Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Update: This version of the story corrects an earlier reference to Peter Fenton’s holdings of Twitter shares.

Twitter’s S-1 documentation for its impending initial public offering hit the web like an atom bomb today, revealing all kinds of juicy information on the company’s revenues, risks, and more.

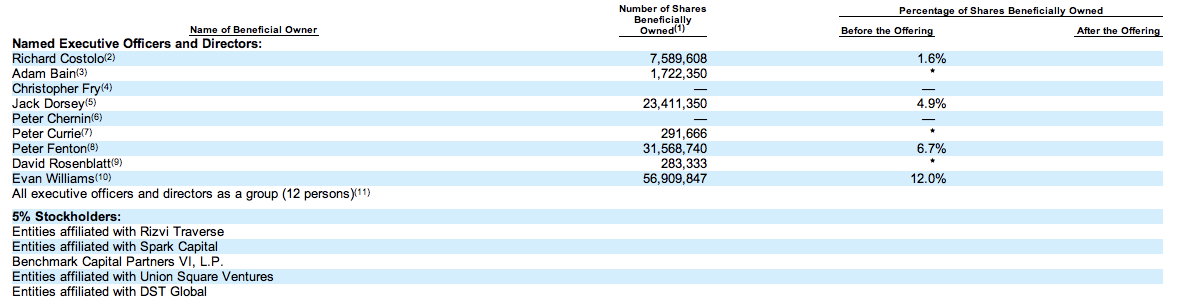

Among the juicy nuggets are the exact details of stock-based compensation — and who owns the most of Twitter.

Dick Costolo, the current CEO, owns comparatively little of the company, thanks to his fairly late arrival on the scene. He owns just 1.6 percent of Twitter, with 7.6 million shares. As partial compensation, however, he does have millions of outstanding options which he can exercise, representing close to five million more shares.

But that still pales before Twitter founders Evan Williams, who has the lion’s share of Twitter at 12 percent and 56.9 million shares, and Jack Dorsey, who has been spending most of his time at Square in recent years. Dorsey has 23.4 million shares, or 4.9 percent of the pre-IPO company. And it also pales before a venture firm Benchmark Capital, which holds 31.6 million shares, or 6.7 percent of the company. Peter Fenton, Benchmark’s partner who was responsible for an early investment in Twitter and sits on the company’s board, will take home a small chunk of those shares, but the majority of them will go to Benchmark’s limited partners.

Other major owners of Twitter stock include investment firms such as Union Square Ventures, Spark Capital, and DST Global. In the S-1 filing, they are listed as “5 percent stockholders.”

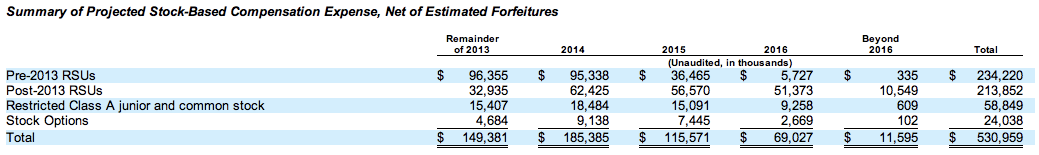

Twitter is also keeping a serious war-chest of stock with which to continue to retain and attract staff. The company expects to incur expenses of $530 million over the next four years for stock-based compensation:

Twitter had initially been planning to raise $1.5 billion in its IPO with shares offered at perhaps $28-30. It has since trimmed the amount that it seeks to raise to just $1 billion, and it has not released any information yet about a projected share price.

At just $20, however, Evan Williams’ 57 million shares would be worth a staggering $1.14 billion. At $30, they’d be worth $1.7 billion.

Not bad for a 140-character per tweet social network.