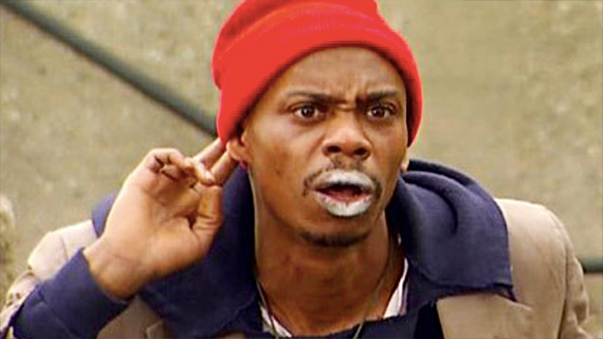

This Monday morning, we opened our inboxes to find a whole boatload of manic-sounding funding announcements sent by twitchy PR people. Seems like every hopped-up investor and his mom threw money at some startup or other — but don’t worry, we had our police scanner set to “stun” and caught all the action for you.

Let’s start the show.

Disclosure: Only commercially available, retail-grade, street-legal stimulants were used to fuel the writing of this and other deals-related posts on VentureBeat today. Today.

Rimini Street takes $15M to go global

Enterprise software maintenance company Rimini Street has secured a healthy $15 million round of funding. The Las Vegas-based startup took the new money from the sticky hands of Bridge Bank, a Silicon Valley firm. Execs said the investment would be used to move beyond the startup’s U.S. origins and into international waters — namely, Brazil and Asia Pacific.

Alteryx announces $12M investment

Analytics company Alteryx has received $12 million in financing from new investor Toba Capital (recently formed by former Quest Software CEO Vinny Smith) and existing investor SAP Ventures. Over the past year, the big-data startup has developed partnerships with Tableau, Teradata, Cloudera, and Hortonworks. Previously, the company took a $6 million round in April 2011.

Secretive startup Reflektion raises $3.3M

Reflektion is still in super-stealth mode, but it’s raised another round of funding. Following a previous raise of $1.5 million, the company filed an SEC Form D today stating it’s taken another $3.3 million. Congrats, mystery company! Here’s what we do know: The San Mateo, Calif.-based startup is helmed by electronic design engineer and serial entrepreneur Rajeev Madhavan; the startup is hiring; and the company has the same name as a stupid DJ, who is currently Google-spanking the PageRank for the name.

Newsle gets $1.65M for news app

Newsle — is that pronounced “news-lee” or “noozle,” do you suppose? — has taken a $1.65 million round for its news app for professionals. We wonder whether LinkedIn’s news-focused redesigned homepage might have Newsle beaten to the punch, but Newsle reps assure us the young company is “totally killing it,” so no worries there, right? At any rate, the Newsle team already moved from the East Coast to a nauseatingly trendy SoMa address in San Francisco, so they can’t really go home just yet. The funding led was by Advance Publications through subsidiary American City Business Journals. The app first launched in 2011; this is the startup’s first institutional round of funding.

Sensopia seals $1.2M deal

Sensopia, creator of reality augmentation app MagicPlan, announced today a $1.2 million round of funding and the release of a development kit to embed its software in any application. The funding will accelerate Sensopia’s growth and development to make the MagicPlan application easy and accessible to normal users. MagicPlan lets you take a photo of your environment and generate a floor plan in minutes. The application can automatically measure, draw, and publish a floor plan by taking a photo with your iOS device. Read the full story on VentureBeat.

Minbox gets a mini-round of $800K

Little things mean a lot! A little goes a long way! Other meaningless clichés about wee things! Minbox, a Dropbox competitor, has taken a $800,000 round of investment. The service, created by online journal Penzu founders, contains free (and to-be-announced Pro) features. Notable participants in the round include Charles River Ventures, CNN president Jeff Zucker, Mailchimp’s Ben Chestnut, and a handful of other folks who are praying for an acquisition within the next year or so. Because let’s be honest: Dropbox already has more than enough competition.

Image credit: Comedy Central