Advanced Micro Devices reported financial results today that slightly beat Wall Street’s expectations for the second quarter ended June 30. But it still lost money.

The Sunnyvale, Calif.-based AMD, a bellwether for PC sales as the second-largest maker of computer microprocessors, said today that it had a loss of 9 cents a share and revenues of $1.11 billion.

In the previous first quarter, revenues came in at $1.09 billion, down 32 percent from a year ago. Last quarter, the chip maker’s net loss per share (after one-time items) was 13 cents a share, or $94 million.

The Sunnyvale, Calif.-based AMD, the No. 2 maker of PC microprocessors, has had a tough couple of years as it trailed Intel in competitiveness and saw a slowdown in demand as consumers began to favor tablets and smartphones over PCs. Since it wasn’t well positioned for that transition, the slowdown hit AMD harder than Intel

Analysts expected a loss of 13 cents a share on revenue of $1.1 billion for the second quarter. AMD had a profit of 6 cents a share a year ago.

AMD gets about 80 percent of its revenue from the PC industry. Rory Read, the chief executive of AMD, joined the company in 2011. He was formerly the No. 2 executive at Lenovo, which has since been battling HP for the title of the world’s biggest PC maker.

“Our focus on restructuring and transforming AMD resulted in improved financial results,” said Read in a statement. “Our performance in the second quarter was driven by opportunities in our new high-growth and traditional PC businesses. Looking ahead, we will continue to deliver a strong value proposition to our established customers and also reach new customers as we diversify our business. We expect significant revenue growth and a return to profitability in the third quarter.”

In after-hours trading, AMD shares are down 3 percent at $4.48 a share. Before the earnings came out, AMD stock rose 6 percent to $4.64 a share.

AMD said that it its gross profit margin was 40 percent in the second quarter, down a couple of points from the previous quarter. Cash was $1.1 billion at the end of the quarter. Computing solutions division revenues grew 12 percent from the previous quarter but were down 20 percent from a year ago. Average selling prices for microprocessors were down year over year and sequentially. Graphics and visual solutions revenues were down 5 percent sequentially and down 13 percent from a year ago.

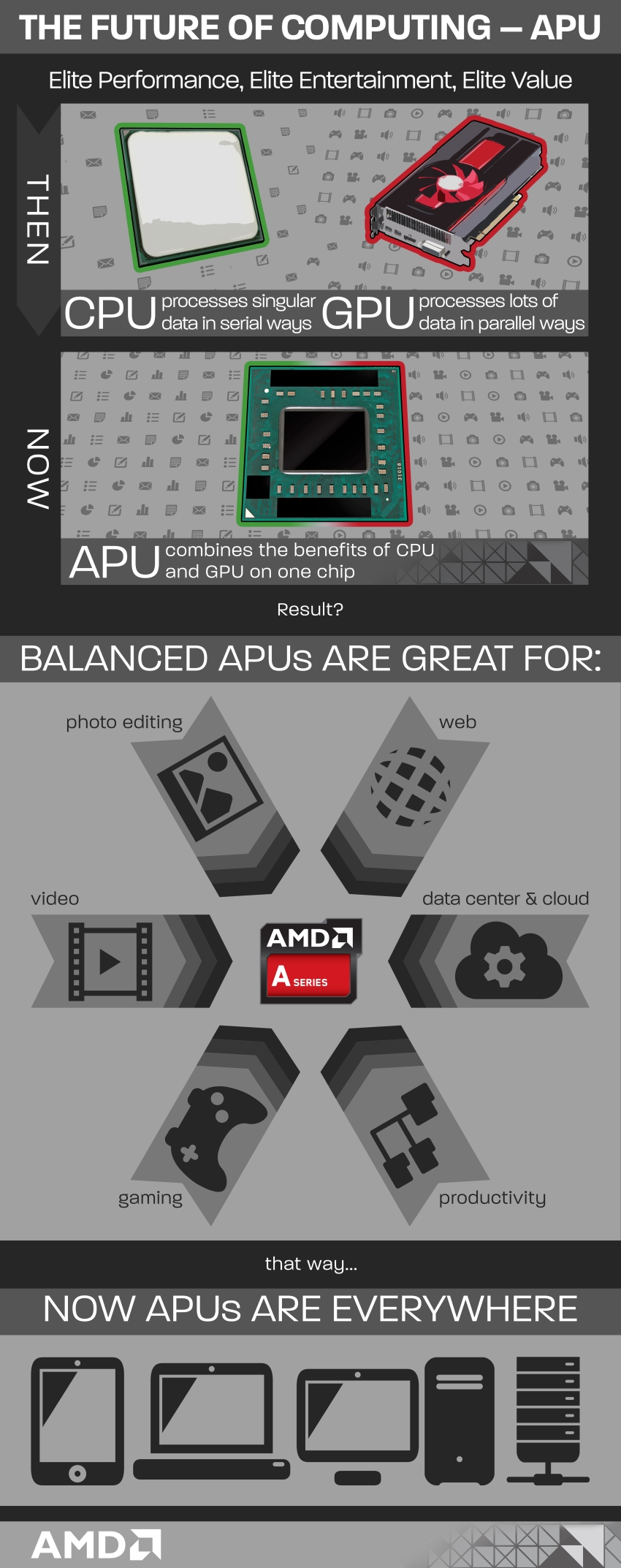

During the quarter, AMD shipped a number of new mobile chips, including its AMD Elite Mobility A-Series accelerated processing units (which combine a microprocessor and graphics on one chip) for tablets, hybrids, and small notebook computers. It also shipped the AMD FX-9590 desktop processor, the first commercially available 5GHz processor in the x86 market.

AMD has begun talking about winning a couple of big video game deals. It is supplying accelerating processing units (APUs) to Nintendo for the Wii U, and it will supply APUs for both the Microsoft Xbox One and the Sony PlayStation 4.

Meanwhile, AMD bought microserver company SeaMicro, and it is using that company’s technology to expand in the data center with low-cost, low-power servers with lots of cores, or processing brains. Those chips could provide a buffer against Intel’s advances in laptops thanks to its launch of its Haswell architecture, which can improve battery life in a laptop by 50 percent and double the graphics performance.

During the second quarter, AMD started shipping its next-generation APU, code-named Temash. AMD said its inventory will increase in the third quarter as it begins mass production of semi-custom chips, or those aimed at the game consoles.

AMD tries to set itself apart by putting more powerful graphics in its APUs, which combine a microprocessor and graphics on the same piece of silicon. AMD says about 42 percent of its APUs are graphics, while only 31 percent of Intel’s newest combo chips are graphics.

For the year, analysts are expected a loss of 21 cents a share on revenue of $4.78 billion. For the current third quarter ending Sept. 30, AMD expects revenue to increase 22 percent sequentially, plus or minus 3 percentage points.

Above: AMD APUs