Advanced Micro Devices has been talking a lot about its leadership in micro servers, the chips with simple cores and low power that can be densely packed into a hive of machines in Internet data centers. Naturally, that’s ruffled some feathers at Intel, AMD’s much larger competitor, which has a commanding lead in both high-end and low-end server chips.

So we talked to Jason Waxman, vice president of the cloud infrastructure group at Intel, about the computing giant’s view of disruptions in the cloud and the possible cannibalization that could happen if micro servers take off and eat at Intel’s high-end Xeon server processors. The conversation was interesting in part because, even though this is currently a small part of the server market, it is potentially one of the most volatile.

Here’s an edited transcript of our conversation.

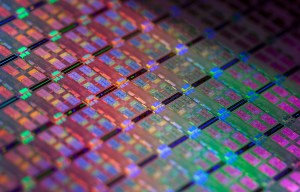

Above: Intel Avoton chip

VentureBeat: I listened to Intel’s earnings call. It sounded like cloud revenues were up about 40 percent in the quarter. That’s pretty good growth.

Jason Waxman: Yeah. The business has been very good in general. Just to provide an opening summary, there is a lot of growth being driven by cloud service providers, but also we’re seeing enterprises driving toward developing their own private cloud plans. Both of those things are showing high growth rates.

One of the things my group does is look at really large, hyper-scale data centers. We think about every piece of technology that they’re looking to optimize, whether that’s facilitating or customizing or optimizing it for their workloads, looking at the applications development and tuning for more performance or allowing them to scale better, looking at the systems themselves and trying to find ways to optimize for unique requirements, or even the facility – we have people within my team that are looking at innovation in all layers of that stack.

A big portion of what we do is thinking about the silicon technology that customers want to drive in that space. To that end, we’ve continued to see a lot of success with the mainstream Xeon product family. The vast majority of all of the servers being deployed in cloud service providers are standard two-socket Xeons, although some of them are tweaked for the unique parameters of those providers.

VB: And the low-end too?

Waxman: We’ve also started looking at emerging applications in different portions of the spectrum. Toward the low end, we’ve seen some applications that might benefit from SoC (system on a chip) technology, and that’s part of the reason we announced our second generation of Atom SoCs, called Avoton, which is based on our 22 nanometer manufacturing. We also have Xeon E3s that are going as low as 13 watts in that space. We’re trying to make sure we have targeted solutions.

We’re also targeting the product toward new segments for us, particularly things like cold storage, where some of the cloud service providers have a large storage requirement that really isn’t doing a lot. It’s “cold” because you’re storing photos that aren’t accessed all that often. Low-power SoCs are great for that emerging application and they represent growth for us. As well as in networking – Intel’s market share in networking is only 10 or 15 percent. Driving SoCs that allow people to make switches more programmable is also an area of growth for us. We’ve created a product based off of Avoton called Rangeley for that segment that includes some of the network-specific offloads and accelerators.density into that space. We’re driving a leadership product line there.

We’re trying to broaden our portfolio, because there is so much growth in cloud, to make sure that all those technology components can come from Intel.

VB: What’s the area that’s been getting the most attention here? Is it the micro servers? How would you characterize what’s getting the most press these days?

Waxman: It’s funny. Micro servers are getting what I would call maybe a disproportionate share of the attention, given that they remain a pretty small portion of the market. There’s a lot of interest in those three segments: micro servers, entry storage, and networking. That’s a high growth area because there’s so much change.

Software-defined networking also has a lot of attention, and the shift toward making switches and networks more programmable. Alongside that, network function virtualization, obviously a lot of focus there. We’ve seen a lot of interest in silicon photonics and the ability to use optics that meet a range of different requirements – distance, cost, and power – that the market doesn’t have today.

Big data is the new buzzword. People are interested in how we’re helping to bring that mainstream, just like we did from a cloud perspective. When you look at the fundamentals of that technology, we built off of volume economics. In as much as you can make technology more cost-affordable, make it easier to integrate, there’s more market demand for it. We’re taking that same view toward big data solutions. How do we work with the industry to make them easier to deploy?

VB: It seems like you think the attention to the micro server business is greater than it deserves right now. What’s your view of how much of the business it has become? AMD and the other advocates in the market are suggesting that it could be 10 or 20 percent. I think they said it was four to six percent right now. What’s your view of where it actually is and what it’s going to grow to?

Waxman: When it comes to forecasts, I’ll leave that to the people that do that best. The Gardners and the IDCs are probably better at that. Anything that’s nascent, you never know what the growth trajectory is going to look like. The only strategy that I can execute to is to make sure that we have the best products and that we can win. Regardless of whether it’s two percent or 20 percent, our job is to make sure that we deliver the best platform.

That said, today I think we have a good handle on how big the micro server market is today. It’s roughly one percent of the server units from our perspective. That’s Atom SoCs plus Xeon E3s plus Core, anything that falls into that category of single socket shared infrastructure. It’s about one percent today, from a volume perspective.