Heard of the “big data” craze? If not, you’re living in a cave. Successful companies of the future, smart people say, are going to be those that quickly and ruthlessly measure and analyze all of their data.

Heard of the “big data” craze? If not, you’re living in a cave. Successful companies of the future, smart people say, are going to be those that quickly and ruthlessly measure and analyze all of their data.

And like in all big rushes, the companies providing the picks and shovels can make a killing.

Lately, a number of enterprising startups that sell big data analysis tools to large companies are seeing explosive revenue growth — the latest sign the big data gold rush is fully on.

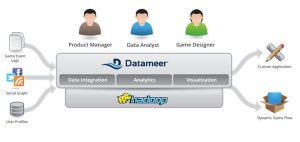

One of them is Datameer, a Silicon Valley (San Mateo, Calif.) company that offers a tool to help other companies analyze and visualize their big data quickly and easily — by providing it in a spreadsheet-like user interface that most employees can understand.

Datameer has tripled revenues over the past 12 months and looks on track to hit a $10 million run rate by early Q3, according to back-of-the-envelope math. Datameer CEO Stefan Groschupf says the company will reach 100 enterprise contracts by that time, and the average contract is $100,000 in value. The company offers annual software subscriptions, including an enterprise version can cost $100,000 or more, depending on data throughput.

Groschupf says many of his customers like to keep the details of their contracts confidential. But if you check Datameer’s web site and other announcements, you’ll see it serves companies like Sears and Visa, as well as emerging companies like hot gaming firms Kabam and Kixeye. Datameer says it also has four of the five largest global banks as paying customers as well as three of the four largest credit card companies and the U.S. government, though Groschupf is mum on specifics, citing confidentiality agreements.

Datameer’s traction comes as news emerges about other big data companies with similar growth. GoodData, a San Francisco company that provides business intelligence from data, said it too has tripled revenues over the past year. GoodData has been around since 2007. Datameer was founded in 2009. The coinciding explosion of growth this year suggests we’re seeing the “hockey stick” growth part of the big data cycle.

Datameer has raised $17.8 million from firms like Kleiner Perkins and Redpoint, but it may raise an expansion round to ensure it can grab more market share even as other competitors pile in. It can reach profitability based on the money it has already raised, said Groschupf.

Datameer’s value comes in offering an easy-to-use application layer on top of Hadoop, the popular open source software framework that allows companies to store and organize data on the fly. While companies can try to hire hard-to-find and expensive Hadoop experts to analyze the data themselves, Datameer’s app layer dumbs things down. Just about any manager in any unit can integrate, analyze, and visualize any data for their own needs. Does an HR manager want to track the performance of sales executives in new ways? Well, they can query that.

Datameer’s value comes in offering an easy-to-use application layer on top of Hadoop, the popular open source software framework that allows companies to store and organize data on the fly. While companies can try to hire hard-to-find and expensive Hadoop experts to analyze the data themselves, Datameer’s app layer dumbs things down. Just about any manager in any unit can integrate, analyze, and visualize any data for their own needs. Does an HR manager want to track the performance of sales executives in new ways? Well, they can query that.

The advantage of the Hadoop-spreadsheet approach is that it allows companies to interact directly with new or existing data sources, without actually changing the underlying data. And it lets them run new types of queries on-the-fly. This contrasts to the cumbersome technology that has dominated until now, where data queries are constrained by slow and expensive data manipulation process: Generally, ETL (extract transform load) technology is used to feed data into enterprise warehouses for subsequent manipulation by business intelligence apps. This process can take up to 18 months to set up, and requires preconceived data modeling. In other words, if your intended queries aren’t thought up beforehand, you’re out of luck. No peering into your data with new sorts of queries.

Datameer’s CEO Stefan Groschupf recently shared evidence of his company’s traction during a panel discussion I moderated at Interop Tuesday (see a good summary here).

Here are five interesting ways Datameer, or services like it, are creating value:

Making money

Datameer helped a large anti-virus software company double the conversion rate of some of its marketing campaigns, netting it more than an additional $20 million in revenue within six months. Before using Datameer, the company had sunk more than $1 million into advertising campaigns that weren’t converting very well: It had used Google ads and tried to market through weblogs, its download logs, and sales accounts. Datameer helped it optimize across all of these areas, with no additional investment in infrastructure or advertising outlays. Similarly, Datameer is helping fast-growing gaming companies like Kabam and Kixeye respond more dynamically to data collected by their users, giving them a leg up on more mature companies like Zynga, which isn’t using Hadoop and is reliant on the more traditional, less flexible ETL/warehouse technology. By encouraging Kabam and Kixeye game developers to write to log files that can be instantly analyzed, Datameer can run 1,000 reports a day on them, checking to see say, what color — red or blue — is best used on game buttons for enticing gamers to click. Similarly, hundreds of other variables can be tracked on the fly, about how gamers are clicking, buying virtual goods, and then leaving.

Identify fraud

Datameer worked with a credit card company to help it save billions by identifying fraud before it happened. Groschupf wouldn’t identify his customer. However, the WSJ recently reported how Visa has used big data to save “billions” by identifying fraud that could have cost it $2 billion; it mentions Visa is using Hadoop but didn’t mention the app running on top of it. The technology allows credit card companies to view data at the individual merchant terminal level and across hundreds of attributes from average authorization volumes to the frequency of purchases that turn out to be fraudulent.

Prediction

Datameer helped an unnamed “hardware company” analyze server usage among its customers to predict when those customers will need a new server. Instead of waiting for the customer to realize servers are at full capacity, Datameer’s data knows capacity will be hit in, say, two weeks, and ships a new server to the customer before they realize they need it. That has helped the hardware company improve sales by more than $100 million “over a few years,” according to Groschupf. Datameer can perform a range of other needs for customers based on trends. One example is price optimization. While online retailer Amazon is using price optimization techniques to update prices up to 12 times a day, traditional retailers have typically optimized pricing once every 12 weeks. Datameer recently helped Sears shorten that time to three days.

Matching people

Datameer’s principal competition is not other providers, says Groschupf, but when companies decide to do the job themselves. Relationship site eHarmony, for example, was an early adopter of Hadoop, and claims this has helped eHarmony allow 550,000 U.S. marriages to happen. eHarmony matches people by running Hadoop every night on the questionnaires filled out by its customer base.

Another big step for the big data industry occurred late last year, when Datameer announced an OEM deal with online human resource software vendor Workday to embed the Datameer analytics platform as part of their big data analytics application for customers. “This marks one of the first deals to integrate Hadoop analytics into the enterprise packaged application ecosystem,” said Tony Baer, an analyst at research firm Ovum at the time. The firm called it a “key milestone in the process for big data securing mainstream enterprise acceptance.”