Electronic Arts acting chief Larry Probst said in an analyst call today that the company has 11 major games coming in the next fiscal year as well as 15 mobile games.

Electronic Arts acting chief Larry Probst said in an analyst call today that the company has 11 major games coming in the next fiscal year as well as 15 mobile games.

These titles include Battlefield 4 and The Sims 4 (coming in early 2014) as well as new versions of familiar franchises such as EA Sports games and the Need For Speed racing series. The previous year, EA released 13 major titles.

Executive vice president Frank Gibeau said the 11 major titles in the works for the next 12 months include Madden, FIFA, FIFA Manager, NBA Live, NHL, and NCAA Football, Need for Speed, Battlefield, Command and Conquer, and the Insomniac game Fuse The Sims 4, part of a series that has sold 150 million games, will debut as a single-player offline game early next year, but it appears that EA may have more announcements in store for the big E3 trade show in June. New titles are coming from EA Sports, Bioware, and DICE.

The mobile games include a Command & Conquer title and an Ultima role-playing game.

And EA had no details on is upcoming Star Wars games, except to say they will not appear in the next year.

Probst said that his key priorities for the year were to lock in place a cost-control plan with plans for growth in both revenues and profits. He said EA is investing in games for the PlayStation 4, the next Xbox, and mobile platforms as well. But it won’t grow overall costs despite the typical hefty investment associated with a hardware transition.

“Doing that in the middle of a hardware transition will be a challenge – something we’ve never done in the 31-year history of this company. But we are committed to making it work,” Probst said in a conference call with analysts today after reporting that EA pretty much hit its financial targets for the fourth fiscal quarter ended March 31.

He said EA would try to win over consumers with “world-class entertainment experiences.”

EA is doing so by cutting costs in other areas, such as collapsing its four separate labels into a single, centralized marketing organization. EA has cut about 10 percent of its employees in the past few weeks. After the call, EA’s stock price was up 8 percent in after-hours trading.

Probst, who took over as executive chairman after the resignation of John Riccitiello in March, said he had no news to report on a new CEO for EA, but he did say that EA was considering both internal and external candidates. On the inside, the candidates likely include chief operating officer Peter Moore and Gibeau.

EA plans to lean on catalog sales and sales of PlayStation 3 and Xbox 360 games this year as it awaits the launch of the new game consoles. The new releases are scheduled for the fall/holiday retail season, for the most part.

Meanwhile, he added, “We have a saying at EA: Transition is our friend. This is a time when we tighten our belts and position the company for future growth and success. We cut operating costs, sharpened our product focus, and made strategic investments in next-generation consoles, mobile, and PCs. The world is changing, and technology is about to take another big leap forward. Our goal is to capitalize on this opportunity by delivering high-quality games and services to our consumers on their platform of choice.”

Adding color to the quarterly results, chief financial officer Blake Jorgensen said that SimCity met expectations, selling more than 1.6 million copies despite a rocky launch where users couldn’t access the game. But Crysis 3 and Dead Space 3 both failed to hit targets.

Among the games coming are Plants vs. Zombies 2 from PopCap Games, which EA bought a couple of years ago for $750 million. PopCap is also working on a new version of Bejeweled.

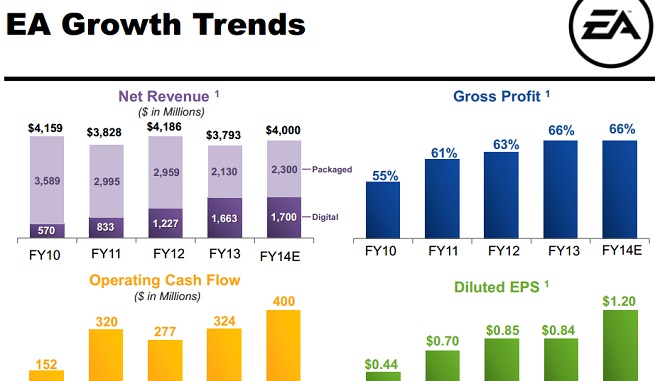

For a company that just lost its CEO, the results are pretty good. Digital revenues were $618 million in the quarter, up 45 percent from a year ago. The digital transition is leaving others, such as THQ and Atari, in bankruptcy proceedings.

Full game downloads, driven by SimCity, were nearly $100 million of the digital revenue amount — and up 65 percent. Extra content and free-to-play content were $224 million, up 45 percent thanks to titles such as FIFA Ultimate Team, Star Wars: The Old Republic, and Bejeweled Blitz. Star Wars: The Old Republic has seen an increase in total active users, with new content being released every six weeks. EA added free-to-play options to the game after subscriptions began to fall. Jorgensen said, “Both models are performing well.”

The company said smartphones and tablets were $79 million of the $104 million in non-GAAP mobile revenues in the quarter, up 27 percent. Real Racing 3 (30 million installs) and The Simpsons: Tapped Out (with 13 million installs and a peak of 5.4 million daily active users) led the way. And EA said that subscription revenue was up thanks to revenue from Battlefield 3 Premium.

EA is planning for mobile revenue to grow 30 percent in the coming year. Full game downloads will grow 25 percent, extra content and free-to-play will be flat, and subscriptions will fall 20 percent. EA said it will have fewer console game launches this year, but with Battlefield 4 launching in the fall, the fiscal third quarter ending Dec. 31 will be a bigger revenue quarter than usual.

Gibeau said EA had both hits and misses on the product front during the March quarter. He said EA learned its lesson around the server problems with the launch of the always-on SimCity and “this will not happen again.” Meanwhile, he said the Sims Free Play mobile game has had more than 55 million installs over the past 18 months. The audience and revenue for that title are still growing.

FIFA Online 3, which launched in beta form in December in Korea, has more than 3.1 million registered users. That title is part of a partnership with Asian game publisher Nexon.

Battlefield 4 is using a brand-new Frostbite 3 game engine, and EA Sports has a new one as well so it can deliver high-end graphics on the new game consoles. Those investments will help “de-risk” the console transition, Gibeau said.

Probst said, “To summarize, EA is in very good shape. At the core is a great team delivering innovative games and services. We have invested in product quality, digital delivery, and sustainable leadership on console, PC, and mobile. In recent weeks, we underwent a reorganization to focus our product portfolio and reduce our operating costs. And we have constructed an ambitious but attainable business plan for our employees and shareholders. Best of all, we’ve got an incredible line up of games and services for our consumers.”

As for holding the line on costs, Jorgensen said, “Larry is a very tough manager. He is holding the executive team to that goal.”

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More