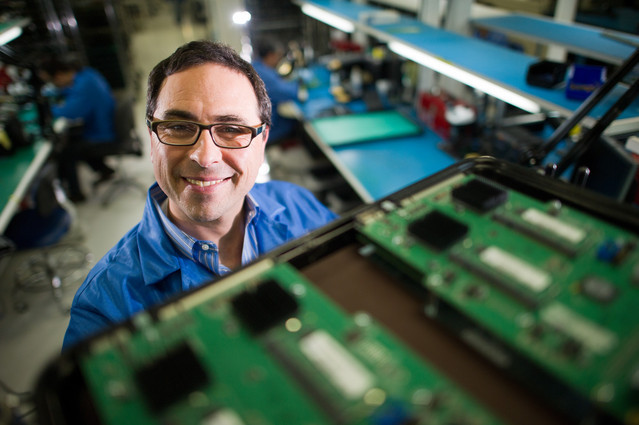

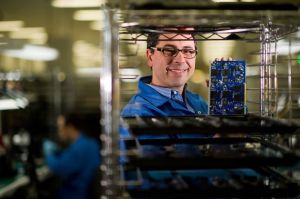

Andrew Feldman is one of the pioneers of micro servers. His company, SeaMicro, used low-cost Intel Atom chips to create a category of servers with lots of processors in a single machine with exceptionally low power consumption for a traditional x86 (Intel-based) machine. When the SeaMicro micro servers debuted in 2010, it was like an Atom bomb on the server business, where high-performance, heat-producing chips were the norm.

Advanced Micro Devices bought SeaMicro early last year for $334 million to gain entry into the energy-efficient server market, and that has helped the company gain new insights into server customers. Feldman is now corporate vice president and general manager of the server group at AMD.

He believes that the micro server revolution is just starting in corporate data centers as the drive for low-cost, high efficiency servers increases. And startups who latch onto the “micro server ecosystem” are going to grow with it. We caught up recently for an interview with Feldman. Here’s an edited transcript of our interview.

VentureBeat: What’s on your agenda these days?

Andrew Feldman: We’re doing well. It’s an exciting time to be in the data center. The number of startups that are aiming the business there, the rate of growth among the storage guys, the interesting networking that’s going on, whether it’s software-defined networking or network function virtualization—It’s just a tremendous amount of exciting stuff that’s being driven by this unprecedented growth of computing in the data center. We’re participating in that in a number of different ways.

VB: The flash memory startups are getting a lot of attention. A billion dollars worth of deals have happened recently.

Feldman: Yeah. Virident was sold for $645 million. Cisco bought Whiptail for $415 million. Pure Storage might have raised $125 million at a valuation of a billion. I think Nimble and Nutanix are doing well. There’s a whole generation behind those guys that are doing well. It’s interesting.

VB: Is there a micro server economy, then, or an ecosystem?

Feldman: For sure. This is all part of a push to build the new data center. The new data center has different combinations of compute and disc and networking. It has different workloads. It has different demands. The traffic patterns are different. It’s very different thing from what we were building 10 years ago. That plays into—Not just the way SeaMicro builds servers, but at AMD, our choice to add ARM to the portfolio. We believe that will be an exciting and important component of the server market going forward. We think that by 2016, 2017, we’ll see double digit share for ARM servers.

We see a continued demand on traditional x86 as well, but even there we see some changes. We see the importance of things like the Freedom Fabric that SeaMicro invented. We see actions like HP building Moonshot. They’re stepping into the fabric-based micro server market and trying to take a step toward some of the innovations that SeaMicro has made.

VB: How have things changed inside AMD? You mentioned ARM. What is new?

Feldman: I have two teams. We built the SeaMicro business and we have the server business. We are informing our CPU design with system expertise and direct contact with the customer. We are trying to match work load to processor design. On the SeaMicro side, we’ve doubled the size of our engineering and increased the size of the sales organization. We’re accelerating our work.

As we announced a little while ago, in the ARM part, we’re netting the SeaMicro technology and the Freedom Fabric into the ARM CPU. These are substantial steps.

VB: And the market size—Is micro server the fastest-growing category?

Feldman: It is the fastest-growing category, for sure. If you look carefully at not just what we sell or what HP sells, but at some of the Dell systems being sold out of their DCS group – which sells to the largest 10 or 12 players in the world – they look like micro servers as well. They have many of the characteristics of shared infrastructure and being tied together. They don’t talk about those because those customers think that’s providing a source of advantage, but I think you’ll see a significant proportion of—In 2010, Diane Bryant assured me that the Atom would never be a server part. Now they have 13 server SKUs.