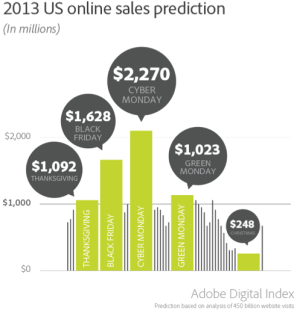

The shortest Thanksgiving-Christmas shopping season since 2002 is almost upon us, but it promises to deliver record earnings. Based on an exhaustive analysis of 450 billion retail website visits over the past seven years, and direct insight into 72 percent of all the cash flowing into the 500 largest retail websites in the U.S., Adobe is forecasting the biggest Thanksgiving, the biggest Black Friday, and the biggest Cyber Monday in history.

And, perhaps, the most expensive advertising bills in history.

Which means that savvy retailers have already started (and maybe finished) their holiday promotions planning. The question is: How can you get your share of all that consumer cash, without overpaying for clicks, for promoted tweets, for likes, and for all the demand generation activities you’re engaging in to ensure people know about your deals?

Which means that savvy retailers have already started (and maybe finished) their holiday promotions planning. The question is: How can you get your share of all that consumer cash, without overpaying for clicks, for promoted tweets, for likes, and for all the demand generation activities you’re engaging in to ensure people know about your deals?

I talked to Adobe’s chief research analyst, Tamara Gaffney, to find out.

“You get into these crunch periods where advertising becomes much more expensive because everyone’s trying to get people to get to their store,” she says. “We did see cost per clicks on Facebook last retail season go up 42 percent … display goes up, search advertising goes up, everything goes up.”

Avoiding the advertising crunch highs starts with understanding the market.

This holiday season, consumers are planning on spending the same amount as last year, but 30 percent of people are planning to increase their online shopping, seeing online retail as a bargain-hunter’s paradise, Gaffney said. But the shortened season — the Thanksgiving weekend is six days later this year — could cost retailers as much as $1.5 billion in potential sales. At the same time, consumers are relying more on mobile — 28 percent plan to buy on mobile — and while direct social influence on purchases remains low, in the single digits, social attribution early in the purchasing cycle drives as much as 36 percent of online purchasing decisions.

So what’s the best strategy?

“First of all, marketers need to utilize some of their less expensive channels — such as social — which are still less expensive than search,” Gaffney says. “Secondly, it gets really important for advertisers to understand where they get the most bang for their buck, to understand how the whole purchasing journey works. For example, conversions are much higher on tablets than smartphones.”

In addition, Gaffney recommends that retailers start their promotions earlier to escape the noise, and personalize their offers so that they can connect with consumers better.

One problem is that perception that online shopping is all about bargains, which drives down retailers’ profit margins.

“Retailers have conditioned people to think of online shopping at a bargain-hunter’s paradise,” she says. “So people often don’t start buying until they see specials.”

One thing that can counteract that tendency is a strong mobile story. That’s as important for brick-and-click enterprises as it is for pure-play online retailers, because nearly four out of ten people buy items online while they are in a store — a very strong argument to have both online and offline presence. Mobile’s also big on Thanksgiving day itself, when many people aren’t home in front of their desktop or laptop computers.

“You see a lot of ‘on-the-fly’ shopping on Thanksgiving,” Gaffney told me. “Mobile is bigger on Thanksgiving Day … we have a potentially boring football game in front of us — that’s just my opinion,” she says with a grin.

And utilizing social now could pay big dividends at Thanksgiving.

“Social media is more of an influencer,” Gaffney says. “People will crowdsource what the hot items or hot toys are via Twitter. Or, for example, I took my son to Toys R Us, took pictures of stuff he wanted, and put it on a Pinterest gift list.”