Bitcoin took us on a wild ride this year — it saw highs and lows, attracting both heady optimism and angry tirades from skeptics.

Most of the action happened in established tech markets in the U.S., Europe, China, and Japan, but the greatest implications could be for the developing world.

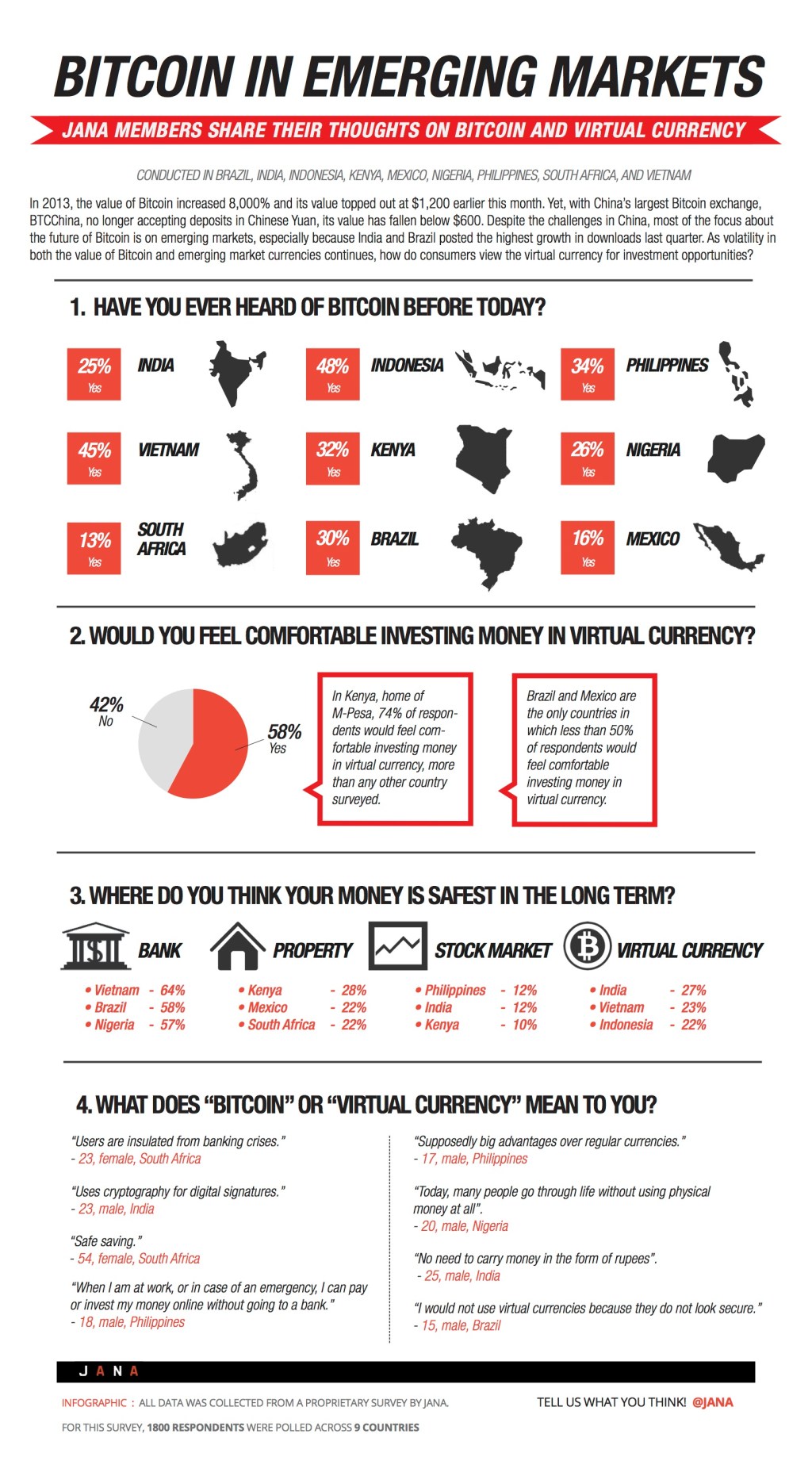

Jana is a mobile platform that connects brands with consumers in emerging markets. The company also has a research arm and decided to survey 1,800 people across nine countries — India, Indonesia, Philippines, Vietnam, Kenya, Nigeria, South Africa, Brazil, and Mexico — to see what they think about Bitcoin (infographic below).

When asked “have you ever heard of Bitcoin before today,” 48% of Indonesian respondents said yes, followed by 45% in Vietnam, and 34% in the Philippines — all Asian countries. South Africa and Mexico had the lowest response rates of 13% and 16% respectively.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

58% of all respondents said they would “feel comfortable” investing in virtual currency. This number was highest in Kenya (74%), which could be due to the popularity of its mobile money service M-Pesa, which means people are already comfortable with digital money. Brazil and Mexico were the only countries where less than 50% of respondents would feel comfortable investing money in virtual currency.

Bitcoin is highly volatile — it soared from under $10 to over $1,200 over the course of the year, with various ebbs and flows. China played a huge part in driving the surge as well as the crashes. China’s largest Bitcoin exchange stopped accepting yuan deposits yesterday morning, sending the price tumbling to $522. The price has since gone back up to around $700.

One of Bitcoin’s biggest selling points is how cheap and easy it is to transfer money. Traditional cross-border transfers (like Western Union) charge exorbitant fees, while Bitcoin is basically free. Furthermore, it is global and not controlled by one particular government.

Adam Draper, who runs a Bitcoin-oriented accelerator program, said that Bitcoin is still more of an asset than a currency. If and when it stabilizes, the impact could be the largest in countries with emerging economies.

“It is interesting to look at inflationary markets like Argentina, Venezuela, and India, where the value of a Bitcoin could be a better store of value than their own currency,” he said in an interview. “Remittances and cross-border payments are also a big deal, and Bitcoin could change the game if adopted appropriately.”

The respondants in Jana’s survey view Bitcoin as less safe than banks, more safe than the stock market, and comparable to investing in property.

However the Bitcoin ecosystem still has a long way to go before it is feasible or practical for people who don’t have money to gamble. Because Bitcoin is still just that — a gamble.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More