Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Twitter has been upping its ad game for the last year in preparation for an IPO that, Silicon Valley buzz says, will likely happen late in 2013 or early in 2014. Now the newsy social network is hiring a financial manager for “when we are ready to go public,” and other positions prepping the company for all the regulatory hassle that going public causes.

Smoke, meet fire.

The job opening that USA Today spotted is no longer visible on LinkedIn, but had a title of “financial reporting manager.” Included in the job description was something that the company would need before it files to go public:

“Responsible for preparation of monthly reporting materials, quarterly/annual financial statements and Form S-1 when we are ready to go public.”

While that listing can’t be found anymore either on LinkedIn or on Twitter’s own job site, there are several other open positions that are also related to the company going public.

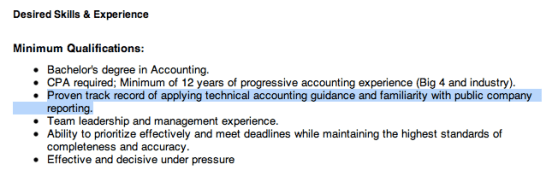

One is a Senior Manager, Accounting Operations job that is still live on LinkedIn. Included in the minimum qualifications for the position is “familiarity with public company reporting.”

One is a Senior Manager, Accounting Operations job that is still live on LinkedIn. Included in the minimum qualifications for the position is “familiarity with public company reporting.”

And another is an Accounting Manager, Global Accounting Operations job that is listed on Twitter’s careers page. Here, Twitter is looking for a CPA with over eight years of experience in “public accounting.” Even more telling, the company is asking for an individual with “in depth knowledge of US GAAP, and SOX.”

SOX, of course, is accounting geek-speak for Sarbanes-Oxley, the massive — and massively onerous — set of laws and regulations enacted by the U.S. government in wake of massive accounting scandals at Enron, Tyco, and WorldCom. The regulations are intended to make major malfeasance very, very difficult, and certainly succeed in making accounting for public companies very, very difficult.

Which of course requires special people with special knowledge and special experience … if you’re planning on going public.

Which of course requires special people with special knowledge and special experience … if you’re planning on going public.

Twitter has always dismissed rumors of an impending IPO, including in recent months. But the company is certainly laying the groundwork for going public, and has been for some time.

A Twitter IPO will be the biggest tech company IPO since Facebook last year, with a current rumored valuation of $10 billion.