistic point of view, which is saving a lot of people some real money, since Bitcoin has some solid momentum just now.

Whether Bitcoin is in a bubble or not, it’s unlikely that it will be go away even if the bubble bursts. The currency solves a practical problem with international transactions, and doing business with Bitcoin can make the cost of transactions basically nothing.

“Bitcoin is perfect for international transfers,” Expensify CEO David Barrett told us a week ago when his company started supporting Bitcoin. “It’s secure, instantaneous, and totally free. We support PayPal, but it is expensive. A 4 percent charge on a large reimbursement can really add up.”

Photo illustration by Tom Cheredar/VentureBeat

Bitcoin chart via Bitcoin Charts