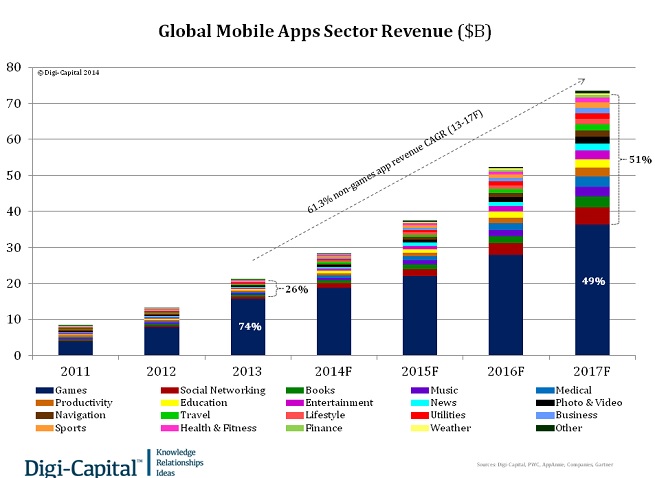

Mobile apps are on a path to reach $70 billion in annual revenue by 2017. And while games drive the majority of app revenue now, they won’t stay on top of the heap much longer.

Digi-Capital, an investment bank for mobile apps and games, said in its first quarter mobile apps study that non-game apps could double their percentage share of total app revenue from 26 percent to 51 percent by 2017, thanks to a 61.3-percent compound annual growth rate from 2013 to 2017.

“Everyone knows that mobile apps are hot, and that games have taken the lion’s share of revenue so far,” said Tim Merel, managing director at Digi-Capital in London. “We think the balance is going to change, with other app categories using new approaches to win. We’re already seeing SaaS-like App as a Service models emerging, and we can’t wait to see what happens next.”

Mobile usage has grown five times in four years to approximately 20 percent of media consumption last year. From 2009 to 2013, the compound annual growth rate for mobile apps was 50 percent.

AI Weekly

The must-read newsletter for AI and Big Data industry written by Khari Johnson, Kyle Wiggers, and Seth Colaner.

Included with VentureBeat Insider and VentureBeat VIP memberships.

Meanwhile, mobile app investment is gathering steam. It has doubled across categories since the third quarter of 2013, with $10 billion invested in the last 12 months.

VentureBeat recently asked mobile developers how to best monetize their games.

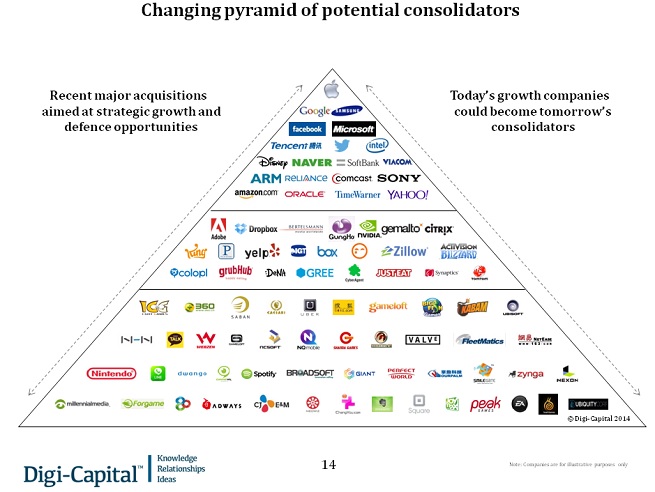

Mobile app mergers and acquisitions accounted for a record $35 billion in the last 12 months, not including Facebook’s $16 billion acquisition of WhatsApp. In the first quarter of 2014, mobile app M&A was $7 billion, or twice the number from a year ago. The acquisitions are split between strategies aimed at growth, consolidation, and defensive moves.

Mobile app public and private valuations have also varied significantly across categories, with some app types valued much higher than others relative to their economic performance. For investors and acquirers, it appears that not all apps are created equal, Merel said.

Free apps with in-app purchases account for more than 90 percent of revenue, but that’s not the case in all app categories. In-app purchases have worked most effectively for monetizing games, accounting for 40 percent of downloads and 74 percent of revenues. But in-app purchases are less effective outside of games, accounting for 60 percent of downloads and only 26 percent of revenue for non-game apps.

The new development is the adoption of the “app-as-a-service” model, which is similar to the software-as-a-service model in other industries.

“The apps market is also creating billion dollar companies at what looks like an accelerating pace globally, and we expect to see as many Asian as Western companies delivering outsize returns for entrepreneurs and investors,” Merel said.

VentureBeat's mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Learn More