Apple CEO Tim Cook affirmed that the iconic smartphone and tablet maker actually does care about market share today in response to an analysts’ question during the company’s second quarter earnings call.

Apple CEO Tim Cook affirmed that the iconic smartphone and tablet maker actually does care about market share today in response to an analysts’ question during the company’s second quarter earnings call.

That the question needed to be asked at all is indicative of how confused Wall Street is with Apple. And Cook’s follow-up remarks probably didn’t help at all.

The analyst said that the smartphone market was growing at 30 percent annually and that based on Apple’s guidance for the coming quarter, it seemed extremely unlikely that Apple would be growing anywhere near that fast. And while Apple owns a higher percentage of the tablet market, Android is starting to take a bigger bite there as well.

“Your point is not lost, and we do want to grow faster,” Cook said in response to the analyst after cautioning him to look at sell-through to consumers, not just sell-in to channel inventory. “We don’t view it however as the only measure of our health.”

The first part of the answer is exactly what Wall Street wanted to hear. The second part, not so much.

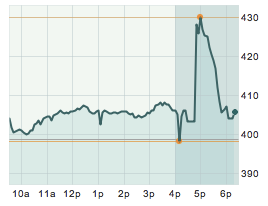

Above: AAPL gains $20, then gives it right back.

Cook then talked about what really matters to Apple, including customer satisfaction scores, which the company typically leads in, customer loyalty rates — another bright spot for Apple — and the amount of ecosystem commerce that takes place within iOS when apps are purchased or items are purchased with apps.

Most of that was good, particularly when Cook said that “three out of four dollars spent on apps are spent on our ecosystem.”

But then he summed it up with a typically Apple-ish Kumbaya moment:

“Market share is important and unit share is important,” Cook said. “But we’re all about customer experience and enriching lives.”

Enriching lives is not at the top of a Wall Street analyst’s list of priorities. Nor does it make the daily agenda of a typical wealthy investor. Increasing market share and making money, however, rank high on both.

Which is one of the reasons why Apple’s stock gained $20 after its earning release hit the wires … and gave it all back by the end of the earnings conference call.

Apple and Wall Street, it would seem, are oil and water.

Image credit: Dean Takahashi/VentureBeat