The Byers family must be ready to pop a bottle of champagne. Father Brook and son Blake, both Silicon Valley venture capitalists, made early bets in Foundation Medicine, a diagnostics company that hit the public markets this week.

Above: Kleiner Perkins partner Brook Byers sits on the board of Foundation Medicine; his son, Blake, is an early investor.

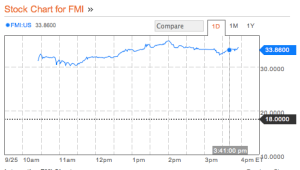

Foundation Medicine is a rare, recent example of a diagnostics company finding IPO success. Today, shares rose as much as 89 percent and hit a high of $35.00. The company raised $106 million at a valuation of almost $900 million.

The Byers (Blake is from Google Ventures and Brook is the Byers in Kleiner Perkins Caufield & Byers) aren’t the only investors behind Foundation Medicine, which offers a more targeted approach to cancer treatment. Wealthy individuals like Yuri Milner and Bill Gates funded the company, as well as biotech investment firm Third Rock Ventures.

Foundation Medicine specializes in personalized medicine, health care’s biggest buzzword. The company develops FoundationOne test kits, which oncologists use to recommend treatment options for patients based on their molecular blueprint.

The company leverages the low cost gene sequencing technologies. Foundation doesn’t look for a single cancer-causing genetic abnormality. Instead, it takes a sample of a tumor from each patent and “mines” it for over 200 abnormalities that are known to cause them to spread. Foundation then sends a report to the physician with treatment recommendations, including experimental clinical trials to consider. These clinical trials were conducted by pharmaceutical giants like Novartis AG, Johnson & Johnson, and Celgene Corp.

Above: Shares touch a high of $35.00

Foundation makes the bulk of its revenues from deals with big pharma. Novartis currently accounts for about 10 percent of its total revenues. Going forward, Foundation Medicine will need to prove to payers that its test is truly saving lives — currently, no insurance plans cover this test. It has been selling its kits on a case-by-case basis. As Xconomy reports, the company only collects $3,800 per patient on its tests despite a $5,800 list price because of ongoing payer negotiations.

Revenues are still not consistent, which hasn’t put off Wall Street’s analysts. The company’s net loss widened to $22.7 million in 2012 from $17.3 million a year earlier. Revenues in 2013 totaled $10.6 million and will likely increase if and when payers come board board.

This is the third biotech company in Third Rock’s portfolio to go public this year. Bluebird Bio made its debut June, and Agios Pharmaceuticals experienced a successful IPO earlier in the year. Agios’ chief executive sits on Foundation Medicine’s board.

Update: At the end of the first day of trading, shares reached $35.35. Given that revenues are still low, and operating costs so high, the company’s valuation appears to have shot up based on hype. We’ll keep a close eye on the stock.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6d1811b9-76cd-4f0d-a2bd-cc57943c81a2)