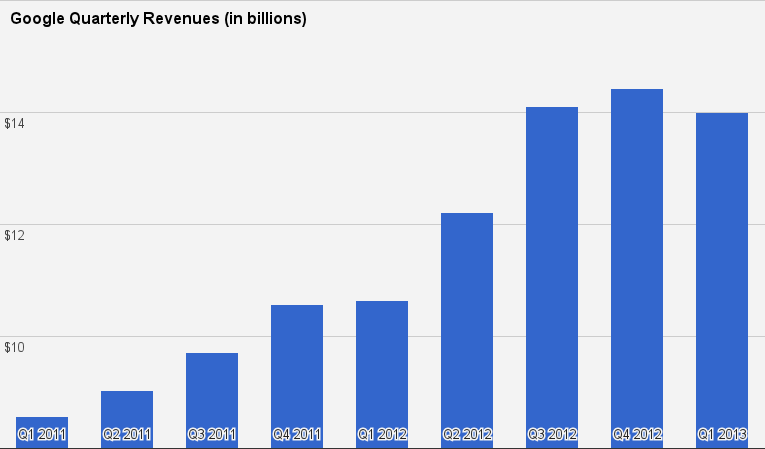

Google dropped its quarterly earnings report today, showing revenues of $14.11 billion for the period.

However, the company’s total expenses for the quarter were up to around $9 billion from $7 billion this time last year, with revenues shifting up only $3 billion year over year. Total profits were up $30 million from last year, but the company’s profitability was slightly declined year over year.

Of course, the vast majority of that revenue figure came from ads, with Google posting $13.1 billion in ad sales for the quarter.

Google’s Q2 in News

- Google Fiber heads to Austin …

- and Provo

- Kleiner & Andreesen commit to Glass apps

- Hands-on with Glass

- More Glass shipments …

- and soon, more hardware

- Trouble with online drug ads

- And then, there was PRISM

- Google acquires Waze

Google-owned sites generated revenues of $8.87 billion, and its partner sites generated revenues of $3.19 billion. The majority of revenues (55 percent) came from sources outside the United States.

As of the end of June, the company’s total war chest of assets sits at $101 billion. The company’s headcount was down from around 53,891 on March 31 to 44,777 as of June 30.

Google’s quarterly investors’ call will take place today at 1:30 p.m. Pacific. At that time, we’ll be reporting on statements from Google execs, including CEO Larry Page, so stay tuned.

Q2 was one of great excitement for the company. It included Google I/O, the company’s annual developer conference and news orgy. While not too many world-ending announcements came from the conference, momentum continued to build around Google Glass, Google’s flagship step into the future of hardware.

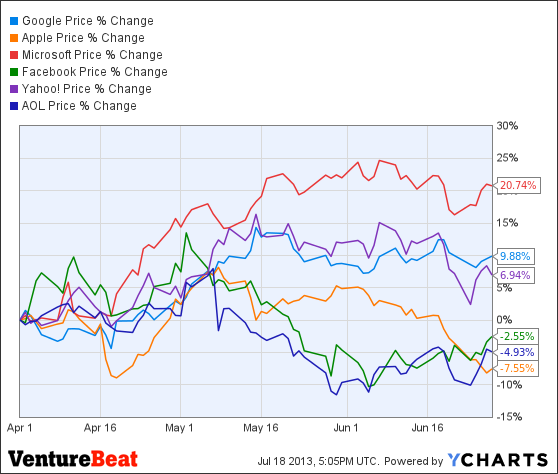

Investors’ confidence in Google’s capability to earn reflected that excitement and momentum, remaining solid throughout the quarter. Here’s a look at Google stock price movement in Q2:

That sky-high stock price also reflects well on Google in relation to similar players in the market. Apple, which competes with Google on the software side, was notably down for the quarter, as was social competitor Facebook.

The big exception to Google’s dominance was Microsoft, the seeming comeback kid of the group, which boosted its share prices to a five-year high with hot products around its operating system, gaming hardware, and developer tools.

Here’s a look at Google stock price versus competitors’ stock prices in Q2, showing percentage change only:

The company is also coming off a historically high year in earnings — $50 billion in revenues for all of 2012. Here’s a look at Google quarterly revenues in billions over the past two years: