Box could well have launched itself onto public markets this month. But it has fought off that impulse as stocks for cloud companies have faltered in recent weeks.

Instead, the cloud-based file-sharing company could end up making its debut on the New York Stock Exchange in June, according to a report today from the Wall Street Journal.

“Our IPO has never had a set date. Since filing, we’ve planned on going when it makes the most sense for the market. That plan hasn’t changed,” a Box spokesperson wrote in an email to VentureBeat.

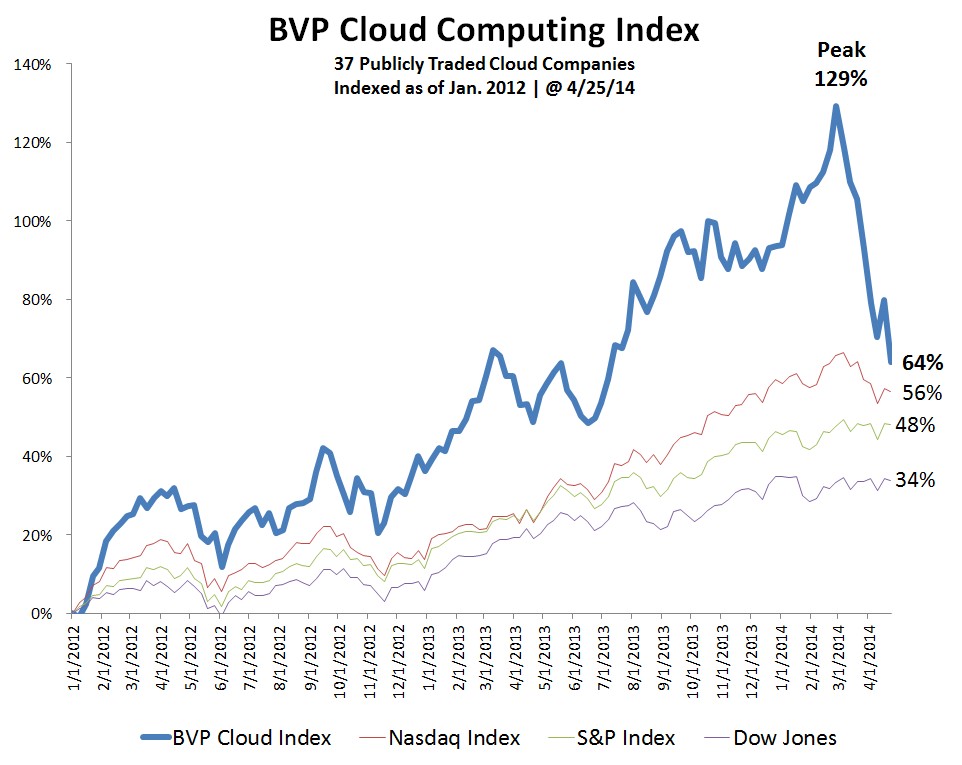

Cloud software companies like Marketo, Netsuite, Salesforce.com, Workday, and Xero have tumbled lately. Just take a look at Bessemer Venture Partners’ cloud computing index for the past few months, and you’ll get the idea.

Such market conditions aren’t conducive to a successful Box IPO — or for other cloud companies, like Dropbox, which could also IPO in the months to come.

But Box can’t wait forever. The company goes through money fast. In the year that ended on Jan. 31, the company registered a $168 million net loss, according to its S-1 filing with the U.S. Securities and Exchange Commission.

So the company will need to raise cash eventually, and that means it will likely turn to the public markets sooner or later, where it will trade under the symbol BOX. It’s just a matter of when — and what will happen after that.