Vulture capitalist Carl Icahn wants Apple to buy back a massive $150 billion of its own stock. He told CEO Tim Cook that last night and plans to meet with the Apple CEO again in three weeks.

Had a cordial dinner with Tim last night. We pushed hard for a 150 billion buyback. We decided to continue dialogue in about three weeks.

— Carl Icahn (@Carl_C_Icahn) October 1, 2013

Apple has already planned and begun to execute multiple stock buybacks, starting last year with a modest $10 billion program, and increasing it this spring by $50 billion. In addition, the company has initiated dividends for the first time in history, all in an attempt to boost its sagging stock price back to the $700 range it enjoyed in 2012.

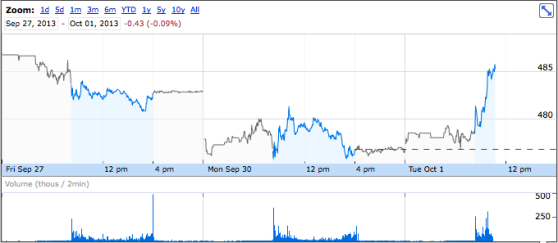

Those attempts haven’t been extremely successful, although Apple’s stock is near $500 lately, well up from the $400 doldrums of a few months ago.

Icahn is usually not good news for a company. The last company he attempted to take over was the struggling Dell, which successfully fended him off. Icahn has bought or attempted to buy companies such as TWA, U.S. Steel, Time Warner, and many others.

Typically, he has made his money as a “corporate raider” who buys companies, dismembers them, and sells off the pieces for more than the monetary value of the whole enterprise, believing that he knows better than the corporate executive how to make money. As his Twitter bio says, “some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.”

In a sense, I guess that’s unlocking shareholder value, but it’s also a very real way to kill companies.

Icahn recently bought about a billion dollars worth of Apple stock, making it his new project, and forcing me to spell his name iCahn.

Apple stock is slightly up on today’s news.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More